I recently interviewed Michael T. Snyder on the Financial Survival radio program. Mr. Snyder is the author of TheEconomicCollapseBlog.com and of a recent novel entitled The Beginning of the End. He’s an intelligent young man with an enviable education: B.S. in Commerce from the University of Virginia; a law degree and a Master of Laws of Taxation from the University of Florida.

I recently interviewed Michael T. Snyder on the Financial Survival radio program. Mr. Snyder is the author of TheEconomicCollapseBlog.com and of a recent novel entitled The Beginning of the End. He’s an intelligent young man with an enviable education: B.S. in Commerce from the University of Virginia; a law degree and a Master of Laws of Taxation from the University of Florida.

In the course of the interview Mr. Snyder confided that, ever since he was a young boy, he sought and expected to find teachers who could explain to him how the world really works. But he never found such teachers at the grade school, junior high, or high school levels. That didn’t surprise him, but he did expect to find such teachers at the college level. He didn’t. He definitely expected to find such teachers at the advanced degree levels for a Juris Doctorate and Master of Tax Laws. He found no such teachers.

More, in the ten years since he completed his last degree, he’s come to the shocking conclusion that, in the world of economics, no one actually knows what’s going on. Our economy seems to bump along from one crisis to another and, so far, has seemed to survive—but no one really knows why.

Worse, so long as no one really understands the “why” behind an economy based on fiat currency—no one is truly in control. There are illusions of economic power, but our government is no more in control than the Wizard of Oz.

I agree with Mr. Snyder. I also suspect that no mortal man really understands how or why the economy continues to function.

If that’s true, then we’re like a troop of monkeys in a Model-T without brakes careening downhill on a mountain road with a driver who doesn’t even understand the connection between the steering wheel and the front tires. It’ll take a miracle for us to avoid a crash.

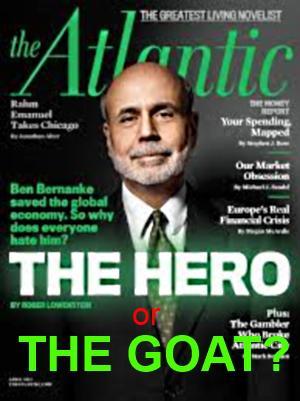

• If the idea that no one really understands the economy seems implausible, consider one man who should understand economics—the current Chairman of the Federal Reserve System:

According to Wikipedia, Ben Shalom Bernanke was born 1953. He was educated at East Elementary, J. V. Martin Junior High, and Dillon High School, where he was class valedictorian. Since Dillon High School did not teach calculus at the time, Bernanke taught it to himself. Bernanke scored 1590 out of 1600 on the SAT.

There’s no doubt that Mr. Bernanke was born with an extraordinary intellectual capacity.

Bernanke attended Harvard where he lived in Winthrop House with the future CEO of Goldman Sachs, Lloyd Blankfein and graduated with a Bachelor of Arts in economics summa cum laude in 1975. He received a PhD. in economics from the Massachusetts Institute of Technology in 1979 after completing and defending his dissertation, Long-Term Commitments, Dynamic Optimization, and the Business Cycle. Bernanke’s thesis adviser was the future governor of the Bank of Israel, Stanley Fischer.

Bernanke was a tenured professor of economics at Princeton from 1996 to September 2002. From 2002 until 2005, he was a member of the Board of Governors of the Federal Reserve System. Bernanke then served as chairman of President George W. Bush’s Council of Economic Advisers before Bush appointed him to be chairman of the U.S. Federal Reserve in A.D. 2006. In A.D. 2010, Bernanke was re-nominated and confirmed for a second term as chairman by President Obama.

Clearly Mr. Bernanke has been well-endowed with extraordinary intellect, education, personal connections and experience. You might think that—like Karnack the Magnificent (the Johnny Carson mystic and fortune teller)—Mr. Bernanke knows “everything there is to know about economics”.

You might think that Mr. Bernanke is the one “teacher” that Michael Snyder has been looking for—the one man who could teach how the system really works.

If so, you’d be wrong. Bernanke is almost as confused and bewildered by economics as the rest of us—and he admits it.

• In A.D. 2011, Bernanke was grilled about gold by Representative Ron Paul. Representative Paul asked, “Is gold money?” Bernanke answered, “No. It’s a precious metal. . . . It’s an asset.”

“Would you say Treasury bills are money?”

“I don’t think they’re money either but they’re a financial asset.”

Irredeemable fiat-dollars might be “currency”–but they’re not “money”. Unfortunately, Rep. Paul didn’t ask Mr. Bernanke if paper dollars are “money”. It would’ve been fascinating to see if Mr. Bernanke were sufficiently brilliant to define “money” in a way that included paper dollars but excluded physical gold.

In any case, Bernanke’s answer that gold is not “money” contradicts the fact that gold has been the world’s primary “money” for virtually all of the last 3,000 years. Bernanke’s denial is a little like declaring the Hope Diamond to be nothing but a chunk of crystalline carbon.

How could the extremely-intelligent, highly-educated Mr. Bernanke defy the 3,000 years of history that defines gold as “money” and instead insist that gold is merely a “precious metal”?

Was that denial evidence of Mr. Bernanke’s need to lie our outright ignorance?

• In June of A.D. 2011, Forbes published “Bernanke Admits He’s Clueless On Economy’s Soft Patch”:

“Fed Chairman Ben Bernanke admitted that the recovery was weaker than expected and that . . . he was at a loss as to what was causing the soft patch. . . . Brutally honest, Bernanke admitted that he had no clue what was actually causing the current fragility in the U.S. economic recovery.”

Again, we see evidence the Michael Snyder is right: no one really understands economics and therefore no one is really in control—including the grand-high wizard of economics, Ben Bernanke.

• According to a July, A.D. 2013 edition of Forbes magazine, “Bernanke Tells Congress: I Don’t Really Understand Gold”:

“Fed Chairman was forced to answer questions about gold on Thursday. Asked about the falling price of gold, which is down nearly 25% this year, Bernanke admitted he doesn’t understand the yellow metal.

“‘No one really understands gold prices,’ Bernanke told the Senate Banking Committee, adding he doesn’t get it either.”

Say whut?!

Gold has been at the center of world economics around for several thousand years. Our current economic system has been only seemingly detached from gold since A.D. 1971—just 42 years ago. And yet, the guy with the 180 IQ, advanced education, political connections that extend back to the 1970s, and chairman of the world’s most powerful and important central bank for the past seven years . . . the guy who’s been responsible for keeping our economy afloat for the past seven years . . . that guy confesses that he doesn’t understand any more about gold than Butterfly McQueen understood ’bout berthin’ babies..

How can anyone claim to control or even comprehend our national economy, the global economy, or even economics in general who remains mystified by the subject of gold? Can any understanding of economics be complete without an understanding of gold?

Again, Michael Snyder appears to have been right. No one (including Ben Bernanke) really understands how or why the “economy” works—and therefore, no one is truly in control.

• According to Forbes, Bernanke also called gold “an unusual asset” and noted that people hold gold as both “disaster insurance” and as an inflation hedge. He expressed surprise about keeping gold as an inflation hedge, noting that “movements in gold” don’t predict inflation very well.

Well, it may be that gold can’t predict inflation very well—especially when the price of gold is being manipulated by the kind of men who Bernanke knew as friends at Harvard and MIT and who grew up to be CEO’s for major Wall St. banks and financial institutions.

More, so far as I know, Bernanke didn’t specify whether gold was unable to predict the free market rate of inflation (over 9%) or the “official” rate of inflation (less than 2%) reported by the government and Federal Reserve.

“Bernanke took solace in the [recent] marked decline in gold prices, though, suggesting they could reflect diminishing concerns over really bad outcomes.”

Bernanke implies that we don’t really need dreary old economists to solve our economic problems (and why would we, if no one really understands economics?). Instead, Americans can avoid “really bad [economic] outcomes” by simply by diminishing our “concerns” about the economy.

Perhaps all we need to know about economics is summed up in Bob Marley’s song “Don’ worry . . . be happy!”

At minimum, by telling us not to be “concerned,” Mr. Bernanke implies that we, “Pay no attention to the little economist behind the curtain!”

In either case, according to the world’s #1 central banker, all we need do is believe the cheerleaders who tell us that the “recovery” has already begun (or, if not, will certainly begin soon). We’ll be fine if we just have “confidence” in government and take orders from a group of economists who are completely uncertain as to how the economy will operate without a gold-based monetary system.

• Forbes continued:

“Gold has been seen as a store of value for thousands of years.”

And yet, the master-economist, Ben Bernanke, doesn’t understand gold. How is that possible?

“More recently, bullion has become an important financial asset seen by many as a sort of currency that cannot be debased, given its relatively fixed quantity.”

Gold has only “recently become” an “important financial asset”? Recently? Really? And gold is only a “sort of currency”?!

Bunk.

Gold has been recognized as “money” for all but the last 42 of 3,000 years.

It’s our paper, fiat dollars that are clearly not “money” but are at best only “recently” recognized as a “sort of currency.”

“Yet it is difficult to pin down the exact logic behind investors’ appetite for the yellow metal.”

What’s so hard to understand about gold? Those who are capable of logical thought see the fraud that’s inherent in paper, fiat dollars. Therefore, such people logically seek to protect themselves from the Ponzi-scheme that currently masquerades as our “paper monetary system”. Not wanting to be defrauded and robbed by their own government and central banks, people buy gold. That “logic” seems obvious and irrefutable.

Gold is easy. It’s an expression of distrust in government and/or the economy. The more distrustful the government/economy becomes, the more demand there’ll be for gold.

But Bernanke claims to not understand.

• It’s easy to make fun of Mr. Bernanke—and I do. Even so, my primary intent is not to ridicule.

I respect Bernanke’s candor—especially in light of his difficult position. If he says something honest that hurts public confidence in the dollar or the economy, there could be adverse economic consequences. The public knows the economy is unstable so it’s easy to inadvertently “spook the herd” with an inadvertent remark and thereby cause a “stampede”.

But, on the other hand, if Bernanke openly lies to maintain confidence and calm the “herd,” his lies will be discovered and exposed, his credibility will be diminished and the “herd” might still stampede deeper into recession or depression. The man is caught in a very precarious position wherein he’s darned if he do, and darned if he don’t. The reason he’s in that position is because no one understands the economy well enough to know what might cause the “herd” to “stampede”. Everyone is “walking on eggs” because no one understands and no one is really in control.

Still, Bernanke is a grown man who must’ve known what he was getting into when he twice accepted nominations to be Fed chairman. Therefore, I respect his position, but I don’t have much sympathy for his dilemma. He got what he wished for and, like Faust, may have come to regret his wish.

My object is to emphasize that no one really knows what’s going on in our economy. No one is really in control.

On the one hand, a lack of economic control may be viewed as cause for great concern. Perhaps our condition really is analogous to a pack of monkeys, rolling down a mountain road in a Model-T that has no brakes. Yes, there’s a monkey behind the steering wheel and he looks authoritative and competent—but there’s a good chance that he has absolutely no idea of how to steer or shift gears. If so, only a miracle will prevent a crash.

On the other hand, if no one person or one group is really in control of our economy, maybe that’s a blessing. Maybe we’ve avoided an economic collapse for the past five, ten or twenty years, not because of the efforts of people like Ben Bernanke, but because of their lack of genuine control. I.e., if Ben & Co. had real control over the economy, maybe they’d have caused a catastrophic depression long before now.

I wouldn’t bet on it, but maybe the reason the economy has remained viable for the past forty years is that, in the absence of absolute control, there are still enough vestiges of “free market” strength at work to keep the economy humming despite all of the government’s and Federal Reserve’s ignorant meddling. If so, the more power government grabs, the more likely we’ll suffer a real crash.

However, for now, it appears more likely that:

1) We have forgotten the nature, advantages and effects of a gold-based monetary system;

2) No one really understands nature and effects of today’s fiat currency and therefore can’t reliably predict the consequences of using more or less fiat dollars;

3) Since fiat currency is constantly changing its value, it becomes almost impossible for anyone to judge whether a particular investment is wise or foolish;

4) Based on the unpredictable value of fiat currency, no one really understands the nature, causes and effects of the current economy;

5) No one is really in control of the economy;

6) Insofar as our economic and monetary systems are highly dependent on public confidence, the inability of anyone to truly control or even understand those systems should diminish public confidence dramatically;

7) As public confidence falls, so will the perceived value of fiat dollars, the strength of our economy and even our nation’s political integrity;

8) In the absence of real understanding and control of our economy and in the absence of public confidence, how will our economy and political system remain intact?

A: By force.

If the United States is going to hold together as a nation, that integration will be increasingly maintained by the force of stricter government regulations and enforcement by a police state.

Implication: By adopting a fiat, paper, debt-based currency, we’ve adopted a monetary system that’s inherently irrational, incomprehensible and uncontrollable by conventional economic means. Because it’s uncontrollable, it’s subject to sudden collapse. A sudden economic collapse might destroy the nation. Rather than allow our irrational monetary and economic systems to collapse under the weight of their intrinsic lies—and risk national collapse as a consequence—people in positions of power will increasingly rely on fraud, criminal acts, brute force and finally a police state.

That’s not a prediction. It’s an observation. It’s already happening.

“Butterfly McQueen” Bernanke is the natural predecessor for Big Brother. Government’s inability to control by means of truth and reason will compel government to try to control by force.

There’s a police state in your future that’s a natural consequence of fiat currency.

The kind of “money” that we choose to use will determine our national fate.

Those currently singing “Don’ worry . . . be happy!” may soon be drowned out by those singing “Homeland! Homeland! Uber alles!”