You have no doubt noticed that the global economy has taken a beating in recent months due to the COVID-19 pandemic. Not just a regular beating either. The COVID-19 recession is the worst economic meltdown since the Great Depression of the 1930s. We are living through history whether we like it or not.

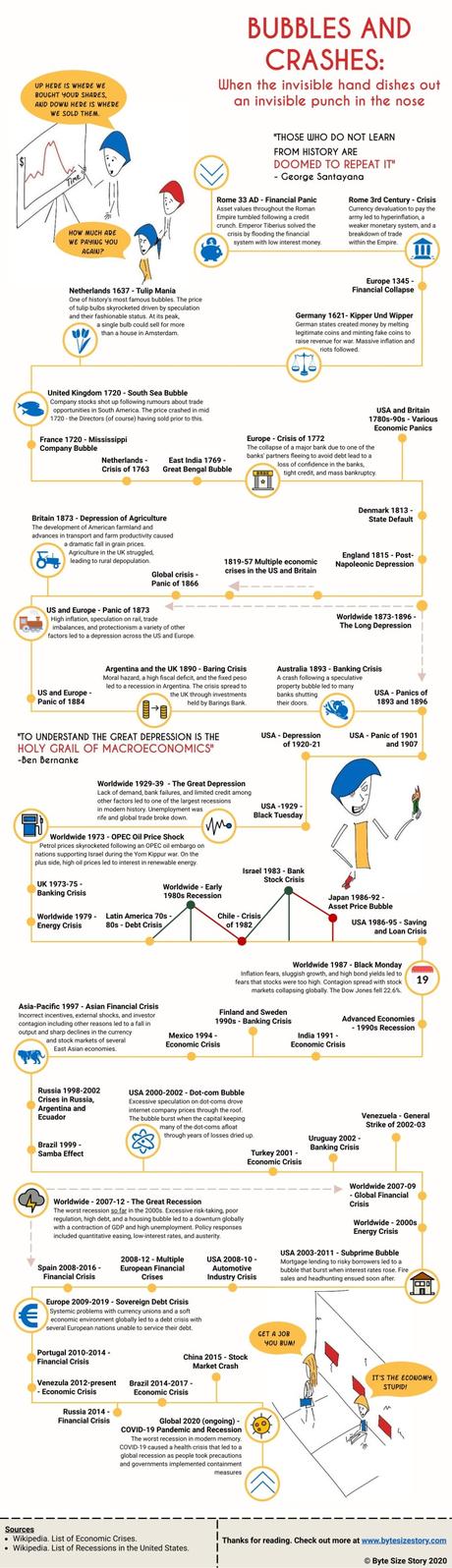

All crises bring with them a chance to better understand this thing we call the economy. Here is a timeline of economic crashes throughout history.

Economists talk about recession as being two successive periods of negative economic growth. That doesn’t necessarily mean much. What matters is that recessions harm people’s wellbeing – think homes lost, less “stuff” purchased, and unemployment. The long-term social effects can be harmful if people are less confident or are without jobs for a long time. While we do pull through recessions, they tend to hit some people harder than others which can have long-run implications. Unfortunately, crashes are an innate part of the economic system.

There is no such thing as long-term economic stability. You might have heard the popular saying that there is an economic disaster every ten years or so. COVID-19 is just the latest in a long line of economic crashes.

Recessions are both a disaster and a learning opportunity. Policymakers need to learn from recessions so we can understand how to mitigate the damage. We probably get better at addressing economic disasters, but the big ones like COVID-19 or the 2008 Great Recession bring with them unique features that we can learn from each time.

There are several reasons why recessions can happen:

- Demand-driven – a widespread drop in spending causes a downturn. We are seeing this during COVID-19 with containment measures, health risks and uncertainty causing people stay at home and reduce spending.

- Supply shocks – a sudden decrease in the supply of a good or service. This type of downturn could occur when there is say a destructive natural disaster or a resource runs dry (e.g. an oil well)

- Bubble bursting – a large drop in asset values (e.g. shares in a company or property) causing people to lose confidence in the economy.

- Financial panics – run on banks due to a loss in confidence in the financial system with depositors removing large amounts of cash.

Depending on the cause of the recession different mechanisms may be used to address the problem. Governments often step up to the plate with large spending packages designed to stimulate the economy and keep money in people’s pockets. Central banks may lower interest rates to encourage people to reduce saving and spend more money. Tax cuts could be popular as a way to encourage spending. Reforms are often proposed with voters advocating change.

Perhaps one day economists will have the ability to properly predict and avoid recessions, but that’s unlikely to happen any time soon. In the meantime, stay safe during COVID-19, and let’s try to make it to the other side in one piece.

About the author: Byte Size Story is run by a New Zealand economist and connects everyday economic interactions with the big picture. The blog talks about popular issues using economic ideas to tell a story, exploring topics such as government intervention, policy and markets.

Where to know more:

The Full list of Guest posts is available here:

- https://francescolelli.info/category/guest-post/