Reminder: Pharmboy is available to chat with Members, comments are found below each post.

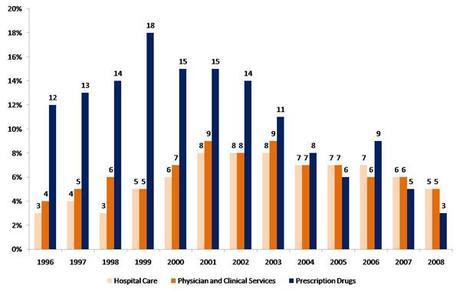

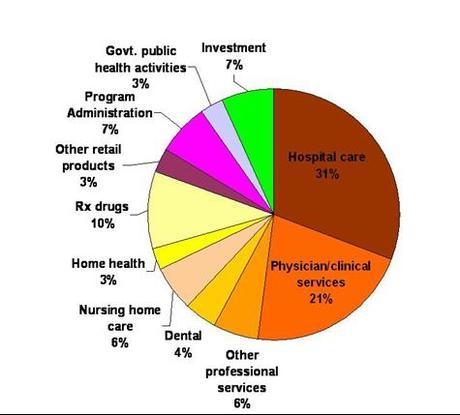

Recent PSW discussions have focused on a variety of cost center increases for the American consumer. Healthcare is one expense that is increasing faster than inflation. Over the past 12 years prescription drug prices have outpaced the two largest healthcare costs, hospital care and physician services (Figure 1). However, pharmaceuticals only make up 10% of all healthcare costs, while hospital and doctor costs make up 52% of the total $2.3T (Figure 2). More effective prescription drugs and vaccines have transformed health care over the last several decades and many health problems have been prevented, cured, or managed effectively through the use of these agents.1 In some cases, the use of prescription medicines have kept people from expensive health care options such as hospitalization and/or surgery. Yet, the debate over controlling the costs of prescription medications will be debated over the coming years, and will be interesting to watch the outcome.

Figure 1. Percent increases of Prescription Drugs, Hospital Care and Physicians (2010, Kaiser)

Figure 2. Health Care Costs (2010, Kaiser)

Total = $2.3 Trillion

Source: Centers for Medicare and Medicaid Services, Office of the Actuary, National Health Statistics Group.

In the meantime, the pharmaceutical industry is headed for a patent expiration cliff as pointed out last year in my article here, and more recently in the NYT’s article here. Pharmaceuticals make up a big part of our life, as in 2007, 90% of seniors and 58% of non-elderly adults relied on a prescription medicine on a regular basis.2 The public demands safe, effective drugs, but the costs to bring these medications to market are becoming more expensive. Development costs have soared in the most recent analysis by Tufts. Their research showed a 64% increase in the cost to discover and bring a new drug (not a reformulation or recombination of an existing drug) to market from $802M in 2000 to $1,320M in 2006. Pharma also must recoup the R&D costs for drugs that make it to market, as well as those that do not. Only one in five drugs that make it to the clinical testing process receive FDA approval and are brought to market.8 The pharmaceuctical industry must reinvent itself, and personalized medicine is the next wave to take the industry by storm.

Personalized medicine is about making the treatment as individualized as the disease. It involves identifying genetic, genomic, and clinical information that allows accurate predictions to be made about a person’s susceptibility of developing disease, the course of disease, and its response to treatment. Personalized medicine is very early in its life-cycle, but it is rapidly advancing to help understand each person’s unique clinical, genetic, genomic, and environmental information. In order for personalized medicine to be used effectively by healthcare providers and their patients, these findings must be translated into precise diagnostic tests and targeted therapies. These personalized data have begun to be utilized in certain areas, such as testing patients genetically to determine their likelihood of having a serious adverse reaction to various cancer drugs.

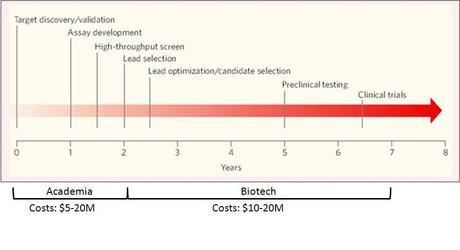

Personalized medicine will allow the pharmaceutical companies to take a bigger piece of the pie (Figure 2), buy cutting into other areas of the healthcare field (e.g., hospitals), even IF healthcare becomes regulated. Think of cancer treatments as the first wave of personalized care to take place. Because of the longer time lines and prohibitive costs to bring new drugs to market (Figure 3), academia and smaller biotechs will be the research engines that do the heavy lifting, and pharma will finalize the products for market. It will be very difficult for a smaller biotech company to become the next Amgen or Genentech, as pharma has deep pockets and investors want to cash in to mitigate risks.

Figure 3. Development Timelines in Pharma/Biotech.

Stem cells and RNAi are in their infancy and something investors can watch for in the future, but cancer and the soon to be genetic testing are the new rage in personalized medicine. Many of our investments at PSW have been in the cancer field, including SGEN, ARIA, IMGN, CRIS, ONTY, etc. and we did buy GXDX before it was bought by Novartis (who made a genetic test for cancer). Below are a few recommendations for a longer term investment portfolio or a binary event investment over the coming 6-8 months for consideration. All entries are 1/4 entries and no portfolio should be invested in biotechs at greater than 10-20% (based upon risk).

Nanosphere (NSPH) – (mentioned by one of our members) I have tried to dissect their business model, and the easiest way to explain it is they are GXDX on a micro scale. In essence, the company uses very small pieces of DNA, protein, RNA, etc to ‘detect’ infections (bacterial, viral), cancer proteins, etc. in the body. Nanosphere was founded in 2000 based upon nanotechnology discoveries at Northwestern University by Dr. Robert Letsinger and Dr. Chad Mirkin. Among other achievements, these discoveries made possible the consistent manufacturing and functionalization of gold nanoparticles with oligonucleotides (DNA or RNA), or antibodies that can be used in diagnostic applications to detect nucleic acid or protein targets, respectively. Since its founding, Nanosphere has made continuous enhancements to the original technology advances by coupling the gold nanoparticle chemistry and capabilities with multiplex array analysis, microfluidics, and human factors instrument engineering and software development to produce a full-solution, diagnostics workstation, the Verigene® System. Here is a video, where the company was featured on PBS. Recently, a stock offering pounded the company down to $2, so get in now and enjoy the ride. Also, insiders are buying like crazy. No options, so stock it is.

Protalix Biotherapeutics (PLX) – a specialty pharma that makes proprietary recombinant therapeutic proteins expressed through its proprietary plant cell based expression system. Protalix’s ProCellEx(TM) presents a proprietary method for the expression of recombinant proteins that Protalix believes will allow for the cost-effective, industrial-scale production of recombinant therapeutic proteins in an environment free of mammalian components and viruses. Protalix is also advancing additional recombinant biopharmaceutical drug development programs. Taliglucerase alfa is an enzyme replacement therapy in development under a Special Protocol Assessment with the FDA for Gaucher disease which is cheaper to manufacture than Genzymes Cerazyme. We played them for the FDA approval in March and were burned by the rejection, but it is still my belief that the company has a TON of upside potential with not only their Taliglucerase alfa, but with their technology which is transferable to many other enzyme replacement diseases (look out BMRN). The FDA (refile) and EU dates are not known, but for a stash away for a rainy day account, I like their chances. Buy stock and sell the Nov 2011 $7.5 calls and puts for $2.40 or better.

Exelixis, Inc. (EXEL) is focused on discovering, developing and commercializing therapies for the treatment of cancer and other serious diseases. The majority of its programs focus on discovery and development of small molecule drugs for cancer. The Company has a pipeline of compounds in various stages of development for the treatment of cancer and various metabolic, cardiovascular and inflammatory disorders. All of its development compounds were generated through its internal drug discovery activities, although it is developing certain of these compounds in collaboration with partners and has out-licensed others. The Company is focusing its development activities on its clinical compounds, XL184, XL147 and XL765. XL184, the Company’s advanced drug candidate, inhibits MET, VEGFR2 and RET, proteins that are key drivers of tumor growth and/or vascularization. XL147 is a selective inhibitor of PI3K while XL765 is a dual inhibitor of PI3K and mTOR. Rumours are swirling that they are in bed with Goldman Sachs for selling the company. Insiders have exercised their options, but I do not see any sales…….hummmm. I like a bull call spread for a binary event. August $11/16 for $1.40 or better. Data are due out sometime in the next few months (ASCO is in June, so data could be revealed there). Get out at 70c.

Vical (VICL) – is another company brought up in chat by a member. Vical engages in the research and development of biopharmaceutical products based on its deoxyribonucleic acid (DNA) delivery technologies for the prevention and treatment of serious or life-threatening diseases. Its products include Allovectin-7 immunotherapeutic, a Phase III clinical trial product to treat metastatic melanoma; TransVax, a Phase II clinical trial product to prevent viral reactivation and disease after transplant; Prophylactic vaccine for H5N1 pandemic influenza virus, which completed Phase I clinical trial to protect against infection, disease, and/or viral shedding. The stock has had a huge run, and may have more to go based upon several analysis including Canaccord Genuity, who sees:

- Anticipation of appreciation going into A-7′s Phase III melanoma trial results maturing in the first half of 2012.

- Bristol-Myers Squibb (NYSE: BMY) was referenced as a point for stand of care and as a recent approval by the FDA. A7 is noted as having even better results, with a 7.5-year survival rate in some of its patients.

- A7 also had a lower adverse event-risk than Yevoy with positive survival data. A-7 was said to absent of Grade 3/4 adverse events.

- The firm now models $1 billion in combined US/EU sales by 2018.

- Almost all of Vical’s market cap is based upon its A7 as an oncology asset, but the belief is that A7 will reflect well upon its entire vaccine platform. The company’s valuation is believed to be back-stopped by the DNA-based vaccine technology platform.

Start accumulating stock, and selling June $5 puts and calls.

Micromet (MITI) – a biopharmaceutical company, engages in the discovery, development, and commercialization of antibodies for the treatment of cancer, inflammation, and autoimmune diseases. Its product development pipeline includes novel antibodies generated with its proprietary BiTE antibody platform, as well as conventional monoclonal antibodies. Like IMGN and SGEN, MITI is in a good position to capitalize on a technology that will aid in future cancer therapies. I will do a separate writeup on them later in PSW, but I wanted to get them out there now for an accumulation phase before they take off. Buy the stock here, and sell the November $7.50 calls and $5 puts for $1.20 or better. Alternatively is buying the November $5/7.5 bull call spread, selling the $5 puts for $0.60 or better.

Disclosure - I own PLX and may initiate the trades noted above.

1Zhang, Y., Soumerai, S. B. Do Newer Prescription Drugs Pay For Themselves? A Reassessment Of The Evidence. Health Affairs 2007 26(3):880-886.

2Agency for Healthcare Research and Quality. Prescription Medicines-Mean and Median Expenses per Person With Expense and Distribution of Expenses by Source of Payment: United States, 2007. Medical Expenditure Panel Survey Component Data. Generated interactively. (February 4, 2010)