Last Thursday, we reported that after having patiently and bravely bought every (or almost every) f**king dip of the Biden bear market, retail investors were on the verge of throwing in the towel and were ready to capitulate alongside their far wealthier (and much more experienced) institutional peers. One day later, we also reported that while in his latest note the biggest Wall Street bear - and contrarian - BofA Chief Investment Strategist, Michael Hartnett, had not turned bullish just yet, he strongly hinted that he will in the near future as a result of his expectation that the Fed will pivot in the near future, and "the most difficult decision in investing for the rest of 2022 will be to pick which FOMC one should flip portfolio before - Sep 20th , Nov 1st or Dec 13th" with Hartnett saying it will most likely be November when the Fed capitulates.

Fast forward to today when Hartnett published the results of his latest fund manager survey for July, which confirmed what we reported last week, namely a prevailing mood of "full capitulation" and "dire level of investor pessimism", and even though Hartnett - like Elliott earlier - sees poor fundamentals for H2 2022, "sentiment says stocks/credit rally in coming weeks", and just like that the biggest Wall Street bear became a bull.

Here are some more details excerpted from the latest Fund Manager Survey (FMS) which took place between July 8 and 15 and polled 293 panelists with $800 billion in AUM (the full report is available to pro subscribers in the usual place).

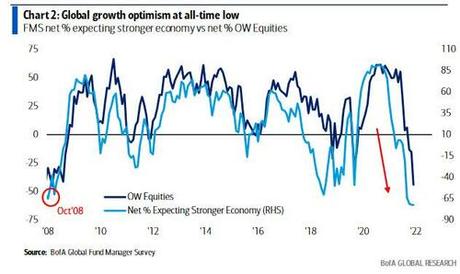

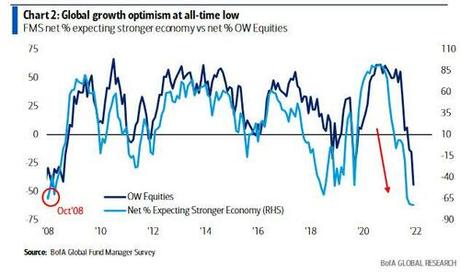

"The Full Capitulation": According to Hartnett, the July FMS shows a "dire level of investor pessimism" manifested by all time low expectations for global growth...

... and profits...

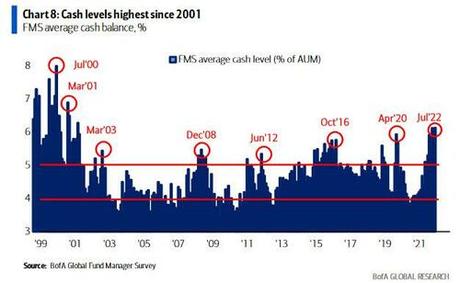

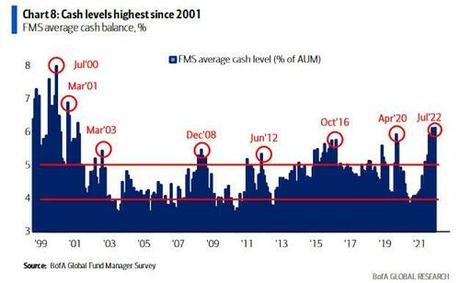

... while cash levels are highest since "9/11"...

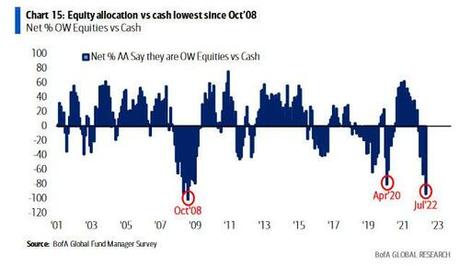

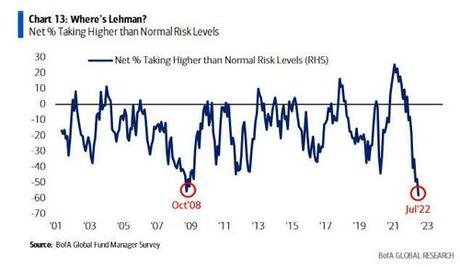

... and equity allocation lowest since Lehman...

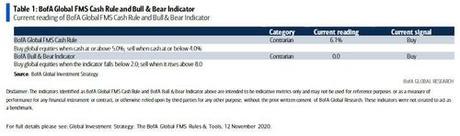

... and a BofA Bull & Bear Indicator which remains "max bearish" at the lowest level on record, i.e. 0.0

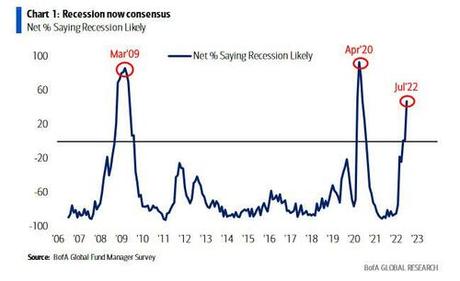

Looking at Macro conditions, global growth expectations have slumped to net -79%, a new all-time low, as recession anticipation soars to the highest since May'20.

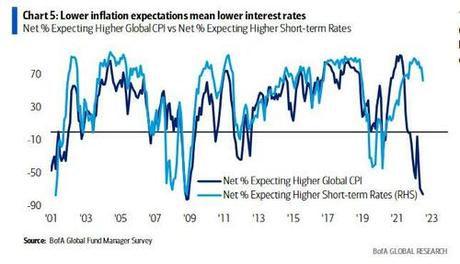

Paradoxically, everyone (net 76%) expects inflation to collapse next year (great lead indicator for short rates)...

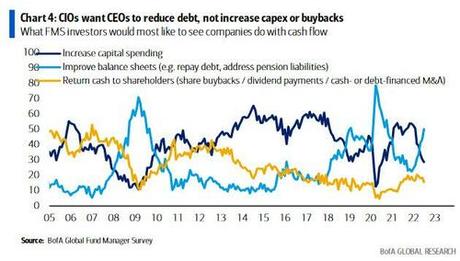

... although for now the mood is still "stagflationary" - probably until the Fed pivots - and investors want corporates to shore up balance sheets (50%) not increase capex (29%) or buybacks (15%).

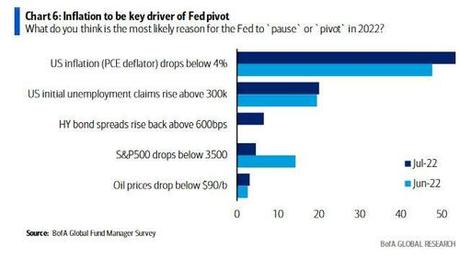

And as we wait for the recession, which investors expect to be triggered by the Fed as it hikes another ~150bp more, investors say PCE inflation <4% will be the most likely catalyst for a Fed pivot...

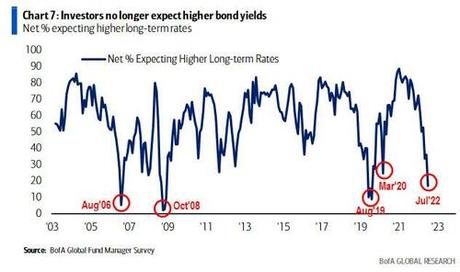

... something which is now just a matter of time, with bond yield expectations at 3-year lows as investors anticipate a "bull flattening" yield curve which then becomes steepening as the front end collapses.

Elsewhere, FMS cash levels surge to 6.1% from 5.6% (highest since Oct'01)....

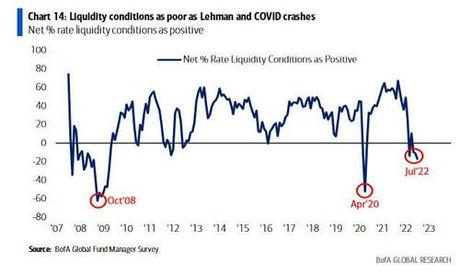

... as investors take risk exposure below Lehman levels...

... which makes sense with most seeing liquidity conditions as poor as the Lehman and Covid crashes.

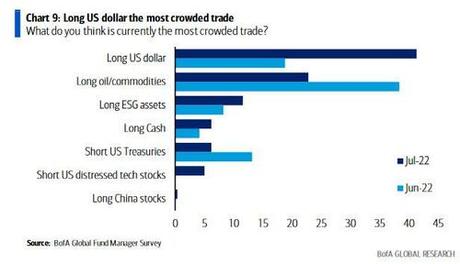

As an aside, one month after consensus said that long commodities was the most crowded trade only to see commodities suffer the fastest and biggest crash since Lehman, it's now the dollar's turn to crater. Why? Because according to Wall Street, the #1 crowded trade - according to consensus - is being long the USD...

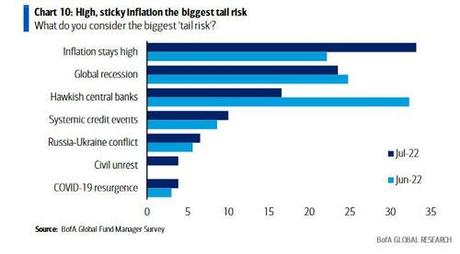

... followed by #2 long oil/commodities, while the biggest tail risk by a comfortable margin is that inflation stays high, which amusingly is seen as an even bigger risk than recession.

Meanwhile, allocation to stocks is finally the lowest since Oct'08 (finally catching up to macro pessimism).

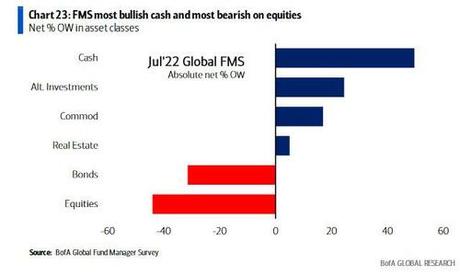

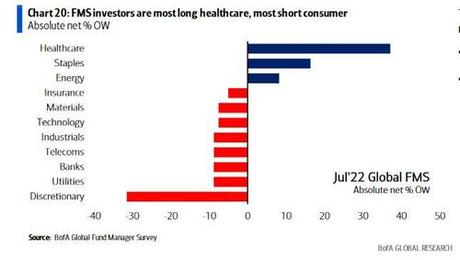

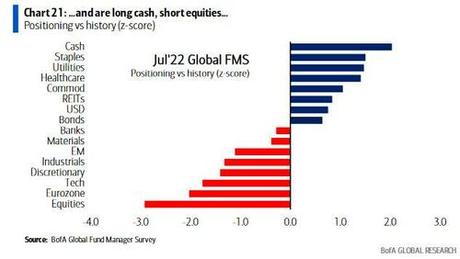

Completing the snapshot of investor portfolios in this pre-recession phase, Hartnett writes that investors are very long cash & defensives (staples, utilities, healthcare)...

... and very short stocks (EU, banks, tech & consumer)...

... while cutting exposure to resources.

Summarizing Hartnett's findings, the strategist writes that " H2'22 fundamentals poor but sentiment says stocks/credit rally in coming weeks" and adds that the " contrarian Q3 trade is risk-on if no Lehman, CPI down, Fed pause by Xmas...short cash-long stocks, short US$-long Eurozone, short defensives-long stocks banks & consumer."