Share repurchases have been the backbone of the stock market's rise over the last few years - and simultaneously, and purely coincidentally, the rise in C-Suite remunerations.

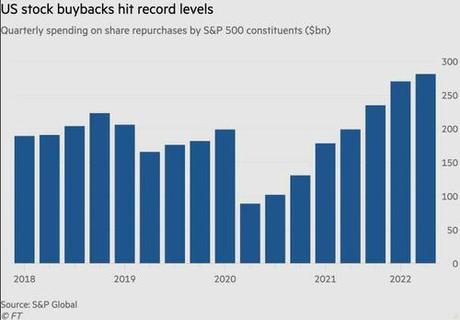

Companies in the S&P 500 spent $281bn on share repurchases in the first three months of 2022, according to S&P Global, setting a new record high for the third consecutive quarter.

Traders on the Goldman Sachs trading desk responsible for executing buybacks estimated companies have authorized $856bn worth of repurchases so far this year.

That spendfest - helping stakeholders and not workers - has been an easy-win talking point for Democrats for years, and so, one of the main revenue generators in President Biden's climate and health package is a tax on share buybacks sending millions of dollars from corporate coffers into the much-smarter and optimally-allocated arms of Washington bureaucrats.

And so in order to avoid those taxes, The FT reports that bankers and lawyers on Wall Street are hunting for ways to help companies:

At the center of their efforts is the use of accelerated share repurchase (ASR) programs, a commonly used mechanism allowing companies to complete buybacks that can be worth billions of dollars.

Although the programmes are recorded as having been executed on a single day, it often takes several months for banks to complete the trades.

The plans hinge on whether forthcoming Treasury guidance will count the day that the company forks over the cash and receives its shares as the date of the buyback, or whether they will have to wait until investment banks actually buy the stock in the open market.

The new tax will generate $74bn in revenues over the next decade, according to official estimates, but bankers warn the number could balloon if the 1 per cent level is the thin end of the wedge and ends up being set higher in subsequent years.

"The assumption, and it's still pretty early... is that a 1 per cent tax in and of itself is not enough to significantly change behaviour," said a New York-based banker who works on corporate share buybacks. "One per cent now is not a big deal, but what if that 1 becomes 3 or 5 or 10 per cent to raise revenue or score political points?"

In a simplified accelerated share repurchase programme, an investment bank agrees to buy a publicly traded company's outstanding stock in the future as part of a forward contract.

The bank is paid upfront by the company to buy the stock.

It then borrows stock in the public market from security lenders, delivering the shares to the company.

The company can then treat those shares as retired, helping boost its earnings per share.The bank, which is effectively short the stock, will spend several months buying back the shares in public markets, ultimately returning it to the security lenders.

As The FT concludes, equity trading desks have not yet seen a surge of interest in executing buybacks. However, bankers said they expected activity to increase in the final months of the year as companies planning buybacks in early 2023 move some purchases into 2022.