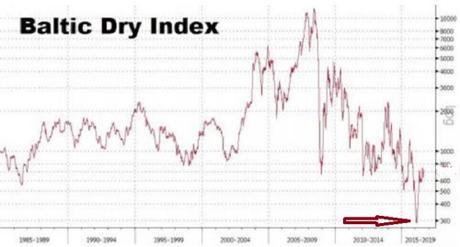

The Baltic Dry Index is a shipping and trade index, created by the London-based Baltic Exchange, which measures the sizes of dry bulk carriers or merchant ships. Changes in the Baltic Dry Index give investors insight into global supply and demand trends, and are a leading indicator of future economic growth (if the index is rising) or contraction (index is falling).

Just as the Baltic Dry Index began emerging from its lowest depth since 1980 (see dark red arrow in chart below), the bankruptcy of Hanjin Shipping, the world’s 7th largest container carrier, threatens to, once again, plunge the index down.

As reported by Reuters, yesterday, August 31, 2016, Hanjin Shipping, South Korea’s largest shipping firm and the world’s 7th-biggest container carrier, filed for bankruptcy after losing the support of its banks, leaving its assets frozen as ports from China to Spain denied access to its vessels.

Led by state-run Korea Development Bank, the banks withdrew their backing for Hanjin on the grounds that Hanjin’s funding plan was inadequate to tackle its massive debt that stood at $5 billion at the end of 2015.

A day after Hanjin’s bankruptcy, the global effects are already felt. As reported by ZeroHedge, September 1, 2016:

- 10 Hanjin vessels have been seized at Chinese ports, adding to the ship that had been seized in Singapore by a creditor earlier this week.

- Many Hanjin ships have either been denied entry to ports — including Busan, South Korea’s largest port — or are unable to dock as container lashing providers worry that they will not be paid. Three Hanjin ships are stranded off the California coast, with the ships and their hundreds of tons of cargo in legal and financial limbo.

- Sharp increases in freight rates for routes where Hanjin had operated. As an example, the cost of shipping a 40-foot container on the Busan-Los Angeles route has jumped about 55%, from $1,100 to around $1,700; rates between South Korea and the U.S. east coast via Panama have risen about 50% to $2,400; Busan to Europe routes would rise 47% in the near term. The most direct impact of this price surge will be borne by South Korean exporters, them additional shipping costs of about $394,805,502 (440.7 billion won) per year. For South Korea, where approximately 50% of GDP is in the form of net exports, the hit would be substantial.

- Manufacturers are scrambling for alternatives. South Korean conglomerates are scrambling to find alternatives. LG Electronics, the world’s No.2 maker of TVs, told Reuters it was cancelling orders with Hanjin and seeking alternatives to ship its freight. It is also making contingency plans for cargo already on board Hanjin ships in the event the vessels are seized. Hanjin’s rival, Hyundai Merchant Marine, announced they would deploy at least 13 of its ships to two routes exclusively serviced by Hanjin, while the South Korean government also plans to reach out to overseas carriers for help. However, a lengthy period of time will pass before the Hanjin void is filled.

- The most troubling outcome is the impact on global supply chains, potentially resulting in a cascading waterfall effect. This is already manifesting itself in the quietly creeping chaos that has gripped the global logistics industry, as operators realize what has happened. South Korea’s maritime ministry said Hanjin’s bankruptcy would affect cargo exports for 2 to 3 months. That means intermediary operations now find themselves without critical components to engage in production, which in turn creates more bottlenecks in overall production.

Seeking to contain the fallout, a South Korean court said it would soon begin proceedings to rehabilitate the carrier – which would allow Hanjin to take legal action in other countries to keep its ships and other assets from being seized. So far it appears to have failed, as reports of “frozen” and stranded container carriers emerge by the hour. Furthermore the task is moot: the court’s move to rehabilitate Hanjin is seen as mainly procedural, and an eventual liquidation of assets is most likely.

Rahul Kapoor, a director at maritime consultancy Drewry Financial Research Services, said, “Unlike dry cargo, liner shipping is all about marketing and service reliability — we haven’t seen any large carriers come back from collapse. There is a loss of faith among customers. It’s very unlikely Hanjin can come back from the ashes.”

Even before the bankruptcy of the world’s 7th largest container carrier, the global economy was already anemic:

- The Organization for Economic Co-operation and Development (OECD) said global trade would only grow by 2% this year, “a level it has fallen to only five times in the past five decades and that coincided with downturns: 1975, 1982-83, 2001 and 2009.”

- According to the Wall Street Journal, U.S. industrial production is faltering: “Overall industrial production peaked in November 2014 but has failed to regain that level amid a mining sector collapse and leveling off at factories.” Overall industrial production was down 1.4% in the 12 months through May 2016; utility output is down 0.8%; and mining output has plunged 11.5%.

- All of which led Michael Pento, president and founder of Pento Portfolio Strategies and author of The Coming Bond Market Collapse, to conclude in a commentary for MSNBC on June 21, 2016, that “the next recession is already here and there isn’t much the Fed can do.”

Tighten your seat belts, folks. We are in for a rough ride . . . .

~Eowyn