Yesterday they were saying $20Bn in damages but the NYC subway system alone may have more than $20Bn in damage. Who's insuring it, I have no idea, but things like that and the devastation along the Jersey shore, where single homes are worth well over $1M and 100 miles of home-filled coastline was hit with record flooding means we could, ultimately, be looking at $50-$100Bn worth of total (not all insured) damage from hurricane Sandy.

So we're not going to go bargain-hunting for insurance companies – it's a very hard group to pick winners and losers in but some segments, like title insurers, tend to sell off with the group – even though they don't even write that kind of insurance – and those can make for some good fishing once the dust settles.

At the moment, the futures are up slightly (8am), but only because the Dollar took a dive to 79.75 as the Euro broke over $1.30 but it remains to be seen if the Dollar will stay under 80 and the Euro will stay over $1.30 – otherwise we'll be back on the downward path very quickly. The oil inventory report has been postponed until tomorrow and oil is back up at $86.35 but, with 1/3 of the country not driving or flying for a few days – don't expect a lot of fuel to be used in the NEXT report – this one only covers through Saturday.

We get our own Unemployment Report with the Non-Farm Payrolls on Friday morning and we're expected to have added 130,000 jobs in October, which would leave Unemployment at roughly 7.8% in the US – nothing to crow about but thank goodness we're not Europe! Higher payrolls, of course, mean more demand for Dollars but not necessarily a strong Dollar as the Fed has already made it clear they will continue pumping money into the economy long after we don't need it anymore. Of course, if Romney is elected, he plant to replace Bernanke, presumably with someone more hawkish and that could turn the Dollar up quickly, which would be bad for stocks and commodities in the short-run – so we'll keep an eye on that next Tuesday.

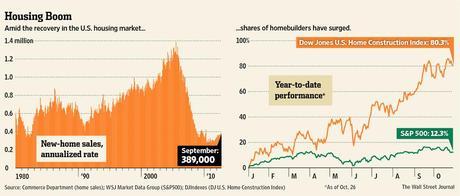

As you can see from the chart above, despite the little bump in the road we've been having, the S&P is still up 12.3%, year-to-date, while an admittedly modest recovery in new home sales has sent the Dow Construction Index (ITB) up 80.3% and that may seem like a lot but it was down from 50 in 2006 to 6.50 in 2009 and only made it back to 12 at the beginning of this year, pretty much doubling with the rest of the market but, like XLF, it had taken a much harder hit and, even back at 20, is still down 60% from the top and our housing market still has a very long way to go before it's back on track – at least another 50% to 600,000 annual starts and even that only replaces the nation's 110M residential properties at a rate of once every 183 years so it seems like a pretty good bet that new home construction should continue to trend higher and we'd love to add some ITB on a pullback ($19.50 is the 50 dma, $16.50 is the 200 dma but not likely to see that again).

“The housing recovery has had modest momentum,” said Anika Khan, a senior economist at Wells Fargo Securities LLC in Charlotte, North Carolina, a subsidiary of the largest U.S. mortgage lender. “We still are looking for housing improvement and think that trend will continue.”

Keep in mind that over 25% of the nation's unemployed are in the construction industry. If we can keep this momentum positive in 2013, it won't matter much what Europe or Asia do as a housing recovery in the US will trump most other issues.

Meanwhile, we still have this mess to clean up, then the elections, then the fiscal cliff so let's not pop any champagne corks just yet…