pic credit: CNBC

Are we about to enter another global crisis? An economic meltdown of gargantuan proportions!? Is everything about to POP?? Well, find in just over 10 minutes.

The Last Global Economic Collapse

The last time America had an economic crisis was during the Great Recession of 2008, which followed the failure of Lehman Brothers. Because it wasn't only the Lehman brothers who went down, the major reason for this economic disaster was turning a blind eye to the financial sector's extreme susceptibility to the possible collapse of the US housing and credit market bubble.

Many of America's largest financial institutions failed or collapsed as a result of the crisis. Bear Stearns, Fannie Mae, Freddie Mac, Lehman Brothers, and AIG are some of the most well-known financial institutions.

The bust of the subprime mortgage market – defaults on high-risk home loans — was the cause of the crash, which resulted in a credit bottleneck in the global financial system. Yes, this had a global impact...what America did had an economic impact all around the world. In the year following the 2008 financial crisis, economic activity fell in half of the world's countries.

The government, on the other hand, took an extraordinary step to get the economy moving again. In response, the government announced a $700 billion bank rescue and a $787 billion fiscal stimulus package.

The March 2020 Recession

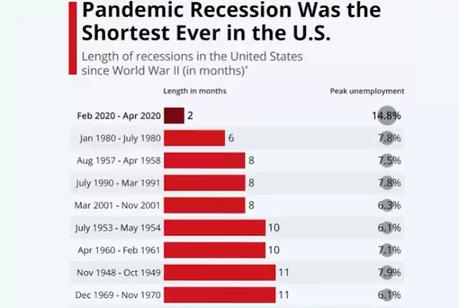

Some claim that the last time we experienced an economic crisis wasn't in 2008, but only around two years ago. In 2020, there will be a minor COVID recession. Which lasted for two months. In the months of March and April of that year. Even FRED data from the US Federal Reserve shows that they regard that period in US history to be a recession.

However, when compared to earlier recessions, this one was the shortest. As can be seen, the next shortest one occurred in 1980, when it lasted 6 months...and on average since World War II. A recession lasts an average of 11 months.

And if the COVID recession had been allowed to proceed normally, it would have probably fit the typical length, but it wasn't. To prop up the economy, the government used severe steps, much more so than in 2008.

Starting with then-President Donald Trump and ending with current President Joe Biden... Amount aid and stimulus measures approved by Congress total $4.5 trillion. This huge money printing stimulus isn't limited to the United States. It's a worldwide phenomenon.

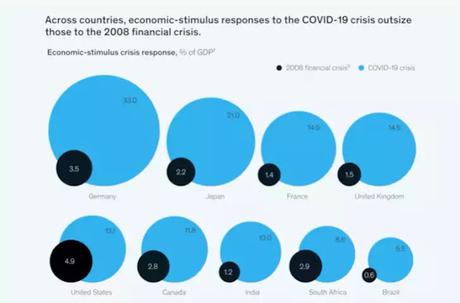

As a proportion of GDP, below are the nations and their stimulus programs. The COVID stimulus is blue, while the stimulus from 2008 is black.

As you can see, the COVID stimulus bubble is far greater than what occurred in the world's largest economies in 2008. All of this has been accomplished while interest rates have remained historically low.

As can be seen in this graph, they have essentially been held at 0 for the US since March of 2020. Borrowers have been given large sums of money, and their capacity to repay has been called into doubt.

Those funds were lent at extremely low-interest rates, which do not nearly compensate the lenders for the risk of a borrower default. Borrowers have been investing this money in a variety of assets. Stocks are at all-time highs.

Asset Bubbles Around the World

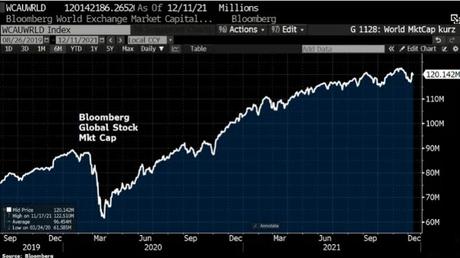

Prior to the Corona crisis, the global stock market was valued at slightly about $90 trillion. Stocks fell to a low of just over 60 trillion dollars in March 2020, and by the end of December 2021, they had risen to over 120 trillion dollars.

What about a different asset... real estate? Pre-pandemic, the median housing price was around 329,000 dollars. That median price decreased to 322,000 during the panic and "recession." The median price has risen to about 405 thousand dollars as of today.

When you look at the entire chart, you can see that this is the fastest-growing period in US house values in history.

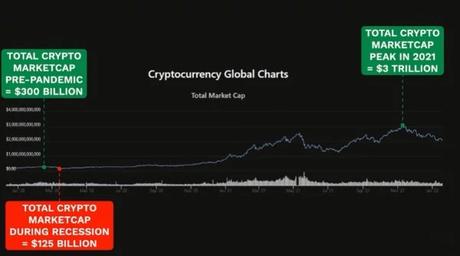

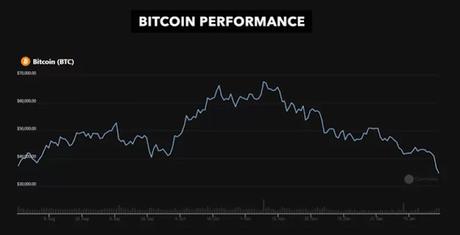

Of course, we're talking about Bitcoin and cryptocurrency. Prior to the outbreak, the crypto markets had a total capitalization of over $300 billion. By March 2020, it had dropped to a low of 125 billion dollars.

However, in November of last year, it reached a high of almost 3 trillion dollars... Assets soared to unprecedented heights, propelled by record low-interest rates...but what happens when the party is over? What happens if the Federal Reserve removes the stimulus? What will happen if the Federal Reserve is obliged to hike interest rates?

So what about the Fed’s stimulus?

The FED initiated a quantitative easing program in March 2020, when it began buying long-term Treasuries and mortgage-backed securities. The Fed's increased demand raises the price of bonds, lowering the yield.

This is compounded by the fact that banks have more money to lend due to historically low-interest rates. It equated to lower-yielding bonds being replaced with higher-performing equities and even cryptocurrency. Investors were on the lookout for assets that may provide a profit... The Federal Reserve's bond-buying program is set to come to an end.

Yes, the Federal Reserve is going to begin lowering interest rates. The Federal Reserve of the United States began tapering in November 2021, reducing total purchases from $120 billion to $105 billion each month.

On December 15, the Fed agreed to double the rate of tapering. Instead of $15 billion, the Fed would cut purchases by $30 billion every month for the rest of the year. This tapering will continue at the current high rate of 30 billion per month, or it may even accelerate and expand until the bond-buying program is completed in late winter or early spring this year.

The reduction in bond purchases will now have a knock-on impact. As the Federal Reserve slows, the yield on them will rise. Bonds will begin to compete more aggressively with stocks... However, unless the Federal Reserve decides to raise interest rates, the additional competition won't be a concern.

So when is that happening?

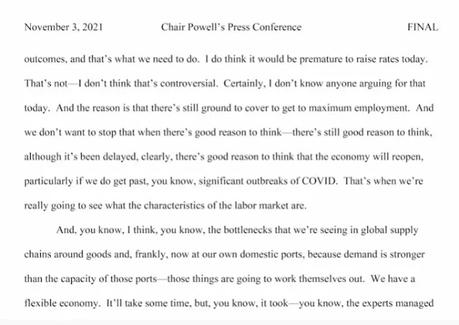

Well, things have changed quite quickly regarding the FEDs' stance on when they are going to raise rates. From this transcript of Federal Reserve chairman Jerome Powell’s speech given in early November, we can see he said this.

“I do think it would be premature to raise rates today. That’s not-I don’t think that’s controversial. Certainly, I don’t know anyone arguing for that today. And the reason is that there’s still ground to cover to get maximum employment.”

So just a few months ago, raising rates was out of the question. Just a month later, Powell’s tune changed. It is now appropriate to raise rates going into 2022. But when is this year is rates planned to be raised?

Well, Jerome spoke again in December clarifying just this. Rates won’t be raised until the Taper is finished, and like I mentioned earlier that is coming sometime next year. But Jerome said 2 meetings away from completing the Taper. What meetings?

Well, he meant the FOMC, Federal Open Market Committee meetings. As we can see from the schedule of the meeting. We have one in January And then the second one, in the middle of March. So if things go according to the FEDs plan….rate hikes may be announced by March of this year.

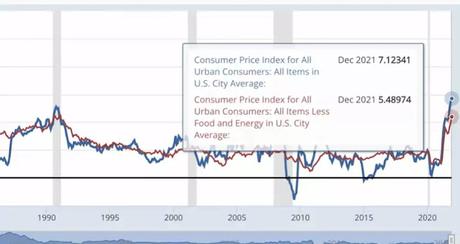

The question is will they and by doing so POP the everything bubble? Well, the reason they just might is inflation. As we can see from this chart, anytime inflation has peaked above 5 percent…we have gone into a recession with the US economy. 1970, 1975, the early 80s, 1990, 2008….

But here is what’s interesting

Using the Federal Reserve's interest rate chart, we can see that each time one of these recessions hit, the FED responded by cutting interest rates. Inflation is now above 5%, with the most recent data drop of DATA putting it at 7.1 percent, indicating that a recession is on the way.

Despite this, the Federal Reserve is considering hiking interest rates. They can't do that without wrecking the economy and deflating the whole system... and causing the downturn.

The Bubble Starting to Burst

Have you observed assets' responses to the Federal Reserve's recent conversations and moves? The S&P 500 has dropped 8.7% in 17 days after reaching a new high on January 4th. The major US market index would enter the correction zone if it fell another 1.3 percentage points.

A further 10% drop would push the index into a bear market, resulting in a full-fledged stock market meltdown. Meanwhile, Nasdaq has already lost 15% of its value since its peak. If the IT index drops another 4.9 percentage points, it will be in a bear market and collapse territory.

And we all know about Bitcoin, which is down about 50% from its November highs. Even though no rate rises have been announced, these adjustments have occurred. The markets are anticipating a statement from the Federal Reserve during this week's first FOMC meeting.

The markets are pricing in an announcement of higher rates. The greater the market selloff and the worsening of the economic downturn, the more the Fed scares markets into believing it would tighten.

The Burst Might Not Come This Year

Incidentally, this also means that the faster markets crash, the faster the Fed panics, and is forced to stabilize stocks because if you didn’t know, this year is an election year…Midterms…a market crash can’t happen or the Democrats will be destroyed in the midterms… Thus…the everything bubble isn’t popping this year…the can will be kicked further down the road, while inflation soars. But it will come…by 2023.