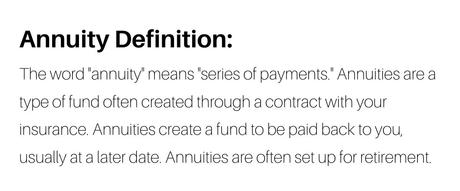

With the Fed keeping rates artificially low, my Mother and her friends began to have problems with their retirement accounts.

With the Fed keeping rates artificially low, my Mother and her friends began to have problems with their retirement accounts.

Annuity accounts there were paying them 5-6% a year and covering things like mortgage payments and utilities began paying 3%, 2%, even 1% and forcing them to pull money out of their retirement accounts to pay their bills. Once you begin to go down that path – it's very hard to get back on track – especially for people whose earning days are long past.

Doug Rapoport is the Fund Manager for Capital Trading Ideas, PSW Investment's hedge fund and he and I sat down and designed a new hedge fund that is based on our "Be the House, NOT the Gambler" that has been successfully practiced in our Butterfly Portfolio for over a decade now. Working together, we came up with an Income Fund strategy that combines a predictable quarterly withdrawal without sacrificing the potential for growth and, though it's only been two months since we launced – I thought it would be a good time to report on our progress – especially as people interested in participating in quarter 2 MUST have their documents ready and money transferred by September 30th.

Here is Doug's Report:

Back in March 2001, I was an Executive Vice President at Gruntal & Co. acting as a financial advisor while also handling insurance needs and estate planning. I was recently lured to their Fort Lee, NJ office after working on Wall Street and midtown New York for the previous 8 years including a year in the World Trade Center. At the time, I lived in Edgewater, NJ which was the next town over so the 5 minute commute and the large bonus checks that were common at that time made the decision very easy for me.

We had just come out of the massive dotcom bubble burst where many tech companies fell as much as 90% if they stayed in business at all. And many other non tech companies were dragged along with it. There comes a time in your life when some experience, gut feeling, and homework are amplified with a large amount of luck. Before the dot.com crash, oil spiked up in 1999 from around $17 to the mid 30’s in early 2000. I thought at that time, the market will feel the effects of that and might pull back a little from the unbelievable tear it was on. I went out of tech in January of 2000 and started buying REIT’s (Crown American Realty was a favorite) that were paying in excess of 8% a year in dividends. Market crashed, REIT’s not only paid their dividend but doubled in price. Now unlike the talking heads on CNBC, who assume most people don’t remember what they said on the show last month, tell you they knew exactly what was coming and made perfect moves as always, I did not. I got lucky and didn’t expect like most people how severe the selloff would be and just thanked my lucky stars that I was on a lifeboat while the Titanic sank.

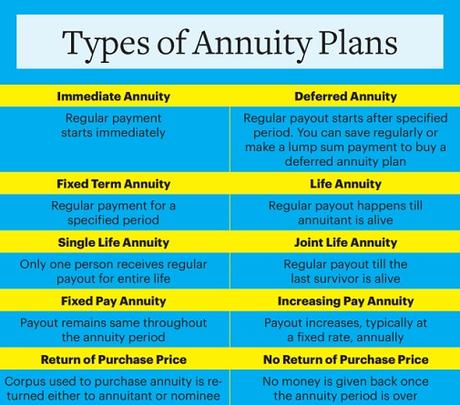

So here I am at Gruntal, accounts not devastated, lots of assets and market starting to flatten out. Wholesalers from different funds and annuities pitching me day in and day out. Offering me lunches, trips, golfing gear (I hate golf), and all the other things that are illegal to do nowadays. I can truly say that I was never swayed by any of that and knew that you have to put your client first and think long term. As their assets increase, so do yours. In most businesses, your customer’s success and happiness is symbiotic with your own. I ended up investing in some European mutual funds knowing the currency exchange rates gave me a 10% boost from the get go the way the fund was structured, some value funds and one annuity that intrigued me. ING at the time had an annuity in 2001 that had a 10 year surrender fee period.

So here I am at Gruntal, accounts not devastated, lots of assets and market starting to flatten out. Wholesalers from different funds and annuities pitching me day in and day out. Offering me lunches, trips, golfing gear (I hate golf), and all the other things that are illegal to do nowadays. I can truly say that I was never swayed by any of that and knew that you have to put your client first and think long term. As their assets increase, so do yours. In most businesses, your customer’s success and happiness is symbiotic with your own. I ended up investing in some European mutual funds knowing the currency exchange rates gave me a 10% boost from the get go the way the fund was structured, some value funds and one annuity that intrigued me. ING at the time had an annuity in 2001 that had a 10 year surrender fee period.

If you kept your money in that fund for those 10 years, you were guaranteed a double on your initial investment or the market value whichever was greater. Now you had to lock in to annuitize off that amount in 10 years or more, you couldn’t just take out a lump sum if you took the guaranteed portion. As a financial planner, this was a great tool. Someone who put in $500,000 (and many clients put in much more than that) would have at worst case $1 Million to annuitize off of in 2011 and at the current annuitization rates in 2001, which was around 6.75%, that was roughly $7,500 a month on a 20 year guarantee and over $11,000 a month on a 10 year guarantee if you were around 70 at the time of annuitization which my clients would be. What’s better than that? For most clients, with the annuity income, social security and other savings, all their needs were more than met. And in all candor, I was not a philanthropist and annuities pay very large commissions. Around 8% I believe of the money invested with no further trailer. Great for everyone, who’s the man?

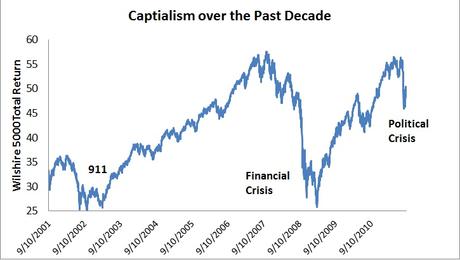

Flash forward to 9/11. Tragedy of epic proportions. I saw the planes hit the World Trade Center from my corner office. I watched the first tower come down. The place I used to work, and the friends I had that still worked there. The only words I remember uttering in shock to my secretary is “I can’t believe it’s gone, there is only one tower”. And then that went too. I was numb like most people that worked in my field and in that area that day as well as the millions across the country.

Markets were closed for the week and when they opened the market dropped hard again. I thought, wow, I dodged another bullet putting my clients in a guaranteed annuity which now looks like the guarantee would be used after all and not market value. ING quickly dissolved that guaranteed model and luckily I got in before they realized how much money they would lose from this.

Then 2008 comes along and the nuclear bomb goes off in the financial world. Now I am not thinking about the safety of my decision to have money in a guaranteed annuity, I’m thinking will ING go out of business though like all insurance products it was reinsured. While accounts before this, were outpacing the guarantee, now there is no doubt, clients will be taking an annuitization of double their investment in 3 more years. No one knows how things would’ve played out if it wasn’t for President Obama and especially Tim Geithner. Looking back, they had such unbelievable keen foresight while swimming through a sea of chaos.

2011 comes around, time to annuitize. We made it through two massive market selloffs within a decade. Uh oh, Houston, we have a problem. It seems the annuitization rate is now less than half of what we anticipated from the start. So that $7500 a month for a 20 year guarantee is now $5000. When planning out for future income, a loss of $30,000 a year for the rest of your life is a big difference. And that $11,000 a month paycheck for a 10 year guarantee is now closer to $9,000.

Now no one LOST money. Everyone still came out ahead when they could’ve lost a tremendous amount in 2008, but we do know how quick the market rebounded in the next 3 years and longer if you were in good option plays or even beat up tech stocks and not stuck in your limited group of mediocre mutual funds to choose from in the annuity that all have sky high management fees.

And now that begs the questions, why are income funds much better to be in than annuities? Well let’s poke holes in the above scenario. Yes, they still got a guaranteed income stream for the rest of their lives. Let’s look at the 10 year as an example. In 10 years, he/she will collect $1,080,000. So a $580,000 profit on what was initially invested in a 20 year total period (10 during investment period and 10 more during withdrawal). That’s about 3.93% a year and if they pass away after 10 years, there is nothing left for the heirs out of that. The amount in the account is zero.

And now that begs the questions, why are income funds much better to be in than annuities? Well let’s poke holes in the above scenario. Yes, they still got a guaranteed income stream for the rest of their lives. Let’s look at the 10 year as an example. In 10 years, he/she will collect $1,080,000. So a $580,000 profit on what was initially invested in a 20 year total period (10 during investment period and 10 more during withdrawal). That’s about 3.93% a year and if they pass away after 10 years, there is nothing left for the heirs out of that. The amount in the account is zero.

Currently, the best fixed income rate is about 3.2% for a 5 year surrender and 10 year period. So you can’t touch that money without penalty for 5 years and you will collect about $15,000 per quarter and after 10 years, it is gone based on an age roughly around 70 again. Account value zero.

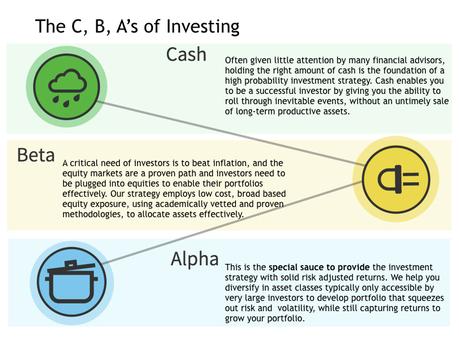

Let’s now take the Capital Trading Income Fund as an example:

We are paying out 2% per quarter of the current investment worth. After 2 months, the fund is currently up about 12% net of all fees. Will this pace continue, probably not. If it does, we will be a multibillion dollar fund in 3 years and the top producing income fund in the world. But let’s say we net 14% a year (compounded yearly) over the next 10 years while withdrawing the same $15,000 a quarter, which is more than the 2% dividend now but less than 2% dividend would be further into the years. We will do this just to compare apples to apples right now. At the end of the 10 year term, you have received the same amount of income, you had the ability to withdraw with no penalty after 6 months instead of 5 years and your heirs are left with $593,514 while you withdrew the same $600,000 in that period.

You never touched your principal and still had the income. In fact it grew for you. And you got that $15,000 a quarter whether you were 30 or you were 70. You weren’t penalized for being younger. And the longer you have it invested, not only will you still see the same stream of income as the annuity but your principal will also continue to grow instead of being depleted. In 20 years’ time, the principal will amount to $940,193.

Answer seems clear so what’s the debate? Well as we know, with the annuity you are paying for the insurance that your money is guaranteed. You cannot lose it. This cannot be said of the hedge fund. But what differentiates us from other funds and even other income funds are the disciplines that I have instilled in the fund to cut down on risk. We will not buy any tech stocks right now. Yes, Apple ran from 360 to 500 in a blink of an eye. Great, still not in our portfolio because of the risk of it falling 20-30% quickly if we have another sell off. Fact is that our economy is not strong. The Fed is creating a massive valuation bubble. We have an election coming up and no one knows exactly how the market will react to either candidate winning. And we still have a raging pandemic that has not been stopped and there is hope but no timeline to when it will. We have already seen in February and early March how quickly tech can fall and how fast it can happen and this is a conservative fund. Now if tech names do get ravaged during a sell off and value is now in play again, they would be considered. Just not currently.

Answer seems clear so what’s the debate? Well as we know, with the annuity you are paying for the insurance that your money is guaranteed. You cannot lose it. This cannot be said of the hedge fund. But what differentiates us from other funds and even other income funds are the disciplines that I have instilled in the fund to cut down on risk. We will not buy any tech stocks right now. Yes, Apple ran from 360 to 500 in a blink of an eye. Great, still not in our portfolio because of the risk of it falling 20-30% quickly if we have another sell off. Fact is that our economy is not strong. The Fed is creating a massive valuation bubble. We have an election coming up and no one knows exactly how the market will react to either candidate winning. And we still have a raging pandemic that has not been stopped and there is hope but no timeline to when it will. We have already seen in February and early March how quickly tech can fall and how fast it can happen and this is a conservative fund. Now if tech names do get ravaged during a sell off and value is now in play again, they would be considered. Just not currently.

Obviously there are no momos (momentum stocks) in our portfolio. We do not hold the names TSLA, NKLA, CMG, NFLX, etc in the portfolio. Again, when making conservative option plays, we do not want volatile movement. We want almost no movement or slow and steady movement.

At most times, we keep the portfolio in 30% or more in cash. We are generating nice returns and the cash gives us more flexibility to hedge against an existing position if need be for further protection.

At most times, we keep the portfolio in 30% or more in cash. We are generating nice returns and the cash gives us more flexibility to hedge against an existing position if need be for further protection.

The stocks that are chosen for the fund are companies that should continue to benefit if there is another shutdown. This is a factor that must be considered as the possibility of a second wave of the virus is possibly a couple months away. Some of the names that we do hold in the portfolio are UPS, COST, LOW, and WMT among others.

Our bull call spreads are conservative when we initiate them. The short cover is generally near the current price of the stock and the put we have added for the same time frame is usually 20% or more out of the money. There are also weekly short calls written against the positions hedging against a move down. If the stock moves up, our position overall will still be net positive and the weekly short calls can always get rolled to the next week if they end up being in the money. The extra calls are creating in a sense our manufactured dividend also on top of hedging against the position.

Taking no chances, bull call spreads are generally closed when 70% or more of the expected profit has been realized. We can roll into a new spread but this way we are taking more money off the table and exposing ourselves to less risk.

Now obviously seeing a much bigger return the first few years, makes it much easier to achieve an average of 14% or higher but the 14% net return is what we have set as a personal bar. In 2 months we have almost reached it and knowing how we are positioned right now, I believe it is very likely we should achieve over a 20% net return if not higher by January. Not to say there isn’t risk, there is, but I believe we are hedged well against it in multiple ways.

Another edge to the income fund vs annuities is also taxation. When you take money out of your annuity, it is taxed as ordinary income. Now in an IRA, taxation is treated the same. Money taken out of the IRA is taxed as ordinary income. But if you have money invested in the income fund in a non-qualified account, after a year, it is treated as a long term capital gain. Not as ordinary income which as of now, is a very big difference in the taxation rate and creates even a bigger potential gap on net income received in comparison vs an annuity.

Another edge to the income fund vs annuities is also taxation. When you take money out of your annuity, it is taxed as ordinary income. Now in an IRA, taxation is treated the same. Money taken out of the IRA is taxed as ordinary income. But if you have money invested in the income fund in a non-qualified account, after a year, it is treated as a long term capital gain. Not as ordinary income which as of now, is a very big difference in the taxation rate and creates even a bigger potential gap on net income received in comparison vs an annuity.

So I laid out the facts and I have given my opinion. It is now up to you to decide which route makes you feel more comfortable especially if you have been considering investing in an annuity. In 2001, if I had the choice to invest in an income fund that used option strategies like this one. It would’ve been a no brainer to skip over the annuity that ended up paying out less than a 4% return a year and choose the higher performing, more liquid play. Now in all fairness, that was actually a good return vs the S&P 500 in the first decade of the 21st Century. But there are no annuities around anymore that guarantee to double your initial investment, and second decade and historically, the S&P 500 has vastly outperformed 4% per year. Maybe my decision to choose that annuity at that point in time was amplified with luck again but I still wish their heirs had something left over when that guaranteed term ended.

We are accepting new deposits from Accredited Investors for the income fund only quarterly. This is because of the quarterly dividend that is being paid out. Our next deposit period is for October 1st. Anyone interested in investing in the fund must have paperwork submitted, approved and monies received by that date.

If you have any questions about the fund, I can be reached at [email protected] or you can reach out to Phil.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!