As the battle rages between American Airlines, US Airways

and the Department of Justice, I've been getting a few fair minded questions regarding

my stance on the merger and why I've had a change of heart. The questions are valid and remind me of a

personal story from when I was a little younger and a lot more naive.

As the battle rages between American Airlines, US Airways

and the Department of Justice, I've been getting a few fair minded questions regarding

my stance on the merger and why I've had a change of heart. The questions are valid and remind me of a

personal story from when I was a little younger and a lot more naive.

I was a junior in college when I met a wonderful woman who eventually agreed to become my wife. My mother, always doing her best to investigate the details of my dating life, asked me if the relationship was going somewhere. "No mom, we're just friends," I told her several times…I actually believed that at the time. A year later after no further updates on the changing status of our relationship, I informed my parents from the back seat of their car that I was planning to get engaged. Dad stopped the car as soon as he could and both my parents turned to look me in the eye. In unison they asked "to who?!"

Now that it's been brought to my attention, I suppose my current opinion on the American Airlines - US Airways merger bears some resemblance to the conversation I had with my parents almost 25 years ago. My opinion most certainly did not change overnight and unlike the successful union between me and my lovely bride, I am much less sure of the proposed marriage between these two companies...even so, I am strongly in favor of the merger.

American Airlines and US Airways are like two ugly kids left standing alone in the shadows at a high school dance. They don't really look all that good together and both were probably hoping for a better partner, but now they're left with a choice...dance with each other or don't dance at all.

When rumors began to circulate that US Airways was once again on the prowl for a partner, I have to admit that I was not only in staunch opposition to the idea, but also gave little credence to the possibility. US Airways unsuccessfully courted both Delta and United and I saw no reason why they would succeed this time around. Their repeated attempts to merge with carriers seemingly capable of standing on their own seemed desperate and pathetic.

Selfishly, my most serious concern was, and still is, the history and unresolved conflict between the employees of US Airways East and US Airways West. After US Airways’ second bankruptcy filing in 2004, investment advisers and industry analysts seemed convinced that the airline should be put up for sale. For months, every time I opened the morning paper I expected to see the US Airways name added to a long and distinguished list of failed airlines...It is widely believed that the 2005 merger with America West saved US Airways from insolvency. I won't attempt to explain the torrid details (mainly because I don’t fully understand them myself), but the contentious relationship between the pilots of US Airways and the pilots of what used to be America West reads like a chapter out of the lives of the Hatfields and McCoys. Frankly, I want nothing to do with that battle.

But as they say...that was then...and this is now.

The airline industry in the United States has changed significantly over the past twelve plus years...a metamorphosis that was both painful and difficult to watch. Ironically, merger mania got started with the 2001 combination of American Airlines and Trans World Airlines which, at the time, created the largest airline in world. But in the years after 9/11, American sold off most of the assets obtained during that merger leaving the company smaller than it was before. Merger announcements followed from Delta – Northwest in 2008, United - Continental in 2010 and Southwest - Air Tran in 2011. That left American and US Airways standing alone like small, insignificant and vulnerable players in game for big boys.

It should be noted that the Department of Justice views Southwest as a large discount carrier, "too small to sway other's actions." I find that laughable and would love to be in the courtroom to hear the justification for such reasoning. Southwest carriers more passengers in the US than any other carrier, even eclipsing post merger Delta and United. The airline flies to 29 of the 30 largest US metropolitan cities and is widely known for the "Southwest effect" in which the carriers entry into a market increases traffic and drastically lowers fares. [1] [2]

Before consolidation, long term stability and profitability for the US airline industry was a joke. With the possible exception of Southwest Airlines, a company that consistently managed an annoying (for anyone who didn't work there) combination of skill and luck, every other airline in the US struggled through cyclical ups and downs that became the accepted norm. The American Airlines bankruptcy in 2011 marked the 100th time a US carrier moved to reorganize its finances since 1990 and the 40th bankruptcy filing since September 2001. [3]

In a March 2013 letter explaining their support for the merger, the five unions involved made the following statement that sums up the perceived benefits for all involved:

“US Airways’ plan details the tremendous synergies and savings that would be created by a merged network. With more routes to more cities throughout the country and abroad, the new American would once again be an attractive option to the business travelers our airlines have lost to Delta and United in recent years. These factors add up to increased revenues and a thriving airline that can break the duopoly currently controlling our industry.

In addition, the new business model will allow the new American to sustain industry-rate contracts for the employees of both carriers and mitigate the furloughs that had been proposed by American’s standalone plan. The employees at American and US Airways want our company to succeed. That is why we support the merger and why we worked together to effect it.

Together, our airlines can compete in the current market and compensate its employees fairly. Apart, they can do neither.

The most frequently cited argument against the merger is that both American and US Airways are succeeding financially and they do not need to merge to thrive. We reject this theory out of hand.

In the ten years leading up to bankruptcy, American lost approximately $1 billion annually. There is near-unanimous agreement in the industry and on Wall Street that American’s problems existed on both sides of the balance sheet. Unfortunately, Chapter 11 only allows the debtor to address its costs. If it were to emerge from bankruptcy on its own, American would remain at a competitive disadvantage in terms of generating revenue.

In fact, the principle difference at the airline would be a smaller workforce (trimmed by thousands of furloughs), a 17 percent cut in wages and benefits, and a frozen pension plan. Similarly, US Airways will continue to be hamstrung by the limitations of its network. The recently-approved mergers of United-Continental and Delta-Northwest have marginalized smaller carriers like US Airways, and their long-term viability is constantly in question. More than perhaps any other, our industry is subject to shocks like fuel spikes, acts of terrorism, accidents, and natural disasters. While large network carriers have the capacity to mitigate such volatilities, smaller airlines are disproportionately affected by them. Indeed, the only way to truly ensure a fair and competitive aviation industry is to allow our companies to combine.

The path forward will be challenging, of that we can be sure. However, with labor agreements in place at both carriers, some of the most difficult tasks are already complete. We believe that the benefits the new American will provide to the traveling public, our colleagues, and our membership are well worth the tremendous effort that merging these two carriers will require.”

The honest truth is that this merger scares me to death. Even though process will be guided by the mandates of the McCaskill – Bond Amendment, the seniority integration is expected to be nothing less than a nightmare. Plus, I've been around long enough to know that American Airlines has a habit of merging with other airlines and liquidating the assets…leaving nothing behind but empty buildings, grounded airplanes and employees who are no longer needed but must be integrated into the seniority system. The primary difference this time is that there will be a changing of the guard.

In order to understand why that is so important, you must know that in 2003, the employees of American Airlines came to the company’s rescue and voluntarily accepted huge pay cuts and reductions in benefits in order to avoid the perils of bankruptcy. The often quoted mantra from company back then was “Pull together, win together.” Once the contracts were signed, labor concessions totaled over $1.8 billion and the pilots alone agreed to cuts that conservative estimates put at roughly $660 million in annual savings.

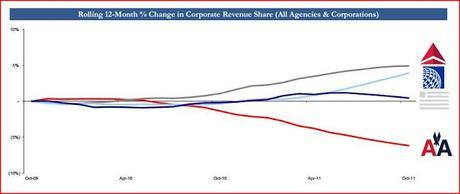

The contractual efficiency achieved through the 2003 labor contracts provided American Airlines with an enormous cost advantage over its rivals. But instead of using this new found leverage to compete soundly with its competitors, the company pursued a strategy of “shrinking to profitability,” sitting on the sidelines waiting for its competition to fail under the weight of higher operating costs. As a consequence, American is now a distant third in terms of domestic network and global reach when compared with Delta and United.

After filing for federal bankruptcy protection in November 2011, and prior to agreeing to merge with US Airways, American Airlines’ restructuring strategy was once again focused on driving labor costs below the lowest common denominator while paying little attention to the revenue side of the equation. It should come as no surprise that the employees of American Airlines want a change in leadership, but more importantly, they want to work for a healthy, viable company capable of long term stability.

From the text of a white house petition currently in the works, "Our industry has suffered immensely for more than a decade, with tens of thousands of jobs lost, families uprooted, and devastating bankruptcies. Recent airline consolidation has moved the industry toward a level of stability that has not been seen since before the Airline Deregulation Act of 1978. Allowing these two final network airlines to merge will complete this stabilization and bring increased service, fair competition, and career stability to more than 100,000 employees."

So that's it in a nutshell. Yes, my position on the merger has changed, but I didn't change my mind overnight or without good reason. I honestly believe the merger between American Airlines and US Airways is in the best interest of both airlines and the flying public. The process will be a challenge, but long term stability is in everyone's best interest.

Withdraw the DOJ suit to block the planned merger between American Airlines and US Airways.

We, the employees of American Airlines and US Airways, stakeholders, the traveling public, and those who support the free-market, petition the Obama Administration to withdraw the Department of Justice suit seeking to block the merger between American Airlines and US Airways, Case 1:13-cv-01236.

CLICK HERE TO SIGN THE PETITION