According to the latest Gallup Poll, Obama’s approval rating is now 39%.

Not only is this the lowest rating he’s ever received, it is also lower than George W. Bush’s in December 2005 when Bush admitted that the decision to invade Iraq had been based on intelligence that “turned out to be wrong.”

And so, consistent with his psychopathology and although he is half-white, Obama is now resorting to the perennial excuse of blacks. It’s RAAAACISM! Of course, that doesn’t explain how millions of “racist” whites could have elected him to be POTUS in 2008 and reelected him in 2012. [snark]

At the same time as he is blaming his falling approval rating on RAAAACISM!, Obama is retreating even more into his make-believe world of grandiose fantasies.

As reported by a fawning David Remnick for The New Yorker, at a fundraiser appearance in the palatial, 27,000+ sq. ft. home of tech millionaire Jon Shirley on Lake Washington in Medina, a suburb of Seattle, Washington, Obama claimed “the economic rescue, the forty-four straight months of job growth” as among his achievements.

That’s a lie.

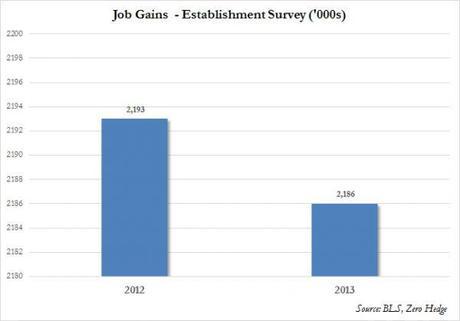

As I had reported in my post of Jan. 10, 2014, “Record number of Americans (92m) not in labor force,” despite the Fed having spending over $1 trillion in 2013 to “stimulate” the economy, there were fewer jobs created in 2013 than in 2012.

And yet Obama says the U.S. economy is doing just great!

The man is either lying through his teeth or he’s so delusional, he requires a straitjacket. There’s of course a third alternative: He’s both.

The reality is the economy is not just not doing well, it is tanking.

How do we know that?

Because retail sales — on which the U.S. economy depends, consumer spending accounting for 70% of America’s GDP – are in a downward death spiral.

We’ll begin with two of America’s retail giants that are virtually bankrupt in all but in name: JCPenney and Sears.

1. JCPenney

See my post on “JCPenney closing 33 stores and laying off 2,000 employees.”

2. Sears

Michael Snyder writes for The Economic Collapse that sales have declined at Sears for 27 quarters in a row – that’s 6+ years! — and the legendary retailer has been closing hundreds of stores and selling off property in a frantic attempt to turn things around.

Unfortunately for Sears, it is not working. In fact, Sears has announced that it expects to lose “between $250 million to $360 million” for the quarter that will end on February 1st.

I haven’t been to Sears for years, but Snyder reports that a couple of months ago he walked into a Sears store in the middle of the week and “it was like a ghost town. A few associates were milling around here and there having private discussions among themselves, but other than that it was eerily quiet.”

3. Best Buy

Snyder reports that the CEO of Best Buy recently admitted that sales had declined at his chain during the all-important Christmas holiday season “due to intense discounting by rivals, supply constraints for key products and weak traffic in December.”

In the immediate aftermath of that announcement, Best Buy stock was down more than 30% in pre-market trading.

4. Macy’s

Macy’s just announced that it is laying off 2,500 employees in an attempt to move in a more profitable direction.

JCPenney, Sears, Best Buy, and Macy’s are anchor stores for America’s shopping malls. Ask yourself what will happen to those malls when those anchors disappear. Ask yourself what will happen to the government’s revenue base when those employees who’ve been laid off from those anchor stores no longer pay income taxes.

5. But it’s not just JCPenney, Sears, Best Buy, and Macy’s, America’s retailers in general are in trouble.

Jim Quinn writes for The Burning Platform, Jan. 19, 2014 (h/t Zero Hedge):

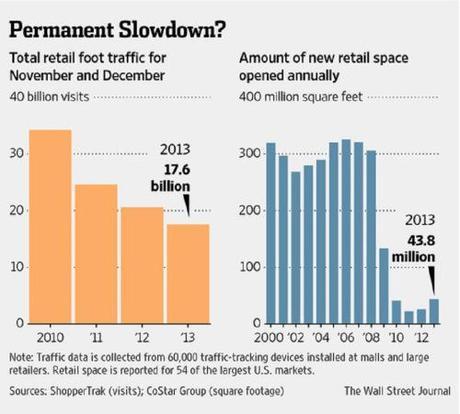

If ever a chart provided unequivocal proof the economic recovery storyline is a fraud, the one below is the smoking gun. November and December retail sales account for 20% to 40% of annual retail sales for most retailers. The number of visits to retail stores has plummeted by 50% since 2010. Please note this was during a supposed economic recovery. [...] Even the heavyweights like Wal-Mart and Target continue to report negative comp store sales. How can the government and mainstream media be reporting an economic recovery when the industry that accounts for 70% of GDP is in free fall?

As you can see in the bar graphs above (click image to enlarge), U.S. retail foot traffic in the pivotal Christmas sales months of November-December, has gone down every year — from 30.4 billion shoppers in 2010, to 20.4 billion in 2011, to 20.1 billion in 2012, to 17.6 billion in 2013.

At the same time, being in deep denial, retailers actually increased retail space by 43.8 million square feet in 2013!

And why are U.S. retail sales continuing to fall?

The explanation is simple. As Michael Snyder explains, a new Gallup survey has found that the number of Americans (42%) who are “financially worse off” than a year ago is significantly higher than the number of Americans (a little more than a third) who say they are “financially better off” than a year ago. “That is why these stores are dying.”

Jim Quinn grimly observes:

The absolute collapse in retail visitor counts is the warning siren that this country is about to collide with the reality Americans have run out of time, money, jobs, and illusions. The most amazingly delusional aspect to the chart above is retailers continued to add 44 million square feet in 2013 to the almost 15 billion existing square feet of retail space in the U.S. That is approximately 47 square feet of retail space for every person in America. Retail CEOs are not the brightest bulbs in the sale bin, as exhibited by the CEO of Target and his gross malfeasance in protecting his customers’ personal financial information. Of course, the 44 million square feet added in 2013 is down 85% from the annual increases from 2000 through 2008. The exponential growth model, built upon a never ending flow of consumer credit and an endless supply of cheap fuel, has reached its limit of growth. The titans of Wall Street and their puppets in Washington D.C. have wrung every drop of faux wealth from the dying middle class. There are nothing left but withering carcasses and bleached bones.

The impact of this retail death spiral will be vast and far reaching. A few factoids will help you understand the coming calamity: