Weekend At Bernie’s or at Bernanke’s?

Wikipedia defines “market trends” as:

“. . . a tendency of a financial market to move in a particular direction over time. These trends are classified as secular for long time frames, primary for medium time frames, and secondary for short time frames. . . .

“A secular market trend is a long-term trend that lasts 5 to 25 years and consists of a series of primary trends.

“A secular bear market consists of smaller bull markets and larger bear markets; a secular bull market consists of larger bull markets and smaller bear markets.

“In a secular bull market the prevailing trend is “bullish” or upward-moving. The United States stock market was described as being in a secular bull market from about 1983 to 2000 (or 2007), with brief upsets including the crash of 1987 and the market collapse of 2000-2002 triggered by the dot-com bubble.

“In a secular bear market, the prevailing trend is “bearish,” or downward-moving. . . .

“A primary trend has broad support throughout the entire market (most sectors) and lasts for a year or more.

“Secondary trends are short-term changes in price direction within a primary trend. The duration is a few weeks or a few months.”

• Thus, Wikipedia defines three kinds of “market trends” that differ primarily in their duration.

Secular trends last between 5 and 25 years.

Primary trends last between 1 and 5 years.

Secondary trends last only weeks or months—but are certainly less than 1 year long.

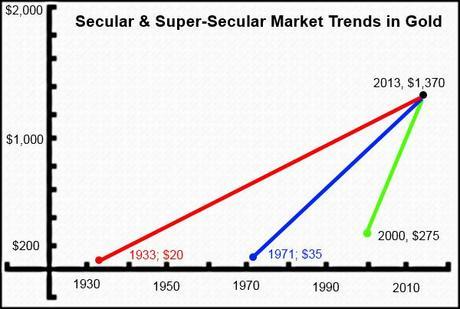

• In September of A.D. 2011, the price of gold peaked at a little over $1,900/ounce. Today, the price of gold is about $1,370 per ounce. If we defined that 23-month period as a trend, it would have to be a “primary” trend (greater than 1 year, less than 5). Thus, we might argue that the “primary trend” for gold for the past 23 months was “bearish”.

But that 23-month primary trend was only one of the several “primary trends” that comprise a longer “secular” trend. So, while the 23-month primary trend might be described as bearish, what was the nature of the longer “secular” trend—bullish or bearish?

The answer depends in part on whatever time frame we choose to identify our “secular” trend.

• For example, suppose we defined the start of our time frame as A.D. 2000 when Saddam Hussein began to sell Iraqi crude oil for currencies other than the fiat/petro-dollar and thereby diminished the value of our “petro-dollars”? What if we extended that trend until today?

In A.D.2000, the price of gold was about $275/ounce; today, $1,370. Thus, over the past thirteen years—which is too long to constitute a “secondary” (weeks or months) or even “primary” (1 to 5 years) trend, and must therefore be a “secular” (5 to 25 years) trend—gold rose to $1,370. That’s a 13-year long “secular trend,” bull market in gold that saw a price increase of nearly 400%. That averages out to about 30%/year (as compared to the A.D. 2000 price of $275).

Within the context of that 13-year secular trend, the fall from $1,900 (A.D. 2011) to $1,370 (today) is truly only one of the series of bearish and bullish “primary trends”. Those shorter, primary trends are mere components of the longer, 13-year, secular trend and therefore less important than the longer, secular trend.

• We could also compute our current “trend” from A.D. 1971—when President Nixon stopped redeeming foreign-held paper-dollars with physical gold at the fixed rate of $35/ounce. If we calculate the subsequent 42-year rise in the price of gold, we’ll see that gold increased from $35/ounce to $1,370/ounce today. That’s an increase of 38 times (3,800%) in 42 years = 90%/year (again, as compared to the original, $35/ounce price).

It’s interesting that, according to Wikipedia, the maximum duration for a “secular” trend is 25 years. And yet, the bullish trend since A.D. 1971 has lasted 42 years—17 more than a conventional “secular” trend.

What shall we call a market trend that lasts longer than 25 years?

How about “super-secular”?

• We might also compute the current market trend in the price of gold from 1933 when the government removed gold as backing for the domestic dollar. In 1933, the price of gold was $20/ounce; today, $1,370/ounce. That’s a price increase of over 65 times (6500%) in 80 years for an average of about 80% per year (as compared to the original $20/ounce).

Again, we see evidence of a long-term market trend that exceeds the 25-year definition for “secular” trends and might therefore be defined as an 80-year-old, “super-secular” trend in the price of gold.

• Over the past 80 years, the price of gold as measured in paper dollars has sometimes increased dramatically (in primary bull markets), sometimes fallen dramatically (in primary bear markets), and sometimes stagnated for extended periods. But, depending on whether you want to calculate from A.D. 1933, A.D. 1971, or A.D. 2000, the price of gold has increased, on average, between 30% and 90% per year (as compared to its starting price) over a “secular trend” period of 13-years and two “super-secular” trends lasting up to 80 years. So far.

Yes, the price of gold has fallen from its $1,900 peak in 2011 to $1,370 today. That’s a mind-numbing fall of almost 30% in 2 years. But it’s only a 2-year primary trend and only one component in each of the three, longer secular and super-secular trends in the price of gold.

These three secular and super-secular trends represent the fundamentals in gold and they’ve all been bullish for up to 80 years.

• What are those “fundamentals”?

The 80-year, super-secular rise in the price of gold isn’t evidence of a conventional “bull market” in the sense of ordinary commodities or stocks. Instead, it’s evidence of the declining value of the fiat dollar. Fiat dollars are the “fundamental” that drives the price of gold.

Gold isn’t going up based simply on conventional notions of supply and demand. Supply and demand play a part in the price of gold, but the primary motivator is the fiat dollar’s loss of public confidence. Gold rises in the secular and super-secular trends to reflect that loss.

There’s no evidence, and virtually no reason to imagine, that the value of the fiat dollar will ever again increase significantly. Therefore, insofar as all evidence and common sense says the dollar will continue to depreciate, it follows that the price of gold will, on average, continue along the secular and super-secular trend lines illustrated in the following graph, until the fiat dollar dies.

Yes, the graph is simplistic. Yes, the graph omits the 23-month decline in the price of gold from $1,900 to $1,370 and also omits the various ups and downs that characterized each of these “trend lines”. But, even so, the graph still illustrates that, despite all of the ups and downs in the price of gold, the fundamental secular and super-secular relationship between gold and fiat dollars remains bullish–and has been so for 80 years. Every time the fiat dollar suffers another major crisis and is shown, again, to have become worth less, the price of gold rises. This rise will persist so long as we rely on fiat dollars.

Again, this rise isn’t evidence of a conventional “bull market” in gold. It’s evidence that the fiat dollar is dying in its own super-secular, 80-year, bear market.

The fiat dollar’s death is concealed by a variety of market manipulations and reminds me of Weekend At Bernie’s—a 1989 comedy about two young guys trying to conceal their boss’s (Bernie’s) death. The movie was based on a funny premise, but no matter how many gags made Bernie seem alive, the central fact remained that Bernie was dead and wouldn’t be reanimated in this life. Similarly, the fiat dollar is dead (intrinsically worthless) and although an endless series of “gags” by the Federal Reserve of US gov-co can make the fiat dollar seem to “alive,” it’s dead and won’t be revived in this economy.

There’s nothing to suggest that the secular and super-secular trends in gold have ended or are even close to ending. So long as the fundamental remains that fiat dollars are being issued by the Federal Reserve, the price of gold will rise. That price will go up sometimes. Sometimes it’ll go down. But, long-term, so long as we have fiat dollars, the secular and super-secular price of gold will rise.