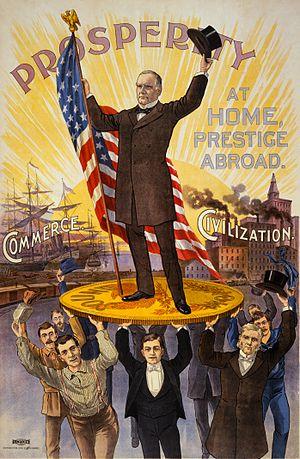

Campaign poster showing William McKinley holding U.S. flag and standing on gold coin “sound money”, held up by group of men, in front of ships “commerce” and factories “civilization”. (Photo credit: Wikipedia)

Ambrose Evans-Pritchard is an English journalist. (What else could he be with that name?) He’s intelligent, well-educated and a fine writer. More, he has so much courage that, during the G.W. Bush administration, his articles on Bush were so insightful and aggressive, that he was forced to leave the United States. I respect that.

However, he recently published an article entitled “A new Gold Standard is being born?” that included one insight that that I found exciting, and a couple more that strike me as lame.

Mr. Evans-Pritchard observes,

“The world is moving step by step towards a de facto Gold Standard, without any meetings of G20 leaders to announce the idea or bless the project. . . . My guess is that any new Gold Standard will be sui generis, and better for it.”

In other words, Evans-Pritchard believes that a new, “de facto Gold Standard” is already emerging as one nation after another begins to rely on gold rather than fiat dollars to purchase oil and settle international trade accounts.

No government, central bank, or G20 spokesman has (as yet) “officially” declared a new gold standard. But Evans-Pritchard believes that a new gold standard is nevertheless evolving “naturally” from the wreckage of the world’s present fiat currency system.

Evans-Pritchard’s observation that the world may be “naturally” gravitating to gold—without official sanction or permission—strikes me as prescient. I think he’s right, and if he is, that means:

1) The sanction/permission of the Powers That Be (PTB) is becoming increasingly irrelevant to the price of gold;

2) The PTB may be soon too impotent to control the US Dollar Index or the price of gold;

3) We may be returning to a true “free (unmanipulated) market” where no one person or institution exerts undue influence, and prices are truly set by the people than the PTB;

4) Fiat currencies may be on the verge of significant decline or even destruction; and,

5) The price of gold may soon increase dramatically.

• Evans-Pritchard cites evidence to support his “de facto Gold Standard” theory:

1) According to the respected Gold Fields Mineral Services “Gold Survey for 2012,” central banks around the world diversified reserves away from the four fiat currencies: dollar, euro, sterling, and yen—and bought more gold bullion (net 536 tons) last year than at any time in almost half a century.

2) Central bank holdings of euro bonds have fallen back to 26%, where they were almost a decade ago. The hope the fiat euro would take its place as the second world reserve currency (alongside the fiat dollar) is fading.

According to Evans-Pritchard,

“Neither the euro nor the dollar can inspire full confidence, although for different reasons. The European Monetary Union (EMU) is a dysfunctional construct, covering two incompatible economies, prone to lurching from crisis to crisis, without a unified treasury to back it up.

“The dollar stands on a pyramid of debt. We all know that this debt will be inflated away over time – for better or worse. The only real disagreement is over the speed.”

3) Germany’s Bundesbank decided to repatriate part of its gold from New York and Paris back to Germany. Evans-Pritchard doesn’t see this event as monumental, but admits that it signals a “breakdown in trust” between major countries and economic powers.

By “breakdown in trust,” Evans-Pritchard apparently means a rising fear that debts denominated in fiat currencies will be significantly repudiated by inflation or open default. Some governments expect other governments—especially, the US—to manipulate their fiat currencies to avoid repaying their debts in full. If that happens, some foreign governments and central banks will suffer huge losses.

If the resulting mistrust grows, “then the world would find itself facing even greater difficulties resolving payments imbalances”—with fiat currencies. As trust in governments and their fiat currencies falls, either foreign trade will be inhibited or nations will begin to pay their trade imbalances with gold rather than paper.

• Although Evans-Pritchard sees a resurrected gold standard emerging, he’s not devout in his praise of gold:

“It is within the EMU fixed-exchange system—i.e. between Germany and Spain—that we see an (old) Gold Standard dynamic at work with all its destructive power, and the risk of sudden ruptures always present.

“The [current] global system [of fiat currencies] is supple. It bends to pressures.”

Therefore, Evans-Pritchard advises,

“Let gold will take its place as a third reserve currency,”

Evans-Pritchard wants to keep the fiat dollar and the fiat euro as the first two world reserve currencies and simply add gold as the third world reserve currency.

But, that’s never gonna happen—at least not for long.

We will have a monetary system that’s either based on gold or based on fiat currencies. Gold and fiat currencies are anathema; they can’t coexist. Once fiat paper is compelled to openly and directly compete against gold (and without any governmental manipulation of prices), the people will quickly learn to prefer gold so much more than fiat paper, that fiat paper will be seen as 2nd class at best, and perhaps be driven to extinction.

Evans-Pritchard praises the utility of gold as:

“one [of the three world reserve currencies] that cannot be devalued, and one that holds the others [fiat dollars and fiat euros] to account,”

But the whole idea of any fiat currency system is to allow governments to avoid being “held to account”. Big government depends on making big promises and then avoiding the resultant bills. Fiat currencies help governments rob their citizens and creditors. Big government depends on not being “held to account” and therefore big government—especially World Government—despises gold. Therefore, governments and central banks will not voluntarily allow gold to replace—or even directly compete with—fiat currencies until after we see a near or complete economic collapse. But, as Evans-Pritchard observes, a new gold standard is emerging without the support or approval of big governments or central banks. I agree with him.

But I disagree with Evans-Pritchard’s belief that fiat currencies and gold could “cohabit” if gold were

“not so dominant that it hitches our collective destinies to the inflationary ups (yes, gold was highly inflationary after the Conquista) and the deflationary downs of global mine supply. That would indeed be a return to a barbarous relic.”

Gold “not so dominant”?

Gold has been “dominant” for three thousand years. To suppose that mankind will soon devise a sustainable monetary system that includes gold in a “less dominant” role is somewhat like supposing we can devise a new athletic event where gravity is not “so dominant”.

Gold may not be as historically “dominant” as gravity, but its monetary dominance is yet to be overcome by mankind except temporarily and then for only a few decades.

Evans-Pritchard apparently agrees that gold is a “barbarous relic” but presumes that this “relic” might yet be “domesticated” so as to allow fiat currencies to continue to function effectively.

I doubt that such “domestication” is even possible. For me, gold is truth while fiat currencies are lies. In the end, the truth will out; the lies must perish.

Paper currency is always a lie. Government intends fiat currency to be a lie used for the purpose of robbing creditors. Government knows from the moment they start printing a fiat currency that it will inevitably run up a huge debt and then repudiate that debt and rob their creditors. Fiat currencies are created for the purpose of robbing citizens and creditors.

Nevertheless, Evans-Pritchard contends,

“A third reserve currency is just what America needs.”

That’s bunk. We don’t even have a second world reserve currency at this time, and Evans-Pritchard is advocating a third. It’s nonsensical.

If we used fiat dollars and fiat euros as two “reserve currencies” and then allowed gold to openly compete as a third “reserve currency,” the fiat currencies will be quickly lose their status as “reserve currency”—which is exactly (though more slowly) what’s happening now.

In this regard, Evans-Pritchard is right. The world is slowly moving into a de facto gold standard. So long as direct competition between gold and fiat currency can be avoided or at least minimized, the move back to a new gold standard will be fairly tedious and not too dramatic. But if gold were allowed to compete directly with fiat dollars and fiat euros, gold’s “dominance” would soon become so apparent, that the fiat currencies might quickly die.

The lies of fiat currency can’t compete with the truth of physical gold. The only way the fiat currencies and gold can coexist is if the gov-co intervenes to manipulate the price of gold (as they’ve done for the past 15 years) and thereby sustain the illusion of value in the fiat dollar.

But, stripped of its status as the one and only “world reserve currency,” the fiat dollar will become increasingly worthless, America will suffer hyper-inflation, economic collapse and then a return to a gold- or silver-based monetary system.

“As Prof Michael Pettis from Beijing University has argued, holding the world’s reserve currency is an ‘exorbitant burden’ that the US could do without.”

I’d agree that the United States might be infinitely improved if:

1) our fiat dollar were no longer the “world reserve currency”;

2) the fiat dollar was therefore admitted to be virtually worthless; and

3) our government was thereby compelled to return to a gold-based (and therefore honest) monetary system.

But government can’t abandon the “exorbitant burden” of “world reserve currency” without also allowing the fiat dollar to collapse. Fiat currency is a monetary “tiger”. The U.S. has mounted and ridden that “tiger” for over 40 years. The ride was exciting and exhilarating, but now its almost over and nobody knows how to get off the tiger without being eaten.

• So long as the fiat dollar has some perceived value, the printers of the fiat dollar have huge power limited only by the number of trees left to make paper and the global supply of ink. That power is produced at the expense of the American people, but from the gov-co’s perspective, so what?

I don’t doubt that most Americans would dismiss my claim that government uses inflation to intentionally rob the American people as cynical and absurd. Conversely, I view people who trust any government as fools and cowards unwilling to face the truth.

Over 200 years ago, George Washington said “Government, like fire, is a dangerous servant or a fearful master.” That wasn’t merely a stylish analogy. Washington described a fundamental fact of life that’s been true for several thousand years. The best you ever get out of any earthly government is a “dangerous servant”.

Trust that servant and turn you back on it and it will morph into a “fearful master” that will reduce you to the status of slave in order to rob you and enhance its own powers.

Fiat currency and the inflation it allows aren’t accidents. Inflation (robbery) isn’t merely the result of some mathematical equations in the field of economics. Fiat currency and inflation are intended to rob the mass of people of any nation who are dumb enough to trust their government. The most reliable defense against that inflation/robbery is a gold-based monetary system that minimizes government corruption by preventing government from “spinning” currency out of thin air.

• Evans-Pritchard argued that having a single “world reserve currency” places an unreasonable burden on the US by citing,

“The Triffin Dilemma—advanced by the Belgian economist Robert Triffin in the 1960s—suggests that the holder of the paramount [fiat] currency faces an inherent contradiction. It must run a structural trade deficit over time to keep the [global, big government, fiat] system afloat, but this will undermine its own economy. The [global, big government, fiat] system self-destructs.”

Has America run a persistent trade deficit for the past 30 years? Does government management of our economy seem self-destructive? Yes . . . and yes.

Triffin was right. If a particular currency becomes the “world reserve currency,” that currency must be made available in en masse to the people of the nations of the world. In order to continuously distribute a mass of fiat dollars to the peoples of the world, the US government must maintain a persistant trade deficit wherein we import more than we export and therefore go deeper into debt. As we import more than we export and consume more than we produce, we send massive sums of fiat dollars to foreign countries which use them as a medium of transfer for international trade.

The problem with sending masses of dollars to foreign countries is that those foreign-held dollars might all come swarming back into the US at the same time. The inflationary impact on domestic prices could be huge and perhaps sufficient to collapse the US economy and/or the fiat dollar.

Triffin implied that once the fiat dollar assumed the status of world reserve currency, the US would start riding a monetary “tiger” that could never be safely dismounted. Triffin was right. In the name of fostering a global economy and New World Order, our government subjected the fiat dollar to the status of world reserve currency and thereby jeopardized America’s economy, prosperity, currency and people.

The moment that Triffin feared corresponds to the alleged threat that China—after accumulating $1.2 trillion in US debt—might decide to suddenly dump that $1.2 trillion and collapse the fiat dollar. That particular threat is probably unreasonable, but it illustrates that the kind of dangers that Triffin warned against over 40 years ago could be real in the near future.

“A partial Gold Standard—created by the global market, and beholden to nobody—is the best of all worlds. Gold offers a store of value (though no yield). It acts as a balancing force. It is not dominant enough to smother the [global, big government, fiat] system.

“Let us have three world currencies, a tripod with a golden leg. It might even be stable.”

And I say, let us have Pixie Dust so we can fly about the room like Peter Pan.

I guarantee that we’ll all be covered with Pixie Dust before we see gold function officially and without manipulation as a third “world reserve currency”.

Even so, the fact that anyone advocates gold becoming a third world reserve currency is evidence that gold has already reached a de facto status as a world reserve currency. Once gold becomes a world reserve currency, it will soon become the world reserve currency. Once gold becomes the world reserve currency, the international use of fiat currencies will largely collapse.

That’s already happening. It’s happening slowly, but it’s happening. Now.