Put this phrase in your vocabulary for the second half of the year because you are going to be hearing it everywhere: "a mild recession."

This is where the puck is going. All of Wall Street's chief strategists and chief economists are going to be pivoting to this case if they haven't already. The "soft landing" idea is going to fade away. Now it will be a soft, silky, sexy mild recession. It's about to become consensus.

There is no reason to live in fear of this, should it actually happen. We have already been living with recessionary conditions in the stock market for 7 or 8 months now.

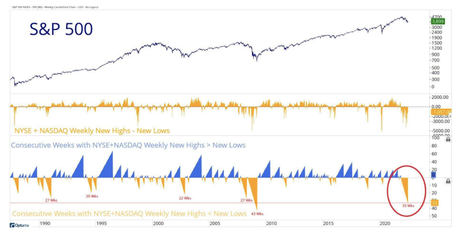

Last night on What Are Your Thoughts we used the below chart from JC:

That's 33 consecutive weeks of more stocks making new lows than making new highs. As you can see, this is historically as bad as it gets with the lone exception of the Great Financial Crisis in 2008-2009. Again, this is not the future, this is the present. We have already been living through it.

This morning's June CPI report came in at 9.1%, another fresh 40-year high and above Wall Street's consensus expectations. Core CPI (which removes the always volatile food and energy components) also came in hotter than expected. PCE - Personal Consumption and Expenditures, an alternate inflation measure said to be more closely watched by the Federal Reserve - might come in milder but this is only because it has a lower weighting to housing and rent prices. The housing component for inflation is now the biggest upside contributor.

The good news is that falling gasoline prices over the last month will help the situation on the ground. In addition, travel prices have been cooling off, both airline fares and hotels are off the highs. But that's about it.

What this report means is that another 75 basis point move is a lock for July's FOMC meeting. That would put the overnight Fed Funds rate at 2.25%. Another large hike is almost guaranteed for September. This morning the Bank of Canada announced a 100 basis point interest rate hike. The market was expecting 50 basis points. Central bankers around the world are done playing games, with the exception of the ECB and BoJ. They are checkmated for various reasons and will not act until everyone else has.

And this week we're going to start hearing from Corporate America, which will only increase the case for "a mild recession" as CEOs and CFOs trip over each other to ratchet down 2nd half expectations. This is what should happen. It sets up future upside surprises should the recession actually prove to be mild.

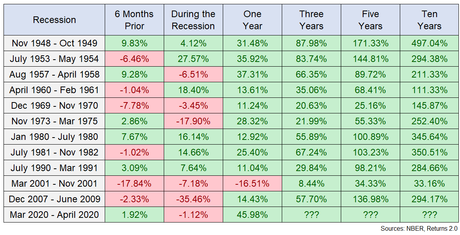

Back to stocks - the chart below should offer you some hope about why the future isn't quite as dour as you might think. History tells us that stocks do a lot of the repricing work AHEAD of recessions. Here's what happened for the stock market before, during and after every recession since World War II via my colleague Ben Carlson. You can read his post here.

Most recessions don't require catastrophic losses, as you can see. In some extreme cases things get really bad. I would argue that they already have gotten pretty bad. Nothing is sneaking up on us - people have been talking about recession all year and stock prices have already been adjusting for this possibility since the first day of January.

It's going to be okay. Put your head down, keep saving and investing, keep your cost of living in check, avoid leverage, remember that all bear markets have one thing in common: They end.