A reader writes:

“In another two years, will gold and silver values return to 2012 values or $700 for gold like Harry Dent predicts? Appears bleak. What is your counter to that?

“Thank you.

“Bill”

Here’s my “counter”.

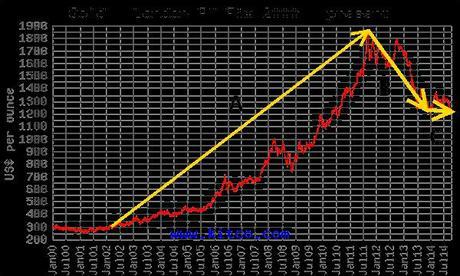

First, consider the following chart of gold prices from A.D. 2000 to today in A.D. 2014:

Gold Price A.D. 2000-2014

The red line charts the actual price changes for gold.

Whatta Rush!

The yellow trend line “A” approximates the rising price of gold from A.D. 2001 (when the price was $280) though the peak price ($1900) in October, A.D. 2011. During this spectacular bull market, the price of gold rose 600% in ten years. If you owned gold, you were a very happy and excited camper.

Whatta Wreck!

The yellow trend line “B” approximates gold’s price decline from the October, A.D. 2011 peak ($1900) to a low of $1,180 in June of A.D. 2013–a mind-boggling fall of 38% in 20 months. It’s unclear whether this period of price decline marked the end of the former bull market (trend line “A“) and the onset of a new bear market–or if the decline seen at “B” was merely a severe “correction“.

If the trend line “B” marked the end for the previous bull market and beginning of a new bear market, the price of gold might yet fall to, say, $600.

However, if the trend line “B” was merely a “correction,” the previous bull market trend seen in “A” is still in force and the price of gold can be expected to soon rise much higher.

Whatta Puzzlement!

Yellow trend line “C” runs “sideways” during over the most recent 15 months from June, A.D. 2013 to today. During that 15 months, the average price for gold has been roughly $1,225.

We don’t know how long the “sideways” trend line “C” can continue. We don’t know if or when the “sideways” “C” trend will give way to a new upward or new downward trend.

But we can reasonably infer that the “sideways” direction of the 15-month “C” trend line has probably terminated the downward trend seen in line “B“. If so, it seems likely that down-trend line “B” was only a “correction” and the fundamentals favoring the bull market first seen in trend line “A” are still in force and likely to push the price of gold much higher.

Based on the available information . . . .

Given the information seen on the chart, I’d guesstimate that there’s at least a 70% probability that the previous downtrend in the price of gold (trend line “B“) is ended and gold will continue to move “sideways” until a new uptrend (similar to trend line “A“) begins.

However, although the chart may be interesting and even persuasive, it doesn’t prove anything.

If we want to increase the probability that our predictions for gold’s future are accurate, we need to consider a few more questions and look deeper into some “fundamentals”.

Questions, questions

Most of us who’d invested in gold prior to its $1900 peak expected its price to continue rising to even more spectacular levels.

We were wrong. As you can see from the trend line “B” in the chart, in the three years since that $1,900 peak, gold has done spectacularly poorly, falling back to as little as $1,180 and losing 38% of its peak price in less than two years (trend line “B”).

Some of us who’d invested in gold prior to the $1,900 peak are shocked and confused. How is it even possible for gold to have lost over one-third of its peak value? Many of us are are discouraged.

For all of us, the big questions are these: Will the price of gold return to the A.D. 2000-2011 trend line “A” (600% up over 11 years)–or will gold continue in the recent 20 month downward trend (“B“) of 38% down? Is the 20-month downtrend “B” just a “correction” in a major bull market that started in A..D. 2000? Or did the 20-month downtrend “B” mark the onset of a new, long-term bear market?

I can’t give you prophecy, so I can’t answer those questions in a way you can rely on.

Fundamentals

However, I can list some facts and implications that I regard as true and “fundamental”. From these “fundamentals” you may be able to draw your own conclusion about gold’s future prices:

1. Fact: Gold has been recognized as “money” for most of 5,000 years. No other currency comes close to that record. Implication: Gold will continue to be recognized and valued as money for some considerable time into the future.

2. Fact: Over the last several centuries, governments have tried to install fiat currencies at least 275 times. With the exception of a few, recent fiat currencies that have not yet failed, all fiat currencies have failed. Implication: All fiat currencies fail.

3. Fact: 43 years ago (A.D. 1971), when President Nixon closed the “gold window” and stopped redeeming foreign-held dollars with gold, the US dollar lost its last vestiges of intrinsic value and became a pure fiat currency.

4. Fact: In the 43 years since the dollar became a pure fiat currency, its value (purchasing power) has fallen by 97%. Implication: Given that the fiat dollar lost 97% of its value in the past 43 years (that’s an average loss of over 2% per year), if that trend continues, the fiat dollar should lose virtually all of its remaining purchasing power within the next two or three years.

5. Fact: As the remaining value of the fiat dollar falls, the prices of other commodities like food, energy and precious metals should rise.

Conclusion:

Assuming that items 1 through 4 (supra) are true, it seems reasonable–and perhaps inevitably true—that, after losing 97% of its value, the fiat, paper dollar is destined to also lose the last 3% of its remaining value within the next two or three years. This loss might be drawn out and delayed, or it might substantially occur at any moment.

As the dollar loses another 1%, then 2% and finally 3% of its original value, the prices for gold and silver denominated in fiat dollars may not only rise, but rise exponentially.

There may be some “bumps” along the way which cause the prices of gold and silver to fall to temporary and irrational lows of the sort predicted by Harry Dent. But ultimate result seems certain: fiat dollars are going to die and cause the price and even value of gold to rise.

Big time.

$700 Gold?

As for Harry Dent’s prediction that the price of gold will fall to $700, I don’t believe it for one minute.

Nevertheless, I hope he’s right because all that means to me is another extraordinary opportunity to buy gold at an irrationally “low” price before it inevitably rises to a spectacular “high” price.

Gold is going up. Inevitably. Way up.

Why?

Because the fiat dollar is going down. Inevitably. Way down.

How high and how soon gold skyrockets remains to be seen—but it’s likely to happen in the near future.

The future may be “bleak” for the US economy.

It may be “bleak” for the US dollar.

But the future for gold is shiny and bright.

What will the price of gold be in two more years?

Can’t say. Don’t know. But it’s more likely to gain 100% and rise to $2,500 than to lose 40% and sink to $700.

In the unlikely event that gold doesn’t hit $2,500 by A.D. 2016, it’ll do so (and a lot more) soon enough.