I have repeated often on this blog about how the Republican economic policies (Trickle-Down) tilted the economic playing field to favor the rich over all other Americans -- and resulted in the largest income and wealth gap since before the Great Depression (and that gap is still growing). These policies gave the rich huge tax breaks (and most of them now pay a lower rate than middle class earners), gave corporations huge subsidies (including tax breaks to help them off-shore U.S. jobs), and damaged the power of unions.

But those policies also did something else. They deregulated the financial industry -- and the giant banks were quick to take advantage of that by selling junk bonds and other worthless financial gimmicks. They made huge profits by taking advantage of consumers, and swapping the worthless stocks and bonds. But this financial bubble couldn't last indefinitely, and it burst in the latter part of 2007.

While the huge wealth and income gap set up the conditions for the Great Recession, it was this bursting of the banking bubble that triggered it. But instead of reaping the disaster from their ridiculous actions, most of the giant banks were bailed out by the taxpayers in the final year of the Bush administration. They survived, while the American people took the hit -- losing trillions of dollars and millions of jobs.

Did the giant banks learn from their mistakes? No. They have gone right back to playing the financial games that got them (and the country) into trouble in the first place -- and sadly, the government is letting them do it (with the congressional Republicans blocking all attempts at financial reform).

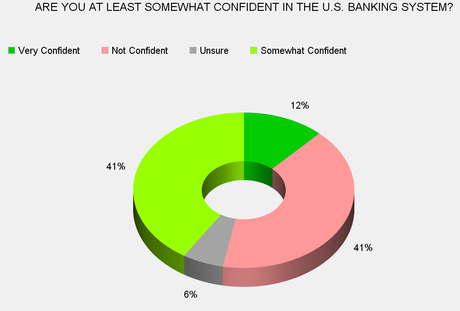

That's why I was not surprised to see the results of this Rasmussen Poll (done on October 16th and 17th of a random national sample of 1,000 U.S. adults, with a margin of error of 3 points). It shows that only 12% of the public has a great deal of confidence in the U.S. banking system, and another 41% have at least some confidence in that system -- while about 41% say they have no confidence (and another 6% don't know what to think).

Actually, I think the banks are lucky that 53% have at least some confidence, considering the fact that no real changes have been made that would prevent another financial disaster -- and they have returned to their same old financial tricks.