3,150.

3,150.

That's still the true value-line we have for the S&P 500 based on old-fashioned notions like actual earnings and actual prospects without the assumption of Trillions of Dollars being pumped into the economy. It's "only" a 20% drop from where we are now and we were down there as recently as October and below 2,850 in June. 2,850 was our old Must Hold Line but we capitulated by 10% on the assumption that Corporate Tax Cuts would not be going away completely – it's the MASSIVE stimulus that's been an upside surprise since then.

The Chart above is still using our 2,850 base and the 5% Rule is still working from 2,850 so it's still in play and that means 3,990 is the 40% line. We had good consolidation at 30% (3,705) during December so we can assume the lines in between that 285-point run will be 20% (57 points) each and that's going to be 3,762, 3,819, 3,876 (which we're testing now) and 3,933. Those are the lines to watch to see how the S&P behaves during earnings season.

Delta (DAL) also lost $2.1Bn for the quarter but they expect to turn it around in Q1 and show a profit. A month into Q1 – I think they are on drugs. There's no changing travel trend to indicate a turn-around that rapid – unless they are counting on $2.1Bn in stimulus to get them over the top.

At $41.62/share, Delta's market cap is $26.5Bn and Delta's net income in previous years has been $3-4Bn but this year they have taken a $14Bn loss, wiping out the last 3 years of gains. Of course, that's not your problem if you are coming in as a new investor – you only care what they do in the future so the optimistic outlook is just what new investors want to hear.

DAL was $60+ before this crisis began but they were also $17 in March – it's very tricky to invest in Airlines – as poor Warren Buffett was recently reminded… While I can't endorse playing an individual airline, I do like the Airline ETF (JETS) and we're already playing that since October in our Future is Now Portfolio:

JETS Long Call 2023 20-JAN 15.00 CALL [JETS @ $22.80 $0.00] 15 10/8/2020 (729) $9,750 $6.50 $3.63 $6.50 $10.13 $0.00 $5,438 55.8% $15,188

JETS Short Call 2023 20-JAN 25.00 CALL [JETS @ $22.80 $0.00] -15 10/8/2020 (729) $-5,475 $3.65 $1.98 $5.63 $0.00 $-2,963 -54.1% $-8,438

JETS Short Put 2023 20-JAN 15.00 PUT [JETS @ $22.80 $0.00] -15 10/8/2020 (729) $-6,600 $4.40 $-2.27 $2.14 $0.00 $3,398 51.5% $-3,203

At the time, we were aggressive with our short puts and that worked out nicely and our net $2,325 credit entry already has a liquidating value of $3,547 for a gain of $5,872 (252%) so far but it's a net $15,000 spread that's now deep in the money so, even if you take it as a new trade – it still has $9,128 of upside potential if JETS can simply manage to continue on to $25 over the next two years. That's a lot more comfortable than putting all our eggs in one airline, isn't it?

Yesterday, in our Live Trading Webinar, we also saw good trading opportunities for GM (GM) and AT&T (T) and you can view the replay HERE. As I pointed out to our Members, we can make truly stunning returns on blue chip stocks that are still trading at reasonable valuations so why mess around chasing these high-flyers in a very toppy market.

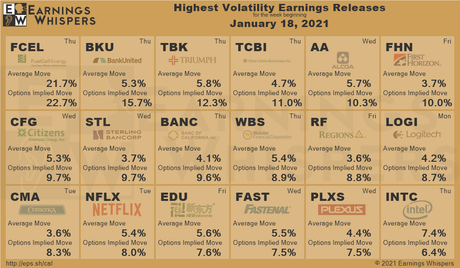

Even better yet, why buy anything until we see how earnings shake out? I'm sure you know that INFORMATION is the key to having a trading advantage and what better information is there than earnings reports, which let us know who's really making enough money to justify their valuations. I'm still very much preferring to see how things go for the next few weeks and, of course, we'll begin to get a handle on what Joe Biden's policies are going to be (and whether they get through Congress) – or we can just guess and trade blindly.

Which would you prefer?

- Biden Stimulus Gets Skeptical Response From GOP Moderates.

- Biden Signs First 17 Executive Actions Starting With Mask Mandate, "Racial Equality" & Rejoining Paris Accord.

- Global Stocks Rise to Record High; Dollar Slips: Markets Wrap.

- ECB Just Can’t Escape Grip of Virus on Economy: Decision Guide.

- Mountain of Small Loans Looms Over Europe’s Banks.

- Australia Unemployment Falls to 6.6% as Recovery Strengthens.

- Oil Erases Gains With Industry Report Showing Rising U.S. Supply.

- Biden Rejoins Paris Climate Agreement, Halts Arctic Oil Leasing.

- China Sanctions Pompeo, Other Trump Staff as His Term Ends.

- China Mocks "Doomsday Clown" Pompeo After 'Genocide' Designation For Uighur Persecution.

- Twitter Locks Out Chinese Embassy in U.S. Over Post on Uighurs.

- Companies Revisit Financial Forecasts Ahead of Potential Tax Changes.

- Insider-Selling Explodes To Record Highs As Buybacks Re-Emerge.

- Opinion: 5 reasons why 2021 just might be the year GM’s stock price stands up to Tesla.

- Investors think there’s more chance Tesla and bitcoin will halve than double, warns Deutsche Bank.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!