32,953.

32,953.

That's where the Dow closed last night after rallying from 32,500 at lunch. Why? We don't know – does it really matter anymore? 33,000 seems impressive but we were at 32,000 on Feb 25th (see "32,000 Thursday – Dow Touches Another Record") and, since then another 1,000 points is only a 2-day move in a month. It came, however, in a spectacular fashion as we first fell to 30,500, THEN we climbed 2,500 points (almost) in the past two weeks.

Of course the free money is about to flow into our economy and everyone is very excited and all the pundits are expecting 7-8% GDP Growth like we are China or something and that has people pricing the market lke we're going to grow like this forever more but even China can't sustain that kind of growth and the growth causes it's own problems (like inflation) – none of which are priced into the market.

Oil was irrationally exuberant and yesterday (as well as Thursday) we discussed shorting it below the $65 line and, so far, it's been good for gains of $750 per contract (our goal is to make $1,000 per contract at $64), so we raise our stop to $500 per contract to lock those gains in and we'll play it again if it comes back around at $65 or $65.50 too – now that we've seen it look toppy there. It's essential to keep tight stops above your lines to limit your losses – money management is the key to success in futures trading.

Oil was irrationally exuberant and yesterday (as well as Thursday) we discussed shorting it below the $65 line and, so far, it's been good for gains of $750 per contract (our goal is to make $1,000 per contract at $64), so we raise our stop to $500 per contract to lock those gains in and we'll play it again if it comes back around at $65 or $65.50 too – now that we've seen it look toppy there. It's essential to keep tight stops above your lines to limit your losses – money management is the key to success in futures trading.

We don't have any good lines to short the indexes at the moment. I'm seeing 32,865 on the Dow (/YM), 3,966 on the S&P 500 (/ES), 13,168 on the Nasdaq (/NQ) and 2,350 on the Russell (/RTY), which is the best shorting line of the bunch so I guess I'd go with that for a short and keep super-tight stops above.

Remember, we have the Fed meeting tomorrow and that's where we think the disappointment begins for the week. Market volume has slowed back down and light trading allows for heavy manipulation, so we'll have to be patient this week.

$4,000,000,000,000 is the amount of infrastructure spending being kicked around in Congress. That would probably keep the markets going for the rest of the year but, seriously, how do we ever plan to pay for this? This is very much like taking the family on a huge vacation to Disney by maxing out all the credit cards to soften the blow that, when it's time to go home – you will have moved into a much smaller house in a much worse neighborhood and this was the last hurrah before bankruptcy – but wasn't Space Mountain great?

We are currently running a $3.2Tn Deficit for the year that ends in June so passing $30Tn in debt will be a snap this year (as I predicted a year ago!). Corporate Taxes are $213Bn, which is nice of them since we gave them a few Trillion Dollars and their owners (the top 666) got one Trillion Dollars richer last year so giving back 5% of it is a nice gesture, don't you think?

That $2Tn of Local Debt is nasty, as is another $1Tn in State Debts and that doesn't even count the unfunded pension plans all those ex policemen, firemen and teachers are counting on to survive the next 20-30 years on. Notice that Interest on Debt has creeped up to $395Bn – almost double what it was last year and all it would take is a 1% rise in borrowng rates and Interest on Debt would surpass Defense Spending as our largest budget item (after the entitlements). How exactly are we ever going to pay for this?

We currently collect just under $3Tn from workers as Income Tax and Payroll Tax and our beloved Corporate Masters kick in another $200Bn, making up almost 6% of the Government revenues – blessed be their names – so balancing our $3.2Tn deficit would mean EVERYONE paying 100% more taxes – just to avoid going deeper in debt. Who's excfited about that?

In THEORY, we can double the GDP and tax revenues would double on their own but you'd have to do that and not increase spending (meaning not increasing Social Security or Medicaid while the economy doubles – so a ridiculous, impossible wish) and, even at China's 7% annual growth rate, that's 10 years to double and another $10Tn or so in debt – at least and, again, if interest rates go back to 3%, then Interest on Debt becomes a $1Tn line item by itself and that adds another $6Tn to our debt in 10 years so now it's $16Tn in debt – even if we cut our deficit 66% to $1Tn while doubling our GDP and still keeping rates near historic lows. Yeah, that's what is going to happen….

In THEORY, we can double the GDP and tax revenues would double on their own but you'd have to do that and not increase spending (meaning not increasing Social Security or Medicaid while the economy doubles – so a ridiculous, impossible wish) and, even at China's 7% annual growth rate, that's 10 years to double and another $10Tn or so in debt – at least and, again, if interest rates go back to 3%, then Interest on Debt becomes a $1Tn line item by itself and that adds another $6Tn to our debt in 10 years so now it's $16Tn in debt – even if we cut our deficit 66% to $1Tn while doubling our GDP and still keeping rates near historic lows. Yeah, that's what is going to happen….

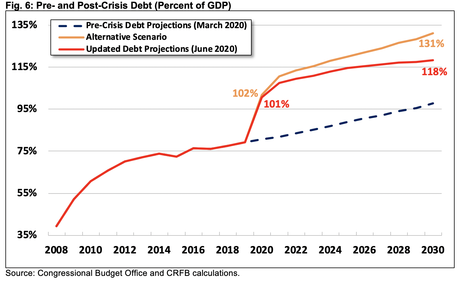

This chart was from June of last year – $3Tn more has been spent since then than is projected in the worst case and $4Tn more is planned ON TOP of the $3Tn deficit we are already running – how insane is that?

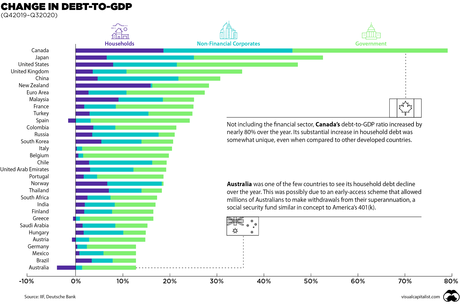

So enjoy the ride while you can – try not to get sick as it's going to be very bumpy. At least we are not alone:

And it's not just our Government that's in debt. Non-Financial Corporations have $11Tn in debt – almost double from the $6Tn that tanked the economy in 2008 – so we have that to look forward to as well.

Reality Check:

Industrial production unexpectedly falls in February

- February Industrial Production: -2.2% M/M vs. +0.5% consensus and +0.9% prior.

- Capacity Utilization 73.8% vs. 75.7% consensus and 75.6% prior.

- Manufacturing Output: -3.1% M/M vs. +0.6% consensus and +1.0% prior.

February retail sales tumble 3%, but January gains revised higher

- February Retail Sales: -3.0% M/M vs. -0.9% consensus and +7.6% prior (revised).

- Core Retail Sales: -2.7% M/M vs. -0.1% consensus and +8.3% prior (revised).

Party on markets!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!