$246,000,000,000,000.

$246,000,000,000,000.

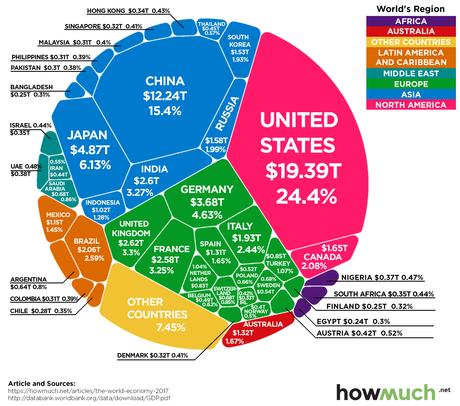

That's what we just hit in Global Debt as of Q1 and, as you can easily see by adding up all the numbers in the chart on the right, our Global GDP is just under $80Tn so we're now hitting the 320% mark on the debt to GDP scale for the first time in human history. And the US "only" has $22.5Tn of that debt so perhaps you are willing to ignore the complete inability of the US to ever pay that bill, but that still leaves $223,500,000,000,000 of debt divided by the remaining $60Tn, which means the rest of the world is getting very close to being 400% of their GDP in debt.

And what is the rest of the World doing about it? The same thing we are – they are easing their policies and they are spending money on stimulus programs because NO ONE can afford a recession – even a mild one can quickly lead to a total collapse that will ignite this global debt bomb – and no one wants to see that happen so we are Globally "extending and pretending" and waiting for the debt fairy to come and forgive us our economic sins.

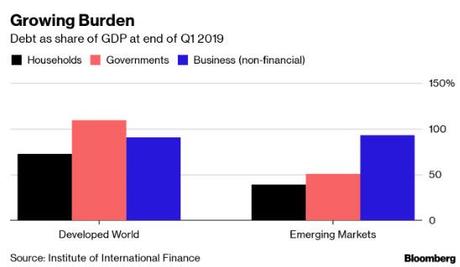

While the Chinese Government is "only" about 100% of their GDP in debt, Chinese Companies make up for it with their own $21Tn pile of debt, 155% of their current GDP. In fact, Chinese firms accounted for 42% of all Corporate Bonds issued in Emerging Markets this year and the IIF says there are now serious risks of default next year and in 2021. Sonja Gibbs the IIF’s Managing Director for Global Policy Initiatives, said:

While the Chinese Government is "only" about 100% of their GDP in debt, Chinese Companies make up for it with their own $21Tn pile of debt, 155% of their current GDP. In fact, Chinese firms accounted for 42% of all Corporate Bonds issued in Emerging Markets this year and the IIF says there are now serious risks of default next year and in 2021. Sonja Gibbs the IIF’s Managing Director for Global Policy Initiatives, said:

"It’s almost Pavlovian. Rates go down and borrowing goes up. Once they are built up, debts are hard to pay down without diverting funds from other goals, whether that’s productive investment by companies or government spending.”

“This is not a group of borrowers with long experience of managing debt over economic cycles. Once you get into a downturn, a lot of firms have a lot of debts that they will have difficulty in paying.”

There's been a shift to shorter-term borrowing in Emerging Markets as the yield curve widens and that leaves highly indebted firms more exposed to swings in global risk appetite. Greece almost caused a global melt-down as that $200Bn economy experienced a melt-down due to rising debt costs – think about how many $200Bn companies are out there that can begin to default on their obligations if rates ever do go higher.

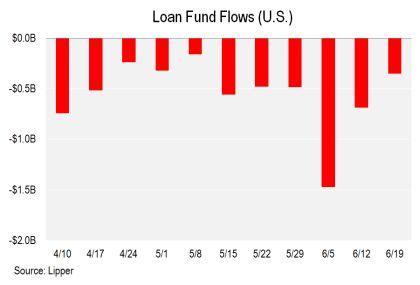

This is a pretty serious thing to be ignoring but it's kind of a slow-moving disaster – it's kind of like seeing the iceberg off in the distance on the Titanic and deciding there's still time for dinner and a show – and what a show it's going to be! Even now, Windstream Holdings, who serve 1.4M telco customers are going through a Chapter 11 and investors have been withdrawing funds from US loan funds for 31 consecutive weeks, which lowers the supply of money available and could begin to drive up rates – Fed or no Fed…

This is a pretty serious thing to be ignoring but it's kind of a slow-moving disaster – it's kind of like seeing the iceberg off in the distance on the Titanic and deciding there's still time for dinner and a show – and what a show it's going to be! Even now, Windstream Holdings, who serve 1.4M telco customers are going through a Chapter 11 and investors have been withdrawing funds from US loan funds for 31 consecutive weeks, which lowers the supply of money available and could begin to drive up rates – Fed or no Fed…

The US leveraged loan market is now $1.2Tn and Collateralized Loan Obligations (CLOs), which are the new CDO's (which caused the last financial crisis) are now $700Bn and are both poorly regulated and poorly tracked. Banks in the U.S. collectively have amassed about $90 billion of CLO holdings, as previously highlighted by Fed Governor Lael Brainard at a presentation for the Peterson Institute for International Economics in December.

This is a function of people chasing returns and looking for anything that pays more than 1% and they are willing to take greater and greater risks to get there. While we're certainly not repeating the mistakes of the past, where CDOs were based on ridiculously over-valued housing prices, CLOs are based on over-valued corporations whose cash-flow is based on low taxes and low interest rates, which allows them to borrow more than was ever loaned out in 2007. Should any of these variables change significantly, CLOs can begin to look like the same house of cards CDOs became.

Consider Tesla (TSLA), which is about $12Bn in debt and may default if things take a bad turn. That's 1/60th of the debt we're concerned about held by a single company where we can easily see the risk but there are 60x more debts like that in China and other developing nations that may be in well over their heads. As Warren Buffett says: "You never know who's swimming naked until the tide goes out." This is high tide for the market cycle by any measure and $1.2Tn is a lot of debt to cover up when that tide begins to fall…

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!