You heard it here first. Well, maybe 2nd as GS's Chief US Equity Strategist, David Kostin, says the U.S. economy will achieve above-trend real GDP growth in 2014, ending a six-year period of economic “stagnation.” And in developed economies, the final year of economic stagnation before GDP growth has been linked to price/earnings multiple expansions averaging 15%. They expect the S&P 500 p/e multiple will continue to rise, reaching 15 times at year-end 2013 and 16 times by the end of 2014.

“We are raising our S&P 500 dividend estimates and index return forecasts for 2013 through 2015. We expect S&P 500 index will rise by 5% from the current level to 1,750 by year-end 2013, advance by 9% to 1,900 in 2,014, and climb by 10% to 2100 in 2015.”

Goldman's timing is, of course, BRILLIANT, as it is Tuesday and the market has been up 18 Tuesdays in a row, so why stop now? 2,100 at 16x earnings is $131.25 per share so, in general, to be on that trend – we need to see 10% annual earnings increases from here ($110) but, of course, we were at $111.30 in January and earnings estimates have DROPPED to $110.10 as 2 rounds of earnings reports have come in weaker than expected so far – so you need a good supply of fairy dust to get as high as David Kostin.

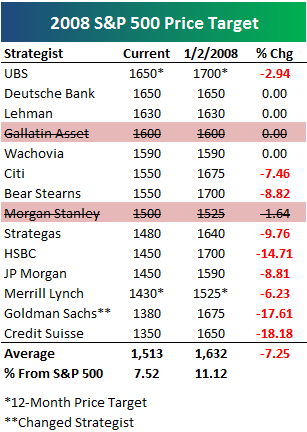

To be fair to GS, they did call S&P 1,675 and yesterday the S&P was at 1,666 (the mark of the Blankfein!) but, unfortunately, they made that call in Jan of 2008 and were, in fact, off by about 744 points on December 31st of that year – and not in a good way! To be fair, in May of that year, they adjusted to 1,380, so only off 439 but the S&P was at 1,380 in May and, as you can see from the May 2008 Bespoke chart on the left, NOBODY SAW IT COMING – even when "it" was already there.

To be fair to GS, they did call S&P 1,675 and yesterday the S&P was at 1,666 (the mark of the Blankfein!) but, unfortunately, they made that call in Jan of 2008 and were, in fact, off by about 744 points on December 31st of that year – and not in a good way! To be fair, in May of that year, they adjusted to 1,380, so only off 439 but the S&P was at 1,380 in May and, as you can see from the May 2008 Bespoke chart on the left, NOBODY SAW IT COMING – even when "it" was already there.

Oddly enough, on Tuesday, May 20th of 2008, I had a moment that now gives me severe deja vu, saying:

I’ve been growling for quite some time now that I want to see a real breakout before we turn bullish and, unfortunately, we could be in for a textbook reversal as we do

…

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.