"Transitory" Inflation is still here – month 5.

"Transitory" Inflation is still here – month 5.

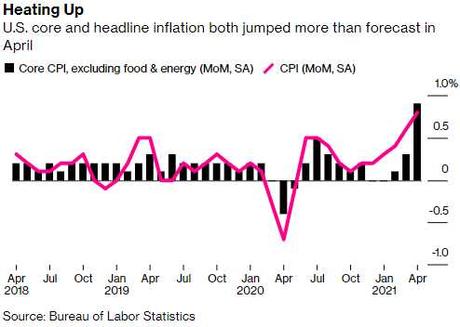

While the Fed tries to convince us it won't last, inflation is soaring higher and higher and bonds are dropping as that market doesn't believe a word the Fed is saying – especially after yesterday's decade-high 0.8% jump in Consumer Prices – double the projections by the usual crew of leading Economorons. How long inflation readings persist on the high side has implications for when the Fed decides to start withdrawing monetary stimulus by paring back bond-buying and raising interest rates from near zero.

“Transient does not mean one month. As supply shortages run up against aftershocks from fiscal stimulus, and the base for comparison remains low, the CPI will continue to run hot into the summer. The impact of the Colonial pipeline shutdown on fuel prices will also have to be monitored closely.” — Andrew Husby and Yelena Shulyatyeva, U.S. economists

“Transitory pandemic influences clearly contributed to the surprise but there’s residual firmness in core inflation that’s hard to ignore,” said Michael Gapen, chief U.S. economist at Barclays Plc. Aside from the reopening effect, “there was still some residual firmness that suggests risks around inflation in the near term are still skewed to the upside.” Wages have shown signs of picking up, and supply chain challenges have elongated delivery times and driven materials prices higher.

“Transitory pandemic influences clearly contributed to the surprise but there’s residual firmness in core inflation that’s hard to ignore,” said Michael Gapen, chief U.S. economist at Barclays Plc. Aside from the reopening effect, “there was still some residual firmness that suggests risks around inflation in the near term are still skewed to the upside.” Wages have shown signs of picking up, and supply chain challenges have elongated delivery times and driven materials prices higher.

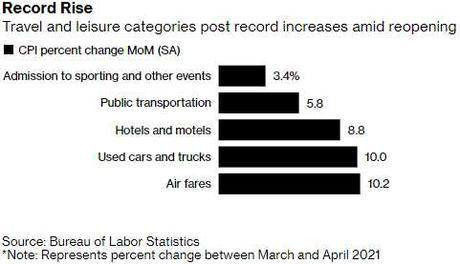

Tranportation Services have not jumped 5.8% since 1975, when the Fed Funds Rate was at 7%. More Federal Spending means more inflation, not even Powell can pretend that it doesn't and Biden still has proposals to spend $4Tn more on Infrastructure along with the Fed's ongoing $2Tn giveaway program and, of course, 0% borrowing rates. If either the stimulus bill is dropped or the Fed allows rates to rise to contain inflation – the blowback on the market could be tremendous.

It's not just the $28Tn National Debt we need to be concerned about but the $10.5Tn of Corporate debt that is 100% higher than the last time the market crashed – as companies have been on a low-rate binge ever since. And what is the main thing corporations spend all that borrowed money on? Buying back their own stocks to make their static earnings look like they are making more…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!