This is clearly out of control.

This is clearly out of control.

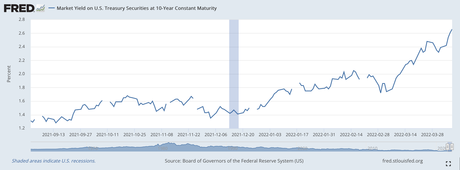

Officially, the Fed has rasied interest rates 0.25% since the start of the year but the interest on a 10-year note has gone up 1.4% and almost 1% of that has been in the past 30 days. This is what happens in 3rd World countries that are on the brink of collapse – not usually in the US of A.

Of course the Fed has told us they intend for Fed Funds Rates to be at 2% a the end of 2022 and that is 1.75% higher than where we began the year and, certainly, if you are going to lend the Government money for 10 years and you know the internal rates will be 2% at the end of the first year (and probably even higher next year), then it would be foolish of you to accept less than 3% – as 10-Year Notes generally command a 1% premium.to the Fed Funds Rate.

So, to some extent, we can just assume the 10-year is being forward-looking but this is a lot of looking forward so what if there are other factors in play and what if, disguised by the promised rate hikes, there is also a loss of faith in our country's ability to pay the money back? We're already $32Tn in debt so it's not too ridiculous to wonder where the Hell we'll be getting that money from – especially since our 2022 deficit is $2.4Tn WITHOUT any additional stimulus being passed and WITHOUT anything being done to address Climate Change, which is estimated to cost $2Tn a year for the rest of the Decade or, failing to do that, tens of Trillions after that as we have to adapt to a melting planet.

If we are running a $2.38Tn deficit and we currently collect $4.117Tn in taxes – how are we going to "fix" the deficit? The Budget is $6.4Tn so we can either cut Government spending by more than 1/3 or we can increase taxes by more than 50% – those are the choices that lie ahead of us. At the moment, we are choosing to just go deeper and deeper in debt but the rising rates are going to increase our annual interest…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!