Netflix fell significantly short of its worldwide subscriber goal in the most recent quarter. They thought they'd add 5 million more members; they got just 2.7. Ouch. Moreover, for the first time in nearly a decade they actually lost subscribers in the US, dropping by 130,000.

Wall Street's reaction has been swift, sending Netflix's shares sliding -11% over the past 24 hours, which translates to a $17 billion loss in company value. So, ya know, not good. Definitely not a good look for a company which just lost bidding wars over The Office and Friends, ceded the title of "most-nominated network" to HBO, and will soon have Disney+, HBOMax and Apple and NBCUniversal streaming services breathing down its neck.

Well, it's been a good run, Netflix. We had some fun. Remember Netflix and Chill? Oh, what about that time you used a Super Bowl ad to sneak attack us with a brand new Cloverfield movie? And who can forget that interactive video game-style episode of Black Mirror? Ah, memories. But, no, seriously, Netflix, get out of here. No wants you anymore. You're just no good and you never will be ever again.

Scratch that last part. I might - just might - have gone too far.

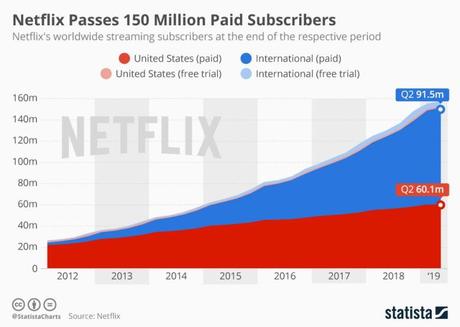

After all, Netflix still reports a domestic subscriber base of 60.1 million and 151.6 million globally. The competition might be surging - Hulu, for example, posted a 48% year over year subscriber increase in 2018 - and the market is about to be flooded with new offerings from the real heavy hitters. Also, don't sleep on Amazon. Jeff Bezos has enough tax-free Monopoly Money to get real serious real fast about going toe-to-toe with Netflix and not just carving out a niche for Amazon Prime as home to critically admired, but underwatched originals for adults. Given how much money his company is shelling out for its forthcoming Lord of the Rings series, that seems to be where their thinking is heading.

However, if you go by subscriber numbers alone Netflix is so far out in front of everyone else it's not even funny. Good for you Hulu and your membership surge, but you're still sitting at just 25 million and haven't even expanded outside of the US anymore. Netflix has more than double that in the US alone, and i ts global numbers are actually up 38% from just two years ago when it only reported 110 worldwide subscribers.

As for the forthcoming competition, Disney+ stands to be the most formidable, but a Morgan Stanley analysis predicts the service will need 5 years to even come closer to Netflix's current global footprint. ( The exact projection is for Disney+ to reach 130 million subscribers by 2024.) So, even if Netflix's numbers grow static or slowly contract the company still has a bit of a window to figure out how to turn things around and stay on top.

The way Reed Hastings sees it, their biggest problem in this most recent quarter was simply quality, or the lack thereof. "We think Q2's content slate drove less growth in paid net adds than we anticipated," the company wrote.

Translation: our new shows and movies didn't do a good enough job of moving the needle.

It's not about losing a bunch of older shows. In a video call with investors, Hastings sanguinely observed, "Content comes and content goes," presumably using best Swayze "pain don't hurt" voice. "The challenge is getting our consumer and our members much more attuned to the expectation that we are going to create their next favorite show." Besides, everyone makes too big of a deal out of Friends, The Office, Pretty Little Liars or any of those other old shows. Even the biggest one of them accounts "only a low, single-digit percentage of streaming hours."

It's not even about the streaming wars. Hastings thinks the competition will be a good thing. "Talent gets to bid themselves off between us, Disney, Amazon, etc.," he argued, adding "it's a great competition that helps grow the industry."

No, the only reason they missed their goal this quarter is because their new shows weren't good enough, despite all of their selective data attempting to convince us that nearly everyone in the world watched Dead to Me, Murder Mystery, and When They See Us.

Before you cancel Netflix, do make sure to binge Dead to Me. It's amazing.

Before you cancel Netflix, do make sure to binge Dead to Me. It's amazing. If that's really all there is to it, however, then why is it that Netflix's subscriber growth was worse in those areas of the world where it raised prices? Cue the The Wall Street Journal pull quote:

Netflix said it missed its subscriber-growth forecasts across all regions; the miss was higher in areas where it raised prices. For the first time since late 2017, Netflix earlier this year raised prices in the U.S. and countries in Latin America and the Caribbean where Netflix bills in U.S. currency for all its subscription plans. [...] The last time Netflix faced quarter-to-quarter subscriber declines in the U.S. was in 2011, after it launched an ill-fated new pricing model that was roundly rejected by subscribers and quickly scrapped.

This points to a key area of vulnerability for Netflix. Ever since the price hike was announced earlier this year, multiple surveys have been conducted to find out just how many Netflix users might cancel their subscription if forced to pay $3-$5 more per month. The Diffusion Group found the number could be as high as 16%; Streaming Observer/Mindset Analytics got an even higher result, with 24% of their respondents indicating a willingness to cancel. Now, the quarterly results are in and Netflix notches its first downturn of US subscribers since 2011, and when it happened back then it was also in response to a change to an unpopular change to the pricing model. Correlation, of course, isn't always causation, but in those case it shouldn't be dismissed.

Meanwhile, in April Disney dropped the mic on the whole damn industry in announcing its streaming service will go for $6.99 - around half the price of a standard Netflix subscription. Oh, those wily bastards. "This is a big meteor dropping into the middle of [the media industry], and it's going to have ripple effects" read one particularly fiery quote - from the project director of Georgetown's Center for Business and Public Policy - in a CNNMoney piece at the time.

Disney can afford to subsidize a money-losing subscription service at a fire sale price like that for years because this isn't the only way it has to make money. Have you heard of this thing called DisneyLand? Apparently it's a real big deal. Same goes for all those toys they sell.

Netflix doesn't have that. For years, all it had was the equivalent of a really killer collection of DVD Box Sets digitized and streamable for an insanely low price. Success was measured in subscription figures, not profit, especially since the whole thing was only possible due to long-term debt financing.

However, as the studios kept upping their licensing fees and Ted Sarandos pushed hard into Originals Netflix's spending inevitably skyrocketed. Since the company's revenue from merchandise and product-placement is still a developing sector of its portfolio, eventually the costs had to be passed on to the consumers. So, prices went up in '17 and again this year. Now, Netflix is spending more than ever before in a desperate bid to replace all of the licensed shows it is about to lose, and in the process for the first time in a long time it looks vulnerable.

Now, Mickey Mouse isn't exactly going to be dancing on Netflix's grave anytime soon, and, as always, the market will dictate just how many of these streaming services it can stand before they all end up being bundled together like some new variation on the old cable TV model. In this oncoming war, price is going to play a huge role in determining the victors, and in that area Netflix's utter dominance and relative seniority as the grandfather of streaming might work against it. The competition is far better suited to undercutting Netflix on price, and in losing subscribers for the first time in nearly a decade Netflix has just shown that it might already be too expensive for some consumers.

Source: The Wall Street Journal

Grew up obsessing over movies and TV shows. Worked in a video store. Minored in film at college because my college didn't offer a film major. Worked in academia for a while. Have been freelance writing and running this blog since 2013. View all posts by Kelly Konda