![Yuga Labs’ Apecoin starts 2023 with positive performance Assessing_Apecoin’s_[APE]_potential_to_stay_profitable_in_the_coming_days_of_2023](https://m5.paperblog.com/i/728/7288060/yuga-labs-apecoin-starts-2023-with-positive-p-L-4_9OYW.jpeg)

ApeCoin [APE], the governance and utility token of the Bored Ape Yacht Club [BAYC], has had a strong 2023 start. The token’s value decreased many times in 2022, but in the last week, it increased by 20.41 percent.

As shown on CoinMarketCap, the 12.28% increase over the past 24 hours is largely responsible for this increase. But how has this increase affected APE patients?

Santiment’s on-chain data revealed that APE holders of the previous 365 days were nearly even with their portfolio value in July 2022. This is demonstrated by the Market Value to Realized Value (MVRV) ratio.

The MVRV ratio at the time of publication was 10.23%. This statistic is one of the outcomes of comparing market capitalization to realized capitalization.

The MVRV ratio has been increasing since January 1. This meant that a substantial amount of profit was not being made. Those who purchased while the ratio was low were also likely to lock in recent profits.

How does it appear on the charts?

As of the time this article was written, the Bollinger Bands indicated that APE was approaching its most volatile phase. The Simple Moving Average (SMA) assists the Bollinger Band (BB) in identifying asset trending. At $4,676, the APE price was over the upper band.

This indicates that an asset was acquired at an excessive price. Consequently, the BB revealed that APE had exceeded its purchase range. Therefore, the price of APE may fall shortly.

Based on what the Exponential Moving Average (EMA) indicated, it appeared as though APE may not be able to maintain its greens for an extended period. This transpired because the 20 EMA (blue) and the 50 EMA (orange) were in a position to battle.

Even though the 20 EMA had a modest advantage, long-term investors in APE may not be as concerned. The 200 EMA (purple) surpassed both the 50 EMA and the 20 EMA during the lengthier time frame. This perspective discusses the potential for a price reversal to be followed by a break and substantial long-term profits.

Are Apecoin token owners hodling?

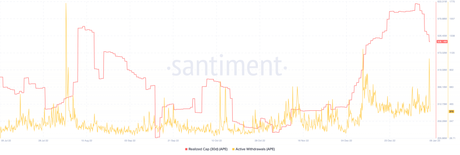

APE’s total cost to purchase has decreased during the past thirty days. The fact that the Realized Cap is $508.1 million demonstrates this point. Additionally, fewer funds were being extracted from the ApeCoin network.

The price peaked at 1043 early on January 9. As of press time, it was 370. This indicated that investors were anticipating a short-term upswing or had longer-term holdings in mind.

Leave this field empty if you're human: