So they were

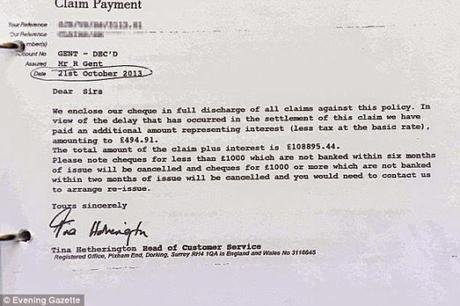

overjoyed when Friends Life sent the check to their solicitors in October

2013; but within a month their joy

turned to horror when ‘Friends Life’ announced they had given them the pension

belonging to another customer with the same name. After spending much of the sum, the sisters

were horrified to learn of the mistake and struggled to repay the total. They

were recently forced to pay Friends Life £7,000 on top of the full amount paid

back as the Insurance company threatened them with legal action.

The devastated pair

were forced to sell their father's house - which they planned to keep as an

investment - to repay the money they had spent. They also had to borrow from

friends and other relatives to make up the full amount of £108,895 and paid it

all back within a year, by last October. Still, Friends Life took them to court earlier this

month and obtained an order to get even more from them - £6,000 in costs plus

£1,000 in interest. The company admitted making an error but said they were

forced to launch legal action because the executors told them the money had

been distributed and would not be repaid and the parties could not settle the

matter amicably.

Thus the botched

Insurance payout cost the sisters an extra £7,000. Going by the timeline, in Sept 2008, Robert

Gent retired from grave-digging and while the sisters attempted to obtain

father’s pension, he passed away in 2011.

Later in Oct 2013, Friendslife informed that they are owed £108,000 in

their father's name. In Nov 13, after the amount was disbursed, Friendlife

contacted the sisters informing that the payment was by mistake. In Oct 14, the repayment is made after

desperate borrowing and sale of house.

In Jan 15, the sisters are taken to Court and ordered to pay £6,000 in

costs and £1,000 interest.

The

sisters are quoted as saying 'We got

quoted a point of law which says that no one should gain from a mistake, which

we accept, but surely no one should have to pay for one either. The Company is

quoted as saying that the significant overpayment was a result of human error

!!

So, what is your say on this ?

So they were

overjoyed when Friends Life sent the check to their solicitors in October

2013; but within a month their joy

turned to horror when ‘Friends Life’ announced they had given them the pension

belonging to another customer with the same name. After spending much of the sum, the sisters

were horrified to learn of the mistake and struggled to repay the total. They

were recently forced to pay Friends Life £7,000 on top of the full amount paid

back as the Insurance company threatened them with legal action.

The devastated pair

were forced to sell their father's house - which they planned to keep as an

investment - to repay the money they had spent. They also had to borrow from

friends and other relatives to make up the full amount of £108,895 and paid it

all back within a year, by last October. Still, Friends Life took them to court earlier this

month and obtained an order to get even more from them - £6,000 in costs plus

£1,000 in interest. The company admitted making an error but said they were

forced to launch legal action because the executors told them the money had

been distributed and would not be repaid and the parties could not settle the

matter amicably.

Thus the botched

Insurance payout cost the sisters an extra £7,000. Going by the timeline, in Sept 2008, Robert

Gent retired from grave-digging and while the sisters attempted to obtain

father’s pension, he passed away in 2011.

Later in Oct 2013, Friendslife informed that they are owed £108,000 in

their father's name. In Nov 13, after the amount was disbursed, Friendlife

contacted the sisters informing that the payment was by mistake. In Oct 14, the repayment is made after

desperate borrowing and sale of house.

In Jan 15, the sisters are taken to Court and ordered to pay £6,000 in

costs and £1,000 interest.

The

sisters are quoted as saying 'We got

quoted a point of law which says that no one should gain from a mistake, which

we accept, but surely no one should have to pay for one either. The Company is

quoted as saying that the significant overpayment was a result of human error

!!

So, what is your say on this ?

With regards – S. Sampathkumar 4th Feb 2015.