Nobody wants to think about all the things that can go wrong on a trip but, the truth is it's better to be prepared. You never know what's going to happen and so much is out of your control when you travel. Travel insurance is one way to protect yourself against the unexpected.

Features Overview

Coverage varies per policy but can include:- Trip Cancellation or Interruption

- Emergency Medical and Dental Expenses

- Emergency Medical Transportation

- Protection for your luggage, camera, and other gear

World Nomads offers 24/7 emergency assistance to help in the event of a medical emergency or evacuation. In this post, we have featured World Nomads Review 2019 that includes detailed insights of its pricing, features, functionality and more.

World Nomads Review 2019: Is It A Reliable Travel Insurance Provider??

Detailed World Nomads Review:

What Destinations Are Covered?

World Nomads offers policy coverage for Brazil and South America, Asia, Canada, Italy, Spain, Vietnam, New Zealand, Australia, Cambodia, Laos, India, China, the United States, the Schengen Zone, and more.

What's Covered With World Nomads?

Here's a general overview of what World Nomads covers. Please note that specific coverage varies per policy and depends on where you're from and where you're going. Be careful to read all of the information about a policy before enrolling.

If you experience a serious illness or injury when away from home and you need to head home for treatment right away World Nomads has you covered with medical repatriation. In addition to transporting you home, they also have an expert staff that takes care of the logistics so you can focus on getting better.

Depending on where you live, World Nomads have policies that cover you if you are injured in an unplanned terror attack. This could include hospitalization, medication, out-patient care, medical transport to return home, or trip cancellation. There are also emergency assistance teams who can help you arrange medical care, contact consular officials, and get in contact with your family.

Accidents can happen at any time during your adventure. World Nomads insurance covers same-day surgery, outpatient treatment, hospitalization, medication, and emergency evacuation. They also have a 24-hour assistance team on-call who can help arrange transportation to the hospital, navigate local customs and language barriers, support family members, and set up payments directly to the medical facility.

If your baggage doesn't show up or is stolen, you're covered for any prescribed medications lost, stolen passports, stolen baggage, bags lost or damaged by the airline in transit, and any bags that have been damaged.

The Schengen Agreement allows people from certain European countries to travel in a certain area as if they're staying in the same country. In order to do this as a visitor from another country, you have to qualify for a Schengen visa. Sufficient travel insurance is needed to qualify for the visa.

Schengen Area coverage from World Nomads includes hospitalization, urgent medical care, out-patient care, and the return of your remains. When looking for this type of policy, be sure the policy limits meet the visa qualifications.

If you have to unexpectedly cancel a trip that you've already booked and paid for, these policies cover some of your expenses. These policies cover you if a doctor says you are medically unfit for travel or if you, a close relative, or your travel partner is hospitalized or passes away

In the event that a serious illness or accident is fatal, the World Nomads team is there to help your family and friends. Coverage includes local burial or cremation and the return of your remains to your home country. Plus, there are emergency assistance teams in place to help your family contact consular officials and navigate the administrative tasks of a death overseas.

Not only do natural disasters increase the risk of injury, but they also shut down accommodations and airports. Depending on your country of residents, World Nomads policies cover trip cancellation,

interruption, or delay as well as medical expenses, problems with baggage, and 24-hour emergency assistance.

If your passport is stolen, getting a replacement isn't easy. Some of the policies offered by World Nomads can help with emergency passport expenses as well as rearranging trip accommodations to wait for a replacement. Specific coverage depends on your county of residence.

If your bags are delayed for 12 to 24 hours (depending on the policy), your policy covers the essential items you need so you don't have to wear the same things every day until your bags turn up. There are spending limits and exclusions and conditions apply.

If you have a chipped, broken, or achy tooth while away from home, World Nomad insurance can cover the procedure you need to get the smile back on your face. Unexpected infections, broken teeth, and jaw or mouth injuries are covered under various policies, dependant on your past dental history.

It's not always easy to know what to do after an assault in a foreign country. World Nomads' emergency teams are on call to guide you if the worst happens.

They'll help you find the care you need for out-patient treatment or same-day surgery. Medication, ambulances, expenses to transport your home if medically necessary, and counseling may also be covered.

What Activities Are Covered?

Not all activities are covered under every plan so make sure you're covered before heading off on your adventure. Here are some of the activities the World Nomads covers:

What's Not Covered

How Does It Work

When shopping for a policy, head to the World Nomads website. Head to the 'Insurance" tab then click on "Get a Quote". From there, you'll be asked to enter your destinations as well as the age and country of residence for each traveler on the policy.

Once you are able to compare different plans, make sure you read the coverage carefully. There are some limitations in coverage depending on where you're from and the country you're planning to visit.

How to Make a Claim

- Flight upgrades unless medically necessary

- Refusal to return home for essential medical care

- Injuries or illness related to drug or alcohol use

- Needlessly risky behavior

- Riding a motorcycle without a helmet and the proper license

- Forgotten bags or gear

- Theft without a written police report

- Excluded pre-existing medical conditions

- Non-emergency treatment that can wait until you return home

- Sexually transmitted diseases

- Death from suicide

- Financial loss from stolen credit cards

- Not following the advice of local authorities after a natural disaster

- Forgetting your passport

- A confiscated passport

- A replacement passport

- Major dental work

- Routine dental work

World Nomads lets you file a claim from anywhere so your trip isn't interrupted any more than it has to be. The easiest way is to create an online account where you can easily follow the links to file a claim complete with supporting documents.

If you do not have an online account or if you reside in Brazil, you will need to fill in a paper form. Contact customer service who will send you a form to complete.

For emergencies, World Nomad has a 24-hour assistance line so you can get in touch right away. They can help arrange for emergency transportation to a medical facility and determine from a medical evaluation whether or not you need emergency transportation home for treatment.

Pros and Cons

Why Should You Use World Nomads?

If you're a young nomad traveling around the world with your partner or a group of friends, World Nomads is a great choice. They cover a lot of different activities and you can enroll in a policy or file a claim quickly and easily on their website. They provide 24/7 emergency assistance if you're injured or hurt and seem like the provide adequate support to your family if you get hurt or injured.

Pros:Keep in mind that Worlds Nomads does not cover travelers over the age of 70 and they don't cover any pre-existing conditions. They also don't accept cancellations for just any reason and work obligations aren't usually accepted. For these reasons, World Nomads may not be the best choice for retirees and families with extensive work and family commitments.

- A lot of activities are covered

- 24/7 emergency assistance

- Easy to use the website for applying for coverage and filing claims

- Able to get or extend coverage while traveling

- Possible to get a policy that goes into effect next day

Quick Links:

Cons:Summary: World Nomads Review 2019 | Should You GO For It??

- Policies only available for travelers under the age of 70

- No coverage for pre-existing conditions

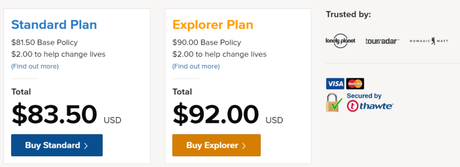

- Only two levels of coverage available, Standard and Explorer

- No option to cancel travel for any reason or work reasons

World Nomads is a travel insurance company that provides policies for traveling to various destinations that cover a variety of situations, including emergency medical care, a stolen passport, missing luggage, natural disasters, or a terrorist attack. They're also available 24/7 to help you in the event of an emergency, whether you need transportation to a medical facility or emergency evacuation.

Different travelers have different needs. For example, a retiree has different concerns than a family with young children. World Nomads seems aimed at a particular type of traveler - a younger adventurer with the freedom to explore the world.