The BBC ran a good article pointing out that it will soon be rent-freedom day, which is analogous to the Adam Smith Institute's tax-freedom day.

So one-half of their earnings go in tax (stealth or otherwise) and one-third goes in rent. That means the average working tenant's disposable income after tax and housing costs is one-sixth of their earnings!

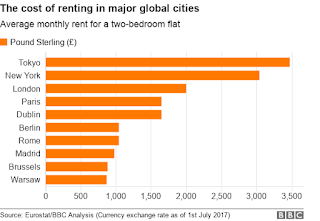

What caught my eye was this graphic further down the article:

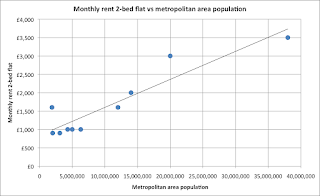

Those rents are fairly proportional to the size of the population of those cities and their metropolitan/surrounding areas, co-efficient of correlation 0.93 (says Excel):

What's the relevance of this, you may ask (except for BenJamin' who put me onto this in the first place).

The point is that larger populations push up rents (agglomeration effects). If you build more homes in large cities, the simplistic supply-demand assumption is quite simply incorrect (unless you prevent any immigration into the city, which is impossible). Build more homes = more people = even higher rents. Rinse and repeat.

Sources:

https://en.wikipedia.org/wiki/Tokyo

https://en.wikipedia.org/wiki/New_York_metropolitan_area

https://en.wikipedia.org/wiki/London

https://en.wikipedia.org/wiki/Paris_metropolitan_area

https://en.wikipedia.org/wiki/Greater_Dublin_Area

https://en.wikipedia.org/wiki/Demographics_of_Berlin

https://en.wikipedia.org/wiki/Rome

https://en.wikipedia.org/wiki/Madrid_metropolitan_area

http://worldpopulationreview.com/world-cities/brussels-population/

https://en.wikipedia.org/wiki/Warsaw_metropolitan_area