There's an inherent problem with the argument the beer community makes when it decries the never-ending war between Big Beer and the Little Guys.

Yes, there are issues to discuss and advantages for some over others, but in the fight for share of mind and stomach, there are battles that go beyond AB InBev versus the world of craft. The lines extend past beer.

In recent years, as buyouts and heated discussions about distribution have taken place, drinkers might have been missing a shift in the very ground beneath their feet. At bars and restaurants across the country, tap lines have never offered such an array of choice, but the same could be said for what's sitting on the shelves behind the bartender, too.

It's not just about beer against beer these days. Wine and spirits are coming for your pint glass, too.

"That is a larger threat and a real threat to a lot of breweries these days, as well in the same way it's a threat to some of the spirit and wine [companies]," All About Beer editor John Holl recently pointed out on an episode of The Beer Temple Insiders Roundtable. "People aren't just drinking one specific beverage category anymore. They're jumping around quite a bit."

This is the drinking reality we live in. Beer may be America's favorite alcoholic beverage, but that doesn't mean Americans don't favor other options, too.

According to data from the Beer Institute and reported by Brewbound, beer's share of U.S. alcohol shipments by serving size (5 ounces for wine, 1.5 ounces for spirits, 12 ounces for beer) has decreased by 10.2 percent in the last 20 years to 50.6 percent. During that same timeframe:

- Spirits shipments have increased 4.8 percent, now 32.2 percent overall

- Wine shipments have increased 5.4 percent, now 17.1 percent overall

In addition:

- From 1991 to 2014, Americans went from drinking 466 million gallons of wine to 895 million gallons.

- From 2000 to 2015, spirits volumes increased from 150 million to 215 million cases.

Don't think that beer companies - especially the biggest in the world - aren't taking notice.

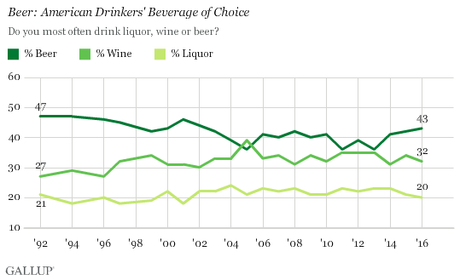

Over the past two decades, the percentage of Americans who prefer one kind of alcohol over the other hasn't changed too drastically. Beer is still on top.

But there's a chance that the youngest generations could help shift this annual expectation. According to Harris Interactive, Millennials drink both beer and spirits most often at home, but spirits rank first at bars or restaurants. As past research and current trends show, this could just be the start of a change.

In a 2004 research paper that analyzed alcohol use studies taken between 1979 and 2000, researchers explored how age demographics and education could impact alcohol choice among legal-aged drinkers. As expected, beer was the most common alcohol consumed by men during their youngest drinking years, tapering off as they got older.

Meanwhile, consumption of both spirits and wine have less structure:

- The most positive correlation between age and spirits consumption for men came between 25 and 59, but the oldest participants in studies, born before 1940, drank the most spirits compared to those born between 1956 and 1975, when the cultural expectation of drinking beer (and availability) was most certainly different. Women aged 20 to 49 drank spirits at a higher rate than other age groups.

- For wine, women's consumption was highest in their 20s and 30s and men saw a decline through the early 40s before rising to its peak consumption in the late 60s.

Things get a bit more interesting when you work in aspects of education, although it may speak to long held stereotypes and assumptions. According to researchers, the more education a study participant received, the bigger a negative impact it had on beer consumption. Conversely, it would have a positive effect on wine consumption. Important to note as we consider today's standards: Millennials are the most educated generation of Americans ever and Gen Z will be no slouch, either.

On face value, this information, accrued over decades of study with a wide range of ages, suggests common patterns that hold true, so there could be continued expectation and correlation to today's drinkers. But doing that would require us to look past the dramatic shift in the American alcohol market, which in just the last five years has changed wildly for businesses and drinkers alike.

One of the key differences in consumer choices today versus those of decades past is the assumption of quality in terms of premiumization across types of alcohol. If we look back at the two decade stretch from 1980 through 2000, for example, we might assume that the level of quality between these three types of alcohol started with beer, then extended upward to wine or spirits. Because we know higher education, and therefore greater levels of income, correlated with choosing wine or spirits, a connection may have been made that higher-priced alcohols directly equated to higher quality, which is why you spend more in the first place.

Taking all this together, today's situation for beer versus other alcohol choices becomes murkier.

We generally know that craft beer drinkers tend to have higher education degrees and have a relatively high income (I've often seen $75,000 mentioned as salary a threshold). Based on past expectations, we should assume that means they're also looking toward wine and spirits as options. But today's marketplace is based around increased premiumization of all categories, meaning that drinkers are no longer bound by switching from beer to wine or spirits in order to obtain perceived levels of quality or experience.

"Craft" beer is still a relatively new concept, but we have a wide range of price points and flavor opportunities. In fact, "super premium" beers, listed at $12.50 to $15 a six-pack, are driving higher prices and the $10 to $12.50 "premium" category is the "primary source of increased revenue growth for beer," according to reporting from Beer Advocate.

In today's consumer marketplace, quality beer can be found early on in a drinker's life cycle. So if the youngest drinkers continue to prefer beer, they can stay within that alcohol style and move up the ranks of quality which were once replaced by wine and spirits.

However, this is not a black and white issue with today's drinkers. As pointed out by John Holl, cross drinking is all the rage. This has shown up in erosion between categories, where we see spirit-inspired beers, beer cocktails and more. According to IWSR, "consumers are showing an increasing willingness to switch categories if another appears more dynamic or fashionable. This has led to migrations not only within spirits, but also between broader categories." Craft beer is no longer the only alcoholic beverage that can create stories of "local" and authenticity that attract drinkers.

Which is why more drinkers are splitting their tabs across beer, wine and spirits.

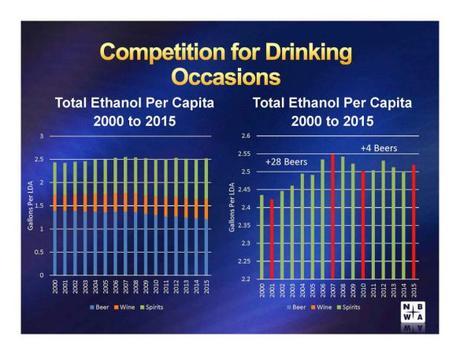

Per the National Beer Wholesalers Association (NBWA), the amount of alcohol consumed by Americans has remained at about 2.5 gallons per adult from 2000 to 2015 while the percentage of Americans who drink alcohol has stayed at about 65 percent for over 70 years. With greater choice across the three main alcohol categories and more drinkers choosing to swap among beer, wine and alcohol, that means some amount of volume has to change.

Spirits, the popular choice for Millennials when visiting bars and restaurants, are booming:

- As of August, there were 1,315 craft distillers active in the U.S.

- The U.S. craft spirits market reached 4.9 million cases and $2.4 billion in retail sales in 2015, growing at a compound annual growth rate of 27.4 percent in volume and 27.9 percent in value between 2010 and 2015.

- The market share of U.S. craft spirits reached 2.2 percent in volume and 3 percent in value in 2015, up from 0.8 percent and 1.1 percent in 2010, respectively.

This is not to be outdone by wine, either:

"With a stable pool of drinkers, the intense competition for drinking occasions has resulted in a decline in beer consumption as wine and spirits have captured more occasions and share," writes Lester Jones, chief economist for the NBWA.

This idea of "occasion" drinking is pivotal for beer going forward, especially for larger companies and niche beers. Corona has thrived off this branding, as one example, making a connection between the beach and relaxation that has made Corona the best-selling import in America. Craft beer has made strides in areas of authenticity, creating popular spots for community hangouts and unique tastes.

"As we fight for consumer occasions, and for consumer share of mind and for the loyalty from consumers, we should be focused on that (wine & spirits) instead of the zero sum game of what we are focused on right now - tearing each other down," said Andy Thomas, Craft Brew Alliance's CEO, during a Brewbound Session event in June.

Thomas' comments are a fitting mixture of warning and battle cry, two things that beer needs to consider. Is the segment at risk to fall behind wine or spirits as the preferred alcoholic beverage for Americans? Certainly not. But like all industries, tides shift just like expectations, and its something that's not to be ignored.

Bryan Roth

"Don't drink to get drunk. Drink to enjoy life." - Jack Kerouac