Is Security and Exchange Commission trying to destabilize the crypto world? What did Gary Gensler indicate in his recent interview? Will XRP be able to compete with Bitcoin? Read this article till the end to find out.

let's talk about this right here from “Mr. Whale '', “Breaking News Security and Exchange Commission to open massive probe into #Binance Exchange, investigating its ties to two fraudulent trading firms, Sigma Chain AG and Merit Peak Ltd.

The entire crypto world is fully in the untamed wild west. Security and Exchange Commission is going after anybody not even leaving the exchanges. I am not recommending to take your assets from Binance but nonetheless, it is a serious problem that an exchange where your investment is housed is being charged by a government body.

And you never know when the Security and Exchange Commission will simply order Binance to cease its trading assets and they have the right to do so. And unfortunately for you, you will be in the thick of it, so be cautious.

And it might all hinge on the outcome of the Ripple against Security and Exchange Commission lawsuit since if the Security and Exchange Commission wins the case, they will have a court ruling to rely on if they decide to act against any of the cryptocurrencies now trading on the market.

If Ripple wins, the Security and Exchange Commission will be forced to withdraw its sanction from every cryptocurrency in the market. Finance Feeds makes the same argument, saying that "the court case might make XRP the sole crypto asset with regulatory clarity in the United States."

In the lawsuit, it could be argued that the two exhibits, which were required by the Security and Exchange Commission, failed to demonstrate that the company and its executives were selling and promoting XRP as an investment contract within the jurisdiction of the Security and Exchange Commission and that the Security and Exchange Commission had jurisdiction over the company.

This increases the likelihood that Ripple will win the lawsuit, which would result in complete independence for XRP and the coin being the only cryptocurrency in the world to enjoy regulatory certainty in the United States. What do you think, will Ripple win the case or not?

Moving on, Gary Gensler has almost reached the point of no return with all of his non-answers, and he is beginning to irritate a large number of people. He appeared on FOX Business when he spoke on the regulation of cryptocurrency, they brought up Ethereum offering, to be nothing more than the Ethereum developers attempt to conceal whales presence in the cryptocurrency market.

He is just providing dubious responses to all of the questions raised throughout the interview. So he oversees the Securities and Exchange Commission of the United States, a nation that aspires to be a leader in innovation, and this person is purposely withholding information that would clear up the whole misunderstanding around cryptocurrency legality.

There are a great number of individuals that are puzzled by this issue. Gary Gensler, despite the fact that he is well aware that the whole industry is on pins and needles, continues to fail to resolve the situation. As a result, the whole industry is tarnished.

This is how you can tell Gary Gensler is a nasty man, and this is why everyone is so furious with him.

Furthermore, Charles Gasparino said on the Twitter quote, “Interesting takeaway from Gary Gensler talks with Liz Claman on the difference between Ethereum ETHER and what Ripple did with XRP.

He would not comment. The Security and Exchange Commission generally does not comment on investigations, which means maybe they are weighing an ETHER case”. In the same interview, Gasparino blasts Gary Gensler as “pathetic” for refusing to answer questions about the Ethereum free pass.

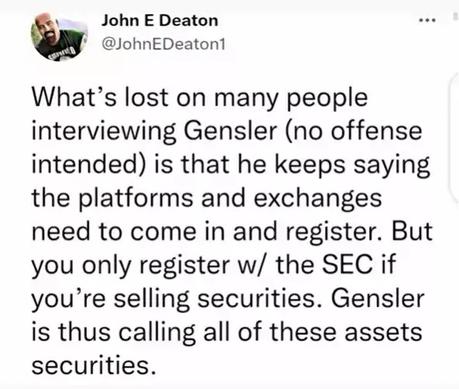

John Deaton tweeted on the interview saying, “What is lost on many people interviewing Gensler (no offense intended) is that he keeps saying the platforms and exchanges need to come in and register. But you only register with the Security and Exchange Commission if you are selling securities.

Gensler is thus calling all of these assets securities.” He goes on to say, “Yet, Jesse or Jp Thieriot or any other CEO of a digital asset platform, is expected to register that they are selling securities even if they do not believe they are selling securities.

After leaving the meeting with the Security and Exchange Commission, Jesse can expect a subpoena, followed by a lawsuit.” Deaton is totally right here, as a Digital Asset investor said, “I think John Deaton is right.

The "honorable" Security and Exchange Commission Chair will resign before actually doing anything honorable and answer questions about the Ethereum Free Pass and his campaign finance and Russia problem.

He thought he would just stroll in and continue to live on the public dole”.It is insane because Gary Gensler is being exposed. I mean, he clearly knew what he was getting into before becoming Security and Exchange Commission chairman, so we know everything is planned ahead of time.

Also Read: What are NFTs & What is the point of buying an NFT? Fully Explained

Furthermore, THIS FEATURE CAN GIVE RIPPLE AN EDGE OF BRIDGING BETWEEN CBDC AND XRP, which could further increase the utilization of XRP. In this regard, Rahul Advani, RippleNet Policy Director for the Asia Pacific area, recently spoke with a financial news site about the company policies.

As part of the chat, he spoke about the Ripple network on-demand liquidity service and the ways in which it might expedite the movement of cryptocurrencies across nations, which will be advantageous to consumers.

Advani noted that it seems that Asian Pacific nations are striving toward the creation of CBDCs and are taking the lead in implementing them in both the retail and wholesale sectors of the economy. When it comes to cross-border payments, Rahul believes that central banks would have to deal with the difficulty of interoperability on their own.

It is due to the simple truth that every government will issue its own digital money at some point. It will result in the same isolated currency system that prevents nations from exchanging their currencies with one another, as has already happened to their virtual currencies, and it will happen again.

Consequently, it is clear that interoperability is a problem, and Ripple Network can assist in finding a solution by enabling cross-border transactions. In fact, the network may utilize its XRP to serve as a neutral bridge in this situation.

In addition to being open-source, decentralized, and publicly available, XRP has the potential to play a role in the future. Ripple believes that XRP is in high demand for liquidity and that it has the potential to serve as a neutral bridge between other currencies.

Additionally, digital currencies issued by central banks of nations that may serve as a bridge between them are also acceptable.

Finally, we have a tweet from "XRP Captain" who says, "Owning 100 XRP is equivalent to holding 100 bitcoins"This is very probably going to be the case in the near future, and there is a chance that XRP could outperform bitcoin and perhaps overtake it.

It will only be feasible if Ripple projects, such as CBDC, come to fruition for XRP and XRP gains widespread acceptability for cross-border transactions throughout the globe.

Do not forget that in order for XRP to reach the level of bitcoin, the Security and Exchange Commission lawsuit will also need to be resolved in Ripple favor. Will the Security and Exchange Commission let XRP achieve its true potential? What do you think?