Photo by Pixabay on Pexels.com

" data-orig-size="1880,1253" sizes="(max-width: 723px) 100vw, 723px" data-image-title="grey metal case of hundred dollar bills" data-orig-file="https://smallivy.files.wordpress.com/2022/05/pexels-photo-164652.jpeg" data-image-description="" data-image-meta="{"aperture":"0","credit":"","camera":"","caption":"","created_timestamp":"0","copyright":"","focal_length":"0","iso":"0","shutter_speed":"0","title":"","orientation":"0"}" data-medium-file="https://smallivy.files.wordpress.com/2022/05/pexels-photo-164652.jpeg?w=300" data-permalink="https://smallivy.com/2022/05/01/why-your-cash-flow-is-so-important/pexels-photo-164652/" alt="" srcset="https://smallivy.files.wordpress.com/2022/05/pexels-photo-164652.jpeg?w=723 723w, https://smallivy.files.wordpress.com/2022/05/pexels-photo-164652.jpeg?w=1446 1446w, https://smallivy.files.wordpress.com/2022/05/pexels-photo-164652.jpeg?w=150 150w, https://smallivy.files.wordpress.com/2022/05/pexels-photo-164652.jpeg?w=300 300w, https://smallivy.files.wordpress.com/2022/05/pexels-photo-164652.jpeg?w=768 768w, https://smallivy.files.wordpress.com/2022/05/pexels-photo-164652.jpeg?w=1024 1024w" class="wp-image-21799" data-large-file="https://smallivy.files.wordpress.com/2022/05/pexels-photo-164652.jpeg?w=723" />Photo by Pixabay on Pexels.comYou become and stay wealthy by managing your cash flow. Period. Certainly having a large income helps and there are some incomes that are not sufficient to grow wealthy, but there are many people with huge incomes who will never become wealthy and there are people with modest incomes who do. Because it is so important, cash flow is the entire focus of my second book, FIREd by Fifty: How to Create the Cash Flow You Need to Retire Early . Today we’ll talk about what cash flow is and how you manage it to grow your wealth.

(Note, this site contains affiliate links. As an Amazon Associate I earn from qualifying purchases. When you click on an affiliate link and buy something, The Small Investor will get a small commission for the referral. You are charged nothing extra for the purchase. This helps keep The Small Investor going and free. I don’t recommend any products I do not fully support. If you would like to help but don’t see anything you need, feel free to visit Amazon through this link and buy whatever you wish. The Small Investor will get a small commission when you do, again at no cost to you.)

FIRE = Financially Independent, Retired Early. Want to learn how to get FIREd and become financially independent, please consider picking up a copy of my new book, FIREd by Fifty: How to Create the Cash Flow You Need to Retire Early This is the instruction manual on how to become financially independent.

What is cash flow?

Cash flow in personal finance is a description of how the money that comes into your life is used, saved, invested, or given away. It isn’t the amounts but where it comes from and where it goes once you have it in your possession. Stealing from physics, where they look at the “balance of mass” and “balance of energy, if we look at the “Balance of Cash,” it follows the same PISO equation:

Production + Inflows = Storage + Outflows

The PISO equation

In words, this is that the wealth that is produced (or stolen/destroyed), plus inflows of money, equals the change in storage of money (how much money/wealth you have) plus the amount of money that is spent and flows out. Production is wealth that you produce internally, like if you were to use your labor to build a house or you painted a masterpiece that you could sell, but choose to keep. Income is money made through work, through investments, gifts from friends and family, etc…. Storage is bank accounts, investment accounts, balances in your PayPal account, and even cash in your pocket or under your mattress. So the amount of wealth you create through your actions for yourself, plus inflows of wealth you get from salaries, investments, and other sources, is equal to the money you spend plus the change in the amount of wealth you have. Simple and very intuitive.

Want all the details on using Investing to grow financially Independent? Try The SmallIvy Book of Investing

How cash flow relates to building wealth

So, how do we use our cash flow to build wealth, or more precisely, how do we set up our cash flow to build wealth? Well, if we rearrange the PISO equation and replace the terms with terms related to personal finance, we get:

Change in wealth =

Salary, Investment Income, and Other Income – Spending + Personal Production

The wealth building equation

We’ll call this “The Wealth building equation.”

So, if we want our wealth to increase, we need to make sure our spending is less than the amount of money we’re bringing in plus the amount of wealth we create for ourselves. In other words, we need to spend less than we make.

Now, I’m sure many reading this are going, “Yeah, duh,” because this is very obvious. But while it is really obvious, most people don’t do it and therefore never become wealthy. A big reason is that people waste a lot of their income on things that do not build their wealth. They buy things that they immediately consume like food, travel, and clothing. They buy things on payments and pay out a bunch of interest because they want to “have it now” instead of waiting until they have the money to pay cash. They build up liabilities like rent, car payments, credit card payments, personal loans, etc… until there is no money left over to invest and save. Rather than looking at the cost of items, they look at the payment versus their income and decide if they can take on the debt. This is why most people live on the edge of bankruptcy where without their job they would default on their loans and lose their car and then retire with nothing and need to live in poverty during the last years of their lives.

How do you live differently and become wealthy instead of being like “most people?” You build your income throughout your life and as you do so, keep the inflation in your lifestyle cost below the rate at which your salary grows. You take some of the money you’re making through salaries and put it into investments, which pay out money through dividends/interest, rents, or capital gains so that your income is growing. You save up and invest and pay cash for things so that you don’t waste money on interest. This is what people who will become and stay wealthy do. If you want to become and stay wealthy, this is what you must do.

Photo by Pixabay on Pexels.com

" data-orig-size="975,1300" data-image-title="fire wallpaper" data-orig-file="https://smallivy.files.wordpress.com/2022/05/pexels-photo-207353.jpeg" data-image-description="" data-image-meta="{"aperture":"0","credit":"","camera":"","caption":"","created_timestamp":"0","copyright":"","focal_length":"0","iso":"0","shutter_speed":"0","title":"","orientation":"0"}" data-medium-file="https://smallivy.files.wordpress.com/2022/05/pexels-photo-207353.jpeg?w=225" data-permalink="https://smallivy.com/2022/05/01/why-your-cash-flow-is-so-important/pexels-photo-207353/" alt="" class="wp-image-21802" data-large-file="https://smallivy.files.wordpress.com/2022/05/pexels-photo-207353.jpeg?w=723" />Photo by Pixabay on Pexels.comFiguring out your cash flow diagram

You could just create a budget and make sure you’re spending less than you’re making each month and put that money away into investments. That will work. But there are ways to fine-tune and supercharge your wealth building, plus avoid mistakes. This is why in FIREd by Fifty we use a cash flow diagram to look at not just month-to-month income and expenses, but all of your financial needs. You look at what you’ll need both now and in the future and then develop a plan to meet those needs. You also figure out how to maximize your income from investments and minimize your expenses for interest and loans. Tips are given for both.

For example, many people will be doing fine financially each month where all of the bills are paid and maybe saving up a little, but then a big expense will come up like needing to replace the air conditioner. They then will take out a loan, adding to their spending each month and reducing the amount they have to save and invest. If they had been planning for those kinds of expenses all along and put it into their budgets, they could have had that money ready to go when the need arose. Even better, if they had been investing that money, their investments would have paid part of the cost of the item, allowing them to get the new AC and not spend all of their savings.

People who take out loans spend more for items than they cost. People who save and invest pay less!

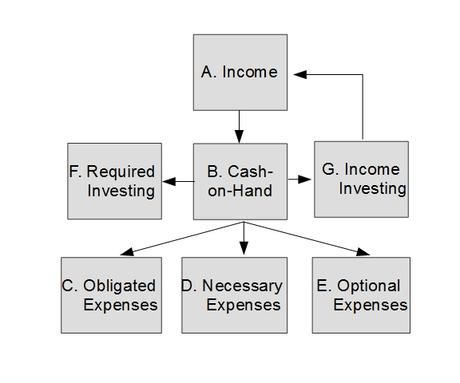

A cash flow diagram is presented in the figure below. Note that it looks a lot like the wealth building equation except the spending and wealth storage elements are broken out into sub-categories. Expenses are broken into:

C. Obligated Expenses: those outflows you are required to make like car payments, mortgage payments, and taxes.

D. Necessary Expenses: those things that you need to buy but where you can often adjust how much you spend for them (these are things like clothing and food).

E. Optional expenses: those things that you don’t need to buy but that make life more enjoyable. These are luxuries like vacations, gifts, and NetFlix.

The Cash Flow Diagram

The Cash Flow Diagram

Your investing/wealth storage is broken down into:

F. Required Investing: this is investing for things like retirement and your kid’s college.

G. Income investing: this is investing to save up for things in the future like the next car or a new roof and also investing just to increase your income. This is money that you can spend now, which gives you extra money needed to pay cash instead of taking out a loan. See how this works?

If you create a cash flow diagram and study it, you can start to see where your issues are – what’s keeping you from building wealth – and then adjusting your behavior to change your future. Building one is a matter of figuring out your current and future expenses, plus your income sources, and then putting them into the boxes and see where your money is going. Those who buy FIREd by Fifty can even request a spreadsheet cash flow diagram to help them with the process.

Missing from the cash flow diagram is production of wealth. If you produce something like building/making things for yourself or create artwork that you could sell but that you hold onto, these would probably be treated like income still when creating your diagram. You could also add to your B. Cash-On-Hand box or maybe to your G. Income Investing boxes if the things you create would be expected to go up in value.

Unhealthy and healthy cash flow diagrams

So how do you know whether your cash flow diagram is healthy or unhealthy? The answer is how big the cash flows are going to expenses compared to how big they are going to investments. Certain types of expenses are also worse than others.

An unhealthy cash flow diagram, which is typical for most people, would see the amount coming from A. Income equal to the amounts going out to the three expense categories. You might think that having a large amount going to E. Optional Expenses would be bad, meaning that you were blowing your money on useless things, but really having a big share of your money going to C. Obligated Expenses would be worse since that means you have little control over your money. If you find yourself spending too much on luxuries, you can just cut back. If you have too many obligated expenses like car payments and personal loans, the only way out is to pay off those loans and not get into new loans.

A healthy cash flow diagram would see relatively little going into obligated expenses, maybe just a relatively healthy obligated expense like a home mortgage that is about 1/4 of normal monthly income so it is easy to pay, then have money flowing both into F. Required Investing and G. Income Investing.

Note that if you don’t have money going into required investing you may be fine for several years, but if you don’t die first there will come a time when it will really bite you. For example, if you aren’t saving up for retirement you’ll find yourself in a very difficult place later in life, probably relying on others for your basic necessities if you can find others that will help you. Many people figure they’ll “live for today,” but then end up crying “whoa is me” when the future comes and they aren’t ready for it. Sometimes the grasshoppers win, but usually it is the ants who spend the summer preparing for winter who end up in a better place later in life when the winter comes.

Income investing is one of the last things people do but is really very important. Many people figure that they’re contributing a bit to their 401k accounts, but really this isn’t always enough. Investing beyond these accounts will make a world of difference over your life.

If you are putting money away for required investments but are not putting much away for income investing, you are likely to see your future cash flow decrease as you take on loans to pay for the random big expenses and/or end up dipping into your retirement savings. Because taking money from these accounts typically comes with a penalty, you might end up paying more for the item than you would have if you had put money away into income investing. Even if you are able to take out money without paying a penalty to the government, if you’re robbing your retirement and college accounts, you’re robbing from your future self. It is best to manage your cash flow so that you’re putting money away into retirement but also putting money into income investing.

Have a burning investing question you’d like answered? Please send to [email protected] or leave in a comment.

Disclaimer: This blog is not meant to give financial planning or tax advice. It gives general information on investment strategy, picking stocks, and generally managing money to build wealth. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. Tax advice should be sought from a CPA. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.