What is the holy grail of cryptocurrency?

When Satoshi Nakamoto and his team created Bitcoin back in 2008, their vision was to create a peer-to-peer decentralized electronic cash. Ethereum was created in 2015, with the vision of creating the first programmable money in the world.

We are all fascinated by this brand-new revolutionary idea of cryptocurrency and the crazy price appreciation, but most of us don't really question ourselves whether these cryptos were actually useful as our day-to-day money.

Ask yourself, when was the last time you actually used Bitcoin to pay for something? Probably never. What is the type of cryptocurrency that would actually be usable in our real-world economy? That's right, the holy grail of cryptocurrency is creating a decentralized form of money that people can actually use on a daily basis, and also on top of that, we can build an entirely new type of permissionless financial ecosystem without a middleman. And that's exactly what Terra Luna does.

In this article, I will share with you guys what exactly Terra Luna is, what they do, how exactly Terra and Luna work together to solve the most challenging problems in the crypto space, and most importantly, why Luna is an extremely powerful and also an extremely undervalued crypto asset that I've been accumulating since 2021. Alright, let's get started.

What problems Terra LUNA is trying to solve

Before we try to understand what Terra Luna is, it is important to understand what problems they are trying to solve. The biggest challenge for cryptos has always been the real-world adoptions for our daily transactions.

Our whole economy is made up of two groups: the consumers and the producers with products and services. The medium of exchange between these two groups is usually the fiat currency, which is controlled by the government. The reason we use fiat currencies for daily transactions is that the price is stable.

For example, let's say, if you wanna buy a Tesla Model S, would you rather pay in US dollars, which you know that a $1 today is still gonna be worth $1 tomorrow. Or would you pay for a Tesla with your Bitcoin, which you know the price of Bitcoin appreciates 300% a year on average? Of course, you would pay in US dollars and keep your Bitcoin.

And that is the major problem of cryptocurrencies nowadays. Because the price fluctuates so much with extremely high volatility, everyone is either holding them or trading them. Nobody wants to spend them. All right, I know what you are thinking.

What about stablecoins like USDC or USDT? Well, although the price of stablecoins is strictly pegged to the US dollar, they are not as stable as you think. In fact, stablecoins are actually pretty risky central-controlled assets that are backed by another asset as collateral.

Currently, there are two kinds of stablecoins out there. First, is the fiat-backed stablecoin. What they do is pretty straightforward, they hold a bunch of US dollars in the reserve as the reserve currency, and issue stablecoins on top of those dollars at a one-to-one ratio, meaning one token can be redeemed at US$1. The typical examples of such stablecoins are USDC and USDT.

The other type of stablecoin is the crypto-backed stablecoin. The typical example is DAI. Similar to USDC, DAI is also priced at a strict one-to-one ratio with the US dollar. But the difference is that DAI is backed by Ethereum as the reserve currency.

Well, I will not go into too much detail about how stablecoin works in this article, I will leave it for another day. But here is the bigger picture I want you guys to pay close attention to, and also the major challenge of our current crypto space, which is, the purely decentralized cryptocurrencies like Bitcoin, are extremely volatile, definitely not usable as daily cash.

And on the other hand, stablecoins are stable in terms of price, but they are not decentralized money. They are more like independent digital central banks. They are controlled by the central organizations as the middlemen.

So the only solution to bridge the gap and to truly connect between crypto space and real-world adoption is to build a currency that is pure decentralized, and also extremely stable in terms of price for daily transactions. And that's exactly where Terra comes into play.

What is Terra?

Terra is a new type of programmable stablecoin. We can think of Terra as a master stablecoin token that supports a whole family of different stablecoins that each one of them can track one country's fiat currency price.

No matter if it's US dollar, Japanese yen, or euro, Terra stablecoin can be created to match any local currency price at an exact one-to-one ratio, and transact at extremely low fees and very fast speed, which can be easily used in our day to day transactions.

For example, Terra has a stablecoin called UST, which tracks the US dollar price. But what if I don't live in the US, for example, let's say, I live in Korea and I can only spend Korean won? No problem, Terra also has KRT, which is a stablecoin that tracks the Korean won's price. So basically, Terra has only one job, which is to be used as a transactional stablecoin around the world.

What backs Terra stablecoins?

All right, now the key question is, if USDC is backed by the US dollar, DAI is backed by Ethereum, then what backs Terra stablecoins? How can Terra track so many different national currencies without any collateral reserves?

Well, then that is exactly where the Luna Token comes into play. Terra is neither a fiat-backed stablecoin nor a crypto-backed stablecoin, it is a programmable stablecoin that is backed by an extremely sophisticated mathematical algorithm called Terra-Luna Protocol.

Luna token is the Terra-Luna Protocol's native staking token that is programmed to absorb the price volatility of Terra stablecoins and to maintain their price level to always match the target price of whichever fiat currencies they are tracking. And this is how it works.

How Terra-Luna Protocol works

All right, this is definitely the most important part of this article. Because understanding how Terra-Luna Protocol works is the key to understanding why the Luna token is extremely valuable and the price will go up a lot higher over time. I will try to make it as easy as possible for you guys to understand.

The entire Terra-Luna Protocol consists of two components: Terra, which is the stablecoin token, and the Luna, which is the staking token. As we mentioned earlier, Terra stablecoin has only one job, which is to track the fiat currency price at a one-to-one ratio.

One Terra UST token matches exactly at $1 in the real world. But here is the problem, because Terra stablecoins have no reserves to back the tokens, they are purely traded based on supply and demand. For example, when the demand for Terra UST goes up and it becomes higher than the supply, the price of UST tokens will go up.

In this case, one token of Terra UST will be worth more than $1. On the other hand, when the demand for Terra UST goes down, and the supply becomes higher than the demand, the price of one UST token will go down and be worth less than $1.

The key factor to make sure Terra stablecoins like UST token always maintain a stable price is to constantly make sure the demand and supply for UST remain balanced. We can't control the demand, because it's purely dependent on the users and economy. The only thing that we can control is the supply. And that is exactly where Luna token comes in to play the magic.

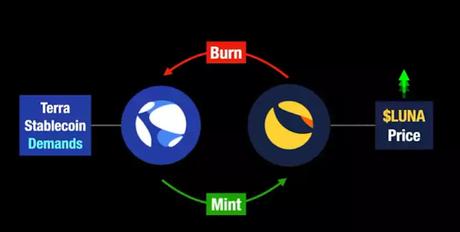

The Protocol links the supply of Luna to the supply of Terra stablecoin. When the demand for Terra stablecoins increases, we need to increase the supply of Terra to match the demand. So the protocol will automatically burn the Luna tokens and convert them into Terra stablecoins to boost the supply.

The supply of Luna goes down, while on the other side, the supply of Terra goes up to match the increasing demand. The whole process will stop when the demand and supply of Terra reach a balanced level, and the price of Terra stablecoin will be stable again at the target tracking price.

The same thing, when the demand for Terra stablecoin goes down, and the supply becomes higher, the protocol will automatically convert the over-supplied Terra stablecoin back to Luna tokens. The supply of Luna goes back up, and the supply of Terra goes back down again until the demand and supply of Terra stablecoins are back to the balance level again.

So in summary, the major role of Luna token is to constantly adjust the supply of Terra stablecoin through burning and minting back and forth, so that it can always make sure the supply of Terra can always match its demand and maintain the Terra stablecoin price stable.

This whole process was pre-programmed into the Terra Luna Protocol algorithm so that we won't even feel the price of Terra stablecoin is constantly fluctuating. Much like the Moon which helps to stabilize our planet Earth rotation, the Luna token plays the essential role to provide Terra stablecoin's stability, so that you and I can use a truly decentralized form of money in the real-world economy.

What drives the Luna token price?

All right, once we understand how the Terra-Luna Protocol works, now, the key question is, what drives the Luna token price? Why buying Luna is still an extremely attractive investment?

Well, the answer to this question actually has already been revealed in the Protocol itself. The price of the Luna token is closely tied to its supply. If we want the price of Luna to go up, then we need to reduce its supply.

Based on the Protocol that we explained earlier, the only scenario for Luna's supply to decrease is when the demand for Terra stablecoins increases. So essentially, the price of Luna has already been pre-programmed to be correlated with the demand of Terra stablecoin.

When the demand for Terra stablecoin goes up, Luna's price will go up. That's right, the more adoptions for Terra stablecoins and more people use Terra stablecoins in their daily life, the more valuable Luna token will become.

And that is why the entire team of Terra Luna has been working extremely hard since day one on building a Terra Luna Ecosystem to solve real-world financial problems like payment, saving, investing, and much, much more. There are hundreds of applications that have been already launched in the Terra Luna Ecosystem and adopted into the real world.

For example, one of the key focuses in Terra Luna Ecosystem is payment, which has some major players like CHAI and PaywithTerra. CHAI is one of the most well-known payment companies in Korea, backed by VC giant, SoftBank.

Their business model is pretty straightforward. They build payment apps, issue debit cards and credit cards for users to pre-top up their funds, spend them in their daily life like paying bills, grocery shopping, and earn extremely high rewards from it, much higher than what the traditional banks offer.

They are extremely popular in Korea. In 2021, the top 14 out of 15 banks in Korea have already integrated with CHAI. They are the number one payment method in convenience stores, supermarkets, bookstores, and even gaming platforms in Korea.

So why can CHAI afford much higher rewards than the traditional banks to attract so many users?

It's because CHAI's payment system is built on a completely decentralized Terra Luna blockchain and adopted the Terra stablecoins as their underlying settlement currencies. Consumers get rewarded by driving up the demand for Terra stablecoins and driving up the burnt rate of Luna tokens.

Because, although the majority of Luna tokens are burnt and converted into more Terra stablecoins, a small portion of those burnt Luna tokens will be rewarded to the stakers, developers, and most importantly, the consumers who use the Terra stablecoins for transactions.

And here is the interesting part. Although CHAI is a pure blockchain decentralized payment company that is adopting cryptos, their targeted customer base is actually those regular non-crypto users. When CHAI's customers make a payment in a supermarket with their credit cards or book a taxi on their mobile app, they don't realize that they are not really spending Korean won.

What they are spending is actually KRT tokens, which is the Terra stablecoin that tracks the Korean won's price. The same thing goes for another payment application called PaywithTerra. It works exactly like PaywithPayPal, but it's a purely decentralized payment system that is entirely built on Terra Luna Ecosystem.

Any online store owner can just simply plug in PaywithTerra API Key on their web store or mobile store, and the customers can make payment with one simple click. Both buyers and sellers who adopted PaywithTerra will be rewarded with a cash bonus from Terra Luna Network.

Same as CHAI users, most of those users don't even realize the whole payment process is actually done by using cryptos on the blockchain without any middleman.

The examples and real-world adoption cases of Terra Luna can go on and on and on, from payment to savings, from long term investing to short term trading, there are over 200 different applications and protocols that are built on Terra Luna Ecosystem and serve people in their daily life around the world that they don't even realize that they are using cryptos.

Bottomline

In my opinion, that is the beauty, and also the strongest bull case for Terra Luna. Unlike Bitcoin or Ethereum, Terra Luna is the first-ever blockchain protocol that truly provides a fully usable decentralized form of money and is increasingly adopted in our real-life daily transactions.

With no doubt, decentralized stablecoin that can bridge the gap between the crypto economy and our real-world economy is the single most important innovation in cryptos. And in this area, there is no one else currently doing a better job than Terra Luna.

They're the absolute dominating player in the programmable stablecoin space. Thanks to the network effect and the strong ecosystem as the moat, the demand for Terra stablecoin around the world is growing at an exponentially faster pace, and that will definitely drive up the price of Luna tokens over the long term.

That is why I'm extremely bullish on Terra Luna. Currently, the market cap of Luna is only less than $40 billion. Based on what Terra Luna is trying to achieve and the brilliant talents on their team to execute, I'm very, very confident to say Terra Luna is an extremely undervalued crypto project that you should definitely keep your eyes on.

Disclaimer: Investing and trading offer a lot of potential benefits, but they also have a lot of risks. You must be informed of and prepared to accept the dangers. Don't risk money you can't afford to lose by trading. I am neither a financial advisor nor an investment advising service. The data and information presented are merely educational and informative. Nothing in this website, including the information it contains, should be interpreted as advice to purchase or sell stocks, futures, indices, FX, cryptocurrencies, or commodities.