Photo by Andrea Piacquadio on Pexels.com

" data-orig-size="1880,1253" data-image-title="adult daughter teaching senior mother using smartphone in park" data-orig-file="https://smallivy.files.wordpress.com/2023/02/pexels-photo-3791665.jpeg" data-image-description="" data-image-meta="{"aperture":"0","credit":"","camera":"","caption":"","created_timestamp":"0","copyright":"","focal_length":"0","iso":"0","shutter_speed":"0","title":"","orientation":"0"}" data-medium-file="https://smallivy.files.wordpress.com/2023/02/pexels-photo-3791665.jpeg?w=300" data-permalink="https://smallivy.com/2023/02/17/why-social-security-doesnt-work-and-how-to-fix-it-in-pictures/pexels-photo-3791665/" alt="" class="wp-image-23136" data-large-file="https://smallivy.files.wordpress.com/2023/02/pexels-photo-3791665.jpeg?w=723" />Photo by Andrea Piacquadio on Pexels.comEveryone has an opinion about Social Security, but few people really understand how it works. Today we’re going to look at the cash flow of Social Security (and Medicare, since it works the same way). In doing so, we’ll show why the existing system is always due to fail no matter how many times it is “fixed.”. We’ll then show a simple way to fix it.

(Note, if you click on a link in this post and buy something from Amazon (even if you buy something different from where the link takes you), The Small Investor will receive a small commission from your purchase. This costs you nothing extra and is the way that we at The Small Investor are repaid for our hard work, bringing you this great content. It is a win-win for both of us since it keeps great advice coming to you (for free) and helps put food on the table for us. If you don’t want to buy something from Amazon or buy a book, how about at least telling your friends and family about our website as a great place to learn about investing and personal finance. Thanks!)

.How Social Security Works

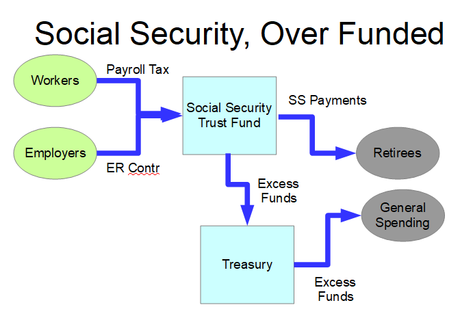

The Social Security system, when it is “over funded” (more money is coming into the system than is being paid out in benefits), has a cash flow diagram like shown below:

Payroll taxes and employer contributions flow into the Social Security Trust Fund. Payments are sent out to retirees. Anything left over is sent out to the general treasury and spent by Congress. Congress puts IOUs into the Trust Fund, but the money to pay back these IOUs comes from the same source that Social Security taxes do: the economy. If the economy dries up, so will the ability to pay back these IOUs.

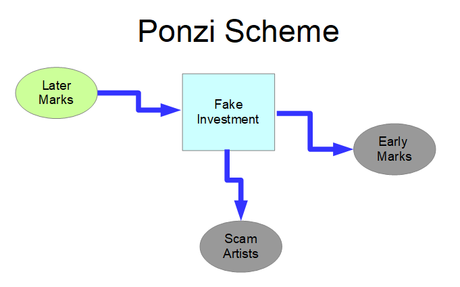

It is often said that Social Security is a Ponzi scheme. To see why, compare the cash flow above to that for a Ponzi scheme:

Here, early “investors” pay money to a guy who says he has a great investment with high returns. The scam artist keeps recruiting new “investors.” He takes money from the newer investors and uses it to pay the earlier investors, saying that the money they are getting is from the investment. The scam artist then takes a portion of the money being paid in by the investors as his cut. This continues until the scammer can no longer find new investors, at which point he has no money to pay the earlier investors and the whole thing collapses. Compare the cash flow of the Ponzi scheme and you’ll see that it works the same way with the ealier retirees taking the place of the early marks, the current employees being the later marks, and the scam artists being the Congress.

Just like the Ponzi scheme, Social Security wil fail without a constant supply of new employees. There must be enough current employees to pay the benefits out to the retirees. When there is more than enough coming in to pay current retirees, Congress spends the money just like the Ponzi scheme con artists. This means that no money is invested so there is no way to build up extra money to save up money to pay for a large group of workers going through the system, as was the case with the Babyboomers.

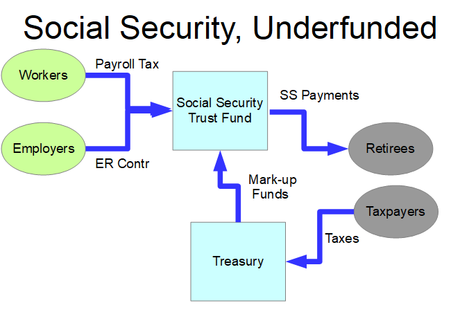

When there are a large group retires that outnumber workers, there is no longer enough coming in from Social Security taxes to pay for current retirees. The system then becomes underfunded. The cash flow looks like the diagram below:

Now, because there isn’t enough money coming in from current workers to cover the payments to retirees, the taxpayers are paying for a portion of the benefits directly through their taxes. Of course, this means both that Congress doesn’t have the extra money from Social Security to spend on other government programs and tax money that was going to programs before is now going to retiree benefits. This is a double whammy for government programs. Something like welfare or defense spending would need to get cut, Social Security retiree benefits would need to get cut, or the government would need to borrow even more money to keep funding everything at the same level. Very difficult choices would need to be made.

Socails Security Keeps Breaking and Being Fixed

When Social Security first started, the percentage collected from workers was very low. Taxes were only a few percentage or pay, which made sense since the benefits were just enough to keep the retiree from starving if he didn’t save other moneies up. Because most people dies within a few years of retirement, this better than nothing payout was reasonable.

We then got into a situation where revenues weren’t covering payouts, so taxes were raised. Benefits largely stayed the same, but now workers were paying more for the benefits received. This means their rate-of-return decreased.

Then in the 1980s, because the Babyboomers were larger than the generations following, taxes were raised again to cover them with the idea that we could save up for the upcoming surge. But this will still not mean enough money will be available to pay for the Babyboomers in retirement because any extra money was spent by Congress. If anything, it got Congress used to having more money to spend so they built up programs way beyond where they are sustainable, making it worse than it would have been. As a result, workers pay more than enough to fund a comfortable retirement, but Social Securty pays out nowhere near enough for that and is soon not going to be able to cover retirees anyway even with the meager payouts provided.

My new mini-book is available for just $2.99. Order your copy today!

A Better System: Private Accounts

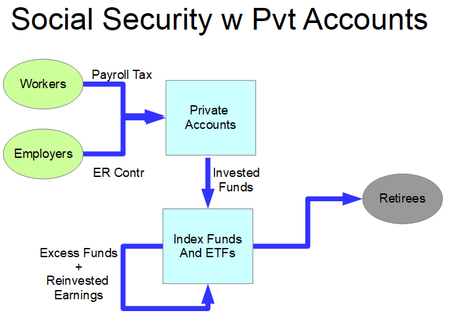

Private accounts, where each worker contributes to a private account that is then invested in index funds and ETFs would work much better. The cash flow for this system would look like this:

Notice that it looks similar to Social Security. Employees and employers are still forced to put money away. This money would be locked up until reirement time. Money in the private accounts would be invested in a specified set of index funds and ETFs. These would be broad funds that cover the whole economy, both the US and the world. To avoid having people making investment mistakes, these investments could be specified based on the age of the worker. These specified investment choices would follow standard investment practices developed through academic research that have been shown to be effective and limit risk.

Often the risk of investing in the stock and bond markets is used as an argument against such a scheme. But n this case workers are putting their money into basically every major company in the world. There would be bull markets and bear markets, but by investing for such a long period of time, these oscillations would be damped out. If all of these funds were to fail entirely, it would mean all of the major companies in the world failed. This would mean the economy of the whole world failed. There would be no jobs in such a scenario and the regular Social Security system wouldn’t have any money coming into it either. We’d all be fighting in the streets for food.

Another feature actually makes this new scheme similar to standard Social Security. Notice from the cash flow diagram with the private accounts that the current employees are sending their money into the index funds and ETFs while the retirees are selling a portion of their investments in these same funds to pull out money for their retirements. This means that the current employees are buying the funds from the retirees, so the funds coming in from the current employees are being given to the current retirees. This means that even if the investments aren’t making money at any given time, there will still be money flowing in to cover the withdrawals of current retirees.

Note the crucial difference in this system fromtraditional Social Security: The investment of excess funds (instead of excess funds being spent) and the generation of and reinvestment of earnings from investments. This means the system is actually able to save and invest. As a result, there will be a lot more money for retirement. Instead of receiving $2000 per month, retirees would receive $5000, $10000, or maybe more. Other benefits include:

- Accounts would have an actual value that could be left to a spouse or kids on death.

- Moneys would be separate from the general treasury, making it harder for the funds to be diverted to other spending.

- Inflation protection would be built in since stocks would increase in value with inflation.

- The extra money invested would help the economy grow, increasing jobs and government revenues in general.

Want to learn a lot more about stock investing?

If you want to go from being one of the crowd to a sophisticated investor, pick up a copy of

(For ways to increase your free cash flow and use it to build wealth, check out FIREd by Fifty, How to Generate the Cash Flow You Need to Retire Early.)

To ask a question, email [email protected] or leave the question in a comment.

Disclaimer: This blog is not meant to give financial planning advice, it gives information on a specific investment strategy and picking stocks. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.