Over the next few posts on This is Why I’m Drunk, I’m dedicating my research efforts to learn more about Craft Brew Alliance, a company that could be up to big things in 2014.

As beer lovers, we judge breweries in all sorts of ways. The people who run them, how they market themselves and the quality of their beer.

But what about financial performance? That’s something that easily falls to the wayside when all you want is something tasty in your glass. But it’s also indicative of what we may be pouring out in the future.

If that’s the case, it’s hard to ignore this: Craft Brew Alliance is kind of kicking ass.

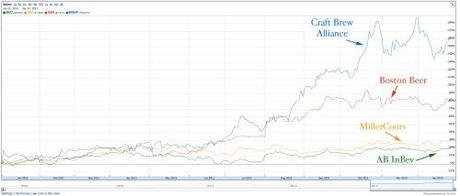

Flying under the radar in a Big Beer world monopolized by AB InBev and MillerCoors, the brewer’s stock grew by more than 160 percent in 2013, roughly double the next company, Boston Beer:

Click to enlarge

I didn’t see that coming, but looking back at the past year for the company, it makes perfect sense.

After starting 2013 with a stock price of roughly $6.70, I wanted to find out just how Craft Brew Alliance was able to end the year trading at about $16.50. In today’s beer business world, the answer wasn’t utterly surprising, but it does offer a great peek into how this brewer may be taking up more shelf space at your local grocery store and bottle shop.

While you may not be intimately familiar with the name Craft Brew Alliance, you’re probably familiar with its brands – Kona, Redhook, Widmer and the gluten-free Omission. Despite its name, the brewer isn’t considered “craft” under Brewers Association standards because a third of the company is owned by AB InBev, essentially so Craft Brew Alliance [CBA] can utilize AB InBev’s monstrous distribution network.

That’s a big part of what made CBA a success in 2013 and what will help them beyond. Another aspect? Their brand selection.

Widmer Brothers

Naturally, hops play a big role in the expansion of Craft Brew’s brands. Widmer, suffering from slow sales declines, was slightly rejuvenated in 2013 after focusing less on “classic” brews like their hefeweizen, discontinuing their Drifter pale ale and shifting a third of their portfolio to IPAs, India pale lager or hop-forward pale ale. If you remove more seasonal-focused beers only sold in 22-ounce bombers, then hop-forward beers become half of what Widmer sells. A new IPA, Upheavel, is expected to launch in 2014 to take advantage of a category that went up more than 40 percent in sales last year.

Naturally, hops play a big role in the expansion of Craft Brew’s brands. Widmer, suffering from slow sales declines, was slightly rejuvenated in 2013 after focusing less on “classic” brews like their hefeweizen, discontinuing their Drifter pale ale and shifting a third of their portfolio to IPAs, India pale lager or hop-forward pale ale. If you remove more seasonal-focused beers only sold in 22-ounce bombers, then hop-forward beers become half of what Widmer sells. A new IPA, Upheavel, is expected to launch in 2014 to take advantage of a category that went up more than 40 percent in sales last year.

By diversifying a struggling brand, Craft Brew is taking an important step in today’s beer business – highlighting hops. Why is this important? Because “Widmer’s goal is to get the attention of hard-core craft beer consumers” and we know how craft beer enthusiasts love their India pale ale.

Whether or not you consider Craft Brew Alliance’s beers “crafty” or not, it’s clear the company is taking a proactive approach with Widmer Brothers in order to revitalize the brand:

It’s consistently rolled out new beer after new Widmer beer, rebranded old ones, redesigned packaging and charged higher prices.

“In the next 12 month period, we’re going to be brewing 23 different Widmer beers,” chairman Kurt Widmer said this week. That’s about twice what the brand produced only two years ago, said Joe Casey, Widmer’s senior director of brewing.

Part of the decline in Widmer sales is directly attributed to less interest in the brewer’s hefeweizen and discontinuation of Drifter pale ale, but Alchemy Ale – the new pale ale – now makes up 50 percent of Widmer’s gains.

What can you expect from Widmer going forward? A recent $3 million investment by Craft Brew Alliance into Widmer’s Portland, Ore. brewery will allow the brewer to make between 700,000 and 800,000 barrels annually, which would make Widmer a top-5 craft beer producer … if it were considered as such. Take this to mean there’s great potential to see more of Widmer brand beers in your local store, especially in 12-packs.

As Widmer focuses on the hoppier side of things for Craft Brew Alliance, we’ll next delve into how the company uses Redhook to expand its brand in a similar way Big Beer giants like AB InBev and MillerCoors try to attract drinkers.

Now you tell me: what are your thoughts on Widmer Brothers beers? Any you like? Hate?

+Bryan Roth

“Don’t drink to get drunk. Drink to enjoy life.” — Jack Kerouac