Last week I wrote a post about various indices of country-level environmental performance, which I prefaced with a caveat that the data are a few years old.

This week I’m going to discuss national indices of economic performance and prosperity. There are indeed some surprises.

But standard metrics of economic performance at the national level almost universally fail to encapsulate the sustainable economic prosperity of its citizens. One could, for example, simply list the ‘wealthiest’ nations according to simple economic turnover by employing the standard, but wholly unsatisfactory metrics of gross domestic product (GDP) and gross national income (GNI). Even most economists admit that GDP and GNI are dreadful measures of ‘wealth’, and the differences between them are largely immaterial.

Top 5 ‘wealthiest’ nations according to per-capita gross national income: Qatar, Macao, Singapore, Kuwait, Luxembourg.

It is probably easier to view GDP as a speedometer, for it measures the speed with which an economy is contributing to the generation of goods and services (i.e., economic turnover), but it does not measure the loss of biodiversity, ecosystem services, and other environmental assets such as forests and mined resources, it does not measure the build-up of greenhouse gases or hormone-mimicking toxic chemicals, nor does it take depreciation of physical capital in our society’s infrastructure in account. As it turns out, GDP actually rises following environmental disasters such as a major oil spill because of the jobs created to clean up the mess, but it does not measure in any way the economic advantage of growing produce in your garden because the goods are not ‘traded’ in the standard market.

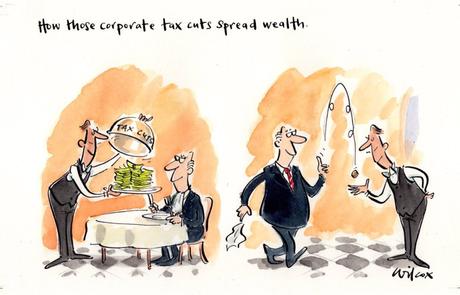

Nor does GDP account for the disparity in wealth among a nation’s citizens, so even though most people might be poor, the existence of even a handful of billionaires can in fact raise a country’s GDP. The GDP metric is so unappealing that even the World Bank has tried to come up with better ways to measure wealth. Although it still falls short of measuring true wealth, ‘total wealth’ — measured as the present (discounted) value of future consumption that is ‘sustainable’ — tries to take into account a country’s present wealth minus damage to its non-renewable stock that is currently being exploited unsustainably (e.g., forests). As such, economic policies based on total wealth would be better able to ensure the long-term sustainability of a nation by including the ‘stock’ of existing capital that includes natural capital.

Top 5 ‘wealthiest’ nations according to per-capita total wealth: Norway, Qatar, Switzerland, Luxembourg, Kuwait.

Another metric that could (and perhaps should) replace the GDP is the Genuine Progress Indicator (GPI), which uses the base data to calculate GDP, but then adjusts them with other components ignored by the GDP, such as environmental costs, crime, income distribution, pollution, and volunteer work. As such, the GPI is a better approximation of sustainable economic welfare. Unfortunately, it has been calculated for only 17 countries so far, so it is not terribly useful for our purposes here.

If we could replace the GDP-growth mantra touted by politicians and media personalities, and get them instead to focus on measuring this metric of wealth in their reports or speeches, we might have a better way forward for measuring a nation’s real prosperity. Alas, we must rely on a battery of other, less-satisfactory metrics instead.

Having money is one thing, but if you owe more than you earn, eventually your bank account will run dry. The house-mortgage conundrum provides a perfect example. If you live in a big, beautiful house, but had to borrow a lot of money from the bank to buy it, then in reality your true wealth is substantially lower than someone who has a lower salary, but owes much less. The same applies to nations in that almost all countries today owe some money to others. While ultimately all ‘assets’ — what we use to measure wealth — at the global scale are equal to total ‘liabilities’ (debt), not all assets are measured in terms of money. Thus, worldwide debt is in fact much higher than the amount of money flowing among countries at any given time.

Still, most governments today try to avoid becoming too indebted to other nations. In general, the wealthier a nation, the more debt it acquires, so we should ideally express total debt as a function of total economic turnover. According to the CIA World Factbook13, four countries have zero debt (Andorra, Brunei, Liechtenstein, Macao); however, let’s ignore these for the moment and report the non-zero debt countries. Accordingly, the country with the lowest debt relative to GDP15 is Turkmenistan (followed by Iran, Algeria, Equatorial Guinea, and Nigeria), whereas the largest relative debt is recorded by Palau, followed by Luxembourg. The USA ranks 158th (out of 186 countries with data), and Australia ranks 161st.

The Legatum Prosperity Index is another composite index that attempts to translate ‘wealth’ (how many assets a country has) with ‘prosperity’ (how that wealth translates into the well-being of the populace). It an index that includes health, social welfare, environmental, and other components. According to the 2017 Prosperity Index, Sweden is ranked highest in the world for economic quality, whereas according to the business environment indicator, the USA comes out in the number one position.

While not strictly an ‘economic’ indicator, the Prosperity Index also measures and ranks countries according to their social capital, which is defined as “the strength of personal relationships, social network support, social norms, and civic participation in a country”. According to this indicator, Australia is listed currently in the number one position, followed by New Zealand.

Income distribution, or ‘economic inequality’ is most often measured using the Gini coefficient, with low scores indicating that a country’s wealth is more evenly spread among its citizens, and high scores meaning that few individuals possess most of a nation’s wealth. While the Gini index is not necessarily the ideal measure of wealth distribution (indeed, there are many different ways to calculate income distribution within a region or country), it is a reasonable index of the number of poor versus wealthy people.

Apart from wealthy Sweden that comes in sixth worldwide for most equitable distribution of wealth among nations, most of the lowest-scoring countries using the Gini index are not the ‘wealthiest’ — Azerbaijan comes in as the nation with the most equal distribution of wealth among its citizens (followed by Slovenia, Ukraine [although probably not today], Czechia, and Slovakia). The nation with the most skewed distribution of its wealth toward the rich is South Africa.

Another way to think about wealth distribution is to consider the poorest people in each country, and the proportion of the nation’s total wealth that they hold. Indeed, one way perhaps to view a fair distribution of wealth is therefore the number of poor people relative to the cost of living within that particular nation.

The first metric in this regard is a simple one — what proportion of a nation’s income is shared by the poorest 10% of the population. Here, Azerbaijan again takes the lead (followed by Ukraine, Burundi, Kazakhstan, and Pakistan), and Venezuela takes the least-coveted position as having the relatively poorest of the poor.

But this metric ignores the so-called ‘poverty gap’ — the mean shortfall of wealth from each nation’s nominated poverty line — that is, how far below the line are the poor on average. Here, the ‘non-poor’ (i.e., the wealthiest) have a zero shortfall. This particular metric therefore indicates both the depth of a nation’s poverty as well as its incidence: Mexico has the smallest poverty gap among nations (followed by Malaysia, Russia, Kazakhstan, and Montenegro), and Honduras has the largest.

Finally, wealth per se might not always (in fact, probably rarely) translate to future sustainability, resilience, and the innovation this requires. Thus, the Global Innovation Index aims to capture the multi-dimensional facets of innovation for 130 economies, which represent 93% of the world’s population and 98% of global gross domestic product. Based on 80 indicators that measure human capital development and research, development funding, university performance, and international dimensions of patent applications, the Global Innovation Index essentially measures a nation’s innovation capacity both locally and how it impacts the globe.

According to this metric, Switzerland ranks the highest, followed by Sweden, United Kingdom, USA, and Finland. Of course, this index does not evaluate the results of the innovation — whether for example it produces safer, more effective medicines or more dangerous and less effective (in the long term) pesticides. Neither does it discount vast innovation producing more accurate triggers for nuclear weapons or better technologies for fracking.

From all of these metrics one thing emerges clearly — no one nation can boast the best economic situation because it depends entirely from what angle we view the country’s performance.

CJA Bradshaw