The Ethereum merge is a big milestone for the ETH cryptocurrency. It’s expected to occur between 10-20 September 2022, and it will mark the transition from its current Proof of Work (PoW) consensus mechanism based on mining into the Proof Of Stake (PoS) mechanism based on cold staking.

This move could very well be one if not the most significant events in Ethereum’s original roadmap. The community consensus is on the side of the PoS chain but the exact implications of the event are still unknown.

Here’s where you can trade on the potential outcomes of the ETH Merge event.

Phemex has the most straightforward ETH Merge market

Phemex is one of the exchanges that runs an ETH merge prediction market.

In their Merge Pool you can bet whether or not the ETH prices will increase exactly 1 week after the Merge. The data will be taken from the block that is exactly 1 week post merge with prices taken from Coingecko.

Phemex made the merge prediction market dead simple. It’s a simple either-or.

This is how the merge prediction market works:

- You deposit some amount of USDT to it, either to the bullish or the bearish side.

- User wagers contribute to the total size of the market pool.

- Your USDT gets you a number of shares in the market.

- If you wagered on the right side of history, you will be one of the winners.

- Winners will split the total pool in proportion to their number of shares.

The oldest method in the book, and why not if it works.

Here’s one note worth sharing, you can only bet on one side of the market, sub-accounts are banned from participating and any form of cheating will get you disqualified. The other note worth sharing is that Phemex is a no-KYC exchange.

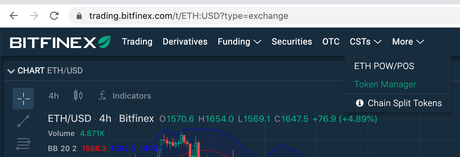

Bitfinex launches chain-split tokens for ETH Merge

Bitfinex is taking a more complex route that leaves more options for traders. Users can generate chain-split tokens (CST) and trade them until they expire at the consummation of the Merge or at the end of 2022, whichever comes first.

The CSTs on Bitfinex are derivative tokens that will allow you to trade on the potential fork event in Ethereum’s consensus protocol. Trading in derivatives on Bitfinex is only available to at least intermediate KYC’d users in eligible jurisdictions.

The chain split would happen in case a canonical PoW blockchain would emerge along the PoS one. In theory, these two could keep existing side-by-side like ETH and ETC or BTC and BCH.

How the Bitfinex CST tokens work

To take part in the ETH Merge markets on Bitfinex, you can generate CST tokens in the Token Manager tool by spending ETH. The tool will generate an equal amount of ETHW and ETHS (PoW and PoS derivative tokens) which you then can trade to reach your desired ratio.

The Chain Split Tokens will trade against USDt, USD and ETH as pairs: ETHS/USDt and ETHW/USDt, ETHS/USD and ETHW/USD and ETHS/ETH and ETHW/ETH. Leverage will not be available.

The tokens will expire once the Merge is consummated or at the end of the year in case that never happens. At expiry, users will be either credited ETH in exchange for the respective token in case only a single consensus chain emerges. Else they will be granted the proportional amounts of tokens of each chain.

The tokens are redeemable back for ETH at any time in case you want to exit before the tokens expire.

Go to Bitfinex

Bitfinex is launching quite a unique market, most exchanges didn’t rush into considering the possibility of a chain split.

Even FTX announced that they will implicitly support the PoS chain in the event of a chain split, but would credit users with the PoW fork as well.

The Australian Independent Reserve on the other hand announced that they would not even credit the PoW fork and users should withdraw in case they would want that token.