Today we have a guest post by Chillznday, owner of Chronohistoria.com. He has a background in hedge funds and will provide an overview on how they work and who might wish to invest in them. Be sure to check out his site!

What is a Hedge Fund

What is a Hedge Fund

(Note, this site contains affiliate links. As an Amazon Associate I earn from qualifying purchases. When you click on an affiliate link and buy something, The Small Investor will get a small commission for the referral. You are charged nothing extra for the purchase. This helps keep The Small Investor going and free. I don’t recommend any products I do not fully support. If you would like to help but don’t see anything you need, feel free to visit Amazon through this link and buy whatever you wish. The Small Investor will get a small commission when you do, again at no cost to you.)

Hedge funds in many ways are the wild west of the investing world. Due to this many investors fail to understand their purpose. For many retail investors hedge funds exist in a shadowy investment realm where they are falsely mislabeled as a bad thing. This article serves to correct some of those misconceptions.

The average retail investor should be aware of hedge funds. Simply by knowing how they operate you can mimic some of their investment methodologies for yourself. For example, every single investment management firm with an AUM (Assets Under Management) of $100 million in the U.S must submit a 13F report quarterly.

Retail investors who are knowledgeable about hedge funds can read these reports to “piece together” successful investment methodologies. For that reason alone, this article serves as a vital starting point for those who wish to increase their yearly ROI. This article outlines the definition of a hedge fund and its purpose, who can invest in them, their fees and returns, some examples of good funds, and if they are even worth it.

I’m pleased to announce the my new mini-book, Mutual Fund Sample Portfolios. Many times people are told to invest, but really don’t know how to select the funds for that portfolio. Wouldn’t it be great to have examples to look at for guidance that you could tweak and adjust for your own personal needs? This new e-book provides sample portfolios for goals like investing for retirement, saving for college, or saving up for an expense like a big vacation or a new pool. More than that, for long-range goals the methodology to manage that portfolio and adjust things as you get nearer to the goal is explained. For example, what to do when you first start a 401k, then what to do when you are 20, 10, and two years out from retiring and needing to use the money. And at only about 40 printed pages in length, it is something you could read through in a couple of hours, then refer back to as needed.

What Is A Hedge Fund And Its Purpose

A hedge fund is simply an investment vehicle where investors pool their assets together. These funds will then take these assets and invest them in a way to either decrease risk or increase capital. In order to do this hedge funds will typically employ a repeatable investment methodology/strategy.

Both mutual funds and hedge funds pool their investors’ capital. However unlike a mutual fund a hedge fund has more leeway in how it invests. A hedge fund is allowed to use leverage and speculative investing practices to obtain above average returns or limit risk. These include strategies such as short-selling, naked options contracts, and other highly risky methodologies.(source)

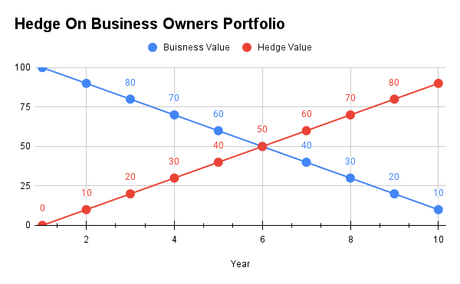

Hedge funds have existed in various forms since the 18th century. One of the oldest,Man Group PLC, has existed since 1783. The term “hedge” comes from a hedge that surrounds and protects an estate from fires, vandalism, or other dangers. During the early 20th century these hedge funds were designed to “hedge” a business owner’s portfolio.

Don’t Forget Gifts for Dogs, Cats and Other Pets

This was done by taking the client’s business model and inversing its potential market cap by investing in other assets that would climb in value should the business owner’s business fail. Here portfolio managers and their teams provided a valuable service, to keep their clients assets protected.

From the above image we can see the initial purpose of a hedge fund. During the 19th and 20th centuries hedge funds were firms designed to help a business owner diversify their total portfolio.

Nowadays the definition has changed. Starting in the 1980’s hedge funds started to advertise to their clients larger than normal returns. This was done through a combination of investment methodologies. The purpose was to attract high net worth clients by promising that the fund could capture more upside.(source)

Who Can Invest In Hedge Funds?

There are only two types of entities that can invest in hedge funds; Institutional investors and accredited investors. This is because the world of hedge funds is incredibly risky. The regulatory agencies such as the SEC want to see either enough capital or knowledge to either weather the risk or adequately understand the investment methodologies.(source)

Institutional investors are entities that pool investors capital to invest with. These are banks, hedge funds, central banks, credit unions, governments, and wealth management firms. Institutional investors are a majority of the current AUM in the funds. This is because each fund employs a set methodology to exploit a select sector or investment type.(source for institutional AUM increasing)

The other type of investor allowed to invest in hedge funds are accredited investors. These are individual people who either have an income that exceeds $200,000 ($300,000 for couples), have a net worth of $1,000,000 (not including primary residence), or hold a series 7, 65, or 82 license.(source)

For the longest time accredited investors were the primary investor in hedge funds. However since the mid 2000’s this has started to change. Primarily for two reasons. First, during times of recession AUM of accredited investors typically flee hedge funds for more conservative investments. Second, high net worth individuals have begun to gravitate more toward private equity firms who can offer less risk in a portfolio.

Expected Hedge Fund Fees and Returns

Every single hedge fund in the world runs differently. This includes their fee structure as well as their historical returns. What follows is the industry average fee and historically expected returns. However while these might be the average, in reality there are extreme outliers on both ends.

Hedge Fund Fees

The traditional fee structure for hedge funds is what’s called a “2&20.”(source)

The first part of the “2%20” is the 2% management fee. This means that every year a client will pay upfront 2% of their total investment as a management fee. As you might expect this number can snowball pretty fast. Some of the larger funds will make several millions per year just for managing the assets, regardless of performance. Smaller funds on the other hand will use this 2% fee just to keep the lights on.

The second part of the “2&20” is the 20% performance fee. How this number is calculated depends upon the fund in question. If a fund can beat a set benchmark (17% per year for example) as well as maintain a positive yearly cash flow then the fund will take 20% of the ROI after the benchmark.

Drinkmate: The Carbonate Anything Drink Maker

This 20% is where funds make the real money. It’s not uncommon for a quarterly bonus for a good manager to be well above $300,000 for even a small portfolio ($5-$10 million). For the larger firms with AUM in the billions their most successful managers will see bonuses of $1-10 million quarterly.

No manager works in a void however, they are often supported by a team of people. Even the most junior of analysts at a small firm on a good year might see a bonus of $30-$50k.

Most of the time clients are more than happy to pay these extremely high fees. That’s because the returns they get far eclipse them.

Hedge Fund Returns

There is no set industry standard on expected yearly returns on investment. Because hedge funds invest in high risk or abstract investment methodologies the returns tend to be all over the place.

A majority of hedge funds end up closing their doors. They don’t return anything for their clients and end up wasting millions of dollars. One prime example of this would be the Tampa Bay firm OptionSellers.

OptionSellers’s employed the risky strategy of selling far OTM options contracts on predictable assets. Normally this type of methodology results in around 25-30% ROI per year but comes with well above a 100% risk. On November 14th, 2019, OptionSellers lost 100% of its AUM when Oil futures dropped in price exercising their sold contracts.(source)

However, some funds see massive returns per year. Renaissance Technologies’s Golden Medallion Fund for example has seen annualized returns of 66% over the past 30 years.(source)

There is no set standard for hedge fund returns. What potential investors need to look at is what is the historical return for their fund as well as what is the historically expected risk.

Some Examples of Good Hedge Funds And Their Methodologies

Of the nearly3,700 hedge funds in the U.S there are only a handful that make the list of a good hedge fund. Below is a list of 3 funds, their investment methodologies, and their historically expected returns.

“Quant” Hedge Fund: Renaissance Technologies

A quant hedge fund is a very loose definition. Essentially anyone who employs computer algorithms to automatically trade assets can be defined as a quant hedge fund. The best one in this category is easilyRenaissance Technologies.

- Methodology:High Frequency Trading

- Owner:Jim Simmons

- Average Return: 66% on medallion fund

- AUM:$165 Billion

Renaissance Technologies is a pioneering firm in the markets. In many ways Jim Simmons changed the way that modern day trading/investing is performed.

Want all the details on using Investing to grow financially Independent? Try The SmallIvy Book of Investing.

Global/Macro Hedge Fund: BridgeWater Associates

A global/macro fund employs grand theory and strategy to position investments to profit from global changes. These can be environmental, social, political, or technological. There are a couple really good ones but the most recognizable one here is Bridgewater Associates.

- Methodology:Global Macro Investing

- Owner:Ray Dalio

- Average Return:11.5%

- AUM:$140 Billion

BridgeWater is the real deal. They employ a fleet of academics who do nothing but talk about investing theory all day. It’s not uncommon for BridgeWater to plan investments out several years in advance and like a chess player watch all the pieces fall into place.

Activist Investor: Elliott Management

An activist investor is someone who places a trade and then goes and forces it to work in their favor. These types of firms will buy out companies, replace board members, or really anything to sway the invisible hand of the market. Easily the best activist investor hedge fund isElliot Management.

- Methodology:Activist investor

- Owner:Paul Singer

- Average Return:13.1%

- AUM:$48 Billion

Elliot Management has routinely beaten expectations with their flavor of activist investing. This is one the main reasons that their AUM has been swelling as of late.

Are Hedge Funds Worth It?

For the general retail investor the answer is no. The average person can expect a return of around 9-10% per year just from large ETFs. Factor that in with compounding interest and you can have a sizable portfolio after a while.

However if you can become an accredited investor and have the necessary capital to open an account with one of the more successful funds then the answer is a yes. Potential clients need to do their homework however. Not all hedge funds are created equally and not all good funds will fit within your portfolio.

If you can find a good fund and manager then they are worth their weight in gold. You will earn far more than an average investor overtime. Finding the right talent is hard, the skills required to be a good investor and generate alpha in portfolios is rare. Because of this funds have a hard time finding and keeping talent before they are scoped up by the larger more established funds.

As such, if you’re thinking about going with a hedge fund you need to ask yourself three things. First, Does this fund have a solid history of good returns and managed risk? Second, can they beat what I can do on my own with ETFs? Third, do they have the necessary talent to continue to do so?

You will suddenly find that locating a good hedge fund like this is like finding a needle in a haystack. Because of this for 99% of people, hedge funds are simply not worth the effort.

Have a burning investing question you’d like answered? Please send to [email protected] or leave in a comment.

Disclaimer: This blog is not meant to give financial planning or tax advice. It gives general information on investment strategy, picking stocks, and generally managing money to build wealth. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. Tax advice should be sought from a CPA. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.