A cash flow forecast is a report which shows how much money a business expects to receive (cash inflow) and pay out (cash outflow) during a given period of time.

Knowing your cash flow situation now and in the future is a key part of managing a business. While it's hard to predict exactly what your bank balance will look like in several months, a cash flow forecast allows you to make an educated guess.

For small businesses this type of financial forecasting is done either as a 12 month forecast or as a rolling 13 weeks forecast for those that want better liquidity planning.

When it comes to forecast duration there isn't a one size fits all. Larger companies may use longer periods while others shorter ones or even mixed forecasts.

The important part to remember is that the longer the forecast the less detailed it will be. So you will have to choose between availability of information and duration.

Positive and negative cash flow

Before diving deeper into creating cash forecasts it's important to understand the notion of positive and negative cash flow.

Positive cash flow is when a business expects to receive more cash than it spends. In other words, you are said to be "cash flow positive" when your business receives more cash than it spends. This leads to a cash surplus which can be used to further grow the business.

If the business expects to spend more than it makes, this is called "negative cash flow." All businesses should strive towards positive cashflow.

This helps your business remain in good financial health and have the necessary resources to navigate market downturns or take advantage of new opportunities

Why use a cash flow forecast

For a large number of small businesses, one late payment means their bank account balance will take a nosedive in the red. Most business owners don't have the slightest idea what their cash balance is at any point time and that can mean trouble if things don't go as planned.

Instead, by being proactive and forecasting your cash flow you'll know exactly how much you need in the future. Cash flow planning can be useful to predict cash surpluses or shortages so you can make better strategic business decisions. For example:

- Better prepare for seasonal fluctuations by using your cash flow forecast to know how much you'll need to set aside for expenses during slower months.

- If you plan to apply for a loan you'll need to come prepared and demonstrate lenders you have the necessary funds to make loan repayments.

- Get a clear picture of the effect of planned business changes. If you plan on hiring or acquiring equipment you can immediately see the impact on your cash balance.

- Spot shortages before they become a major problem and create a safety net to cover any unexpected expense that arises.

- Run multiple scenarios with best or worst case to see how your business would cope and if you need to borrow to avoid liquidity issues.

- Answer questions like, can I expand into new territories or can I invest in new products and services.

Ultimately an accurate forecast allows you to understand the impact of future plans and the possible outcomes.

Why is a cash flow forecast important

Poor cash flow management is a common accounting problem. A survey of small business failures in the US shows that 82% were due to poor understanding or lack of cash flow management. The situation is no different in the UK.

Cash flow is the lifeblood of any business, "cash is king" as they say. Knowing what is flowing in and flowing out at all times could mean the difference between your business doors being open or closed.

Having a firm understanding of your business' cash position and having the right financial information is essential to the success of your company. Without knowing the expected incomings and outgoings, businesses are flying blind when making financial decisions.

Cash flow planning gives you the insight you need to make the right changes before it's too late. With a cashflow forecast, you can see any potential shortfalls early on and rectify the problem before the business suffers. It is an integral part of good financial management.

How are cash flow forecasts calculated?

A cash forecast is the net balance of your starting cash plus your projected inflows minus your projected outflows.

Cash Flow Forecast = Starting Cash + Projected Inflows - Projected Outflows = Ending CashBecause it's a forecast it must use a variety of data sources to be accurate and as mentioned previously the longer into the future you want to predict the harder it's going to be. That's because it's much harder to make accurate estimates about far future transactions.

However, if you keep your cash forecast updated often that shouldn't be a problem and you'll still get a good idea if you're on the right track to a surplus of cash or if you need to steer the boat into a different direction.

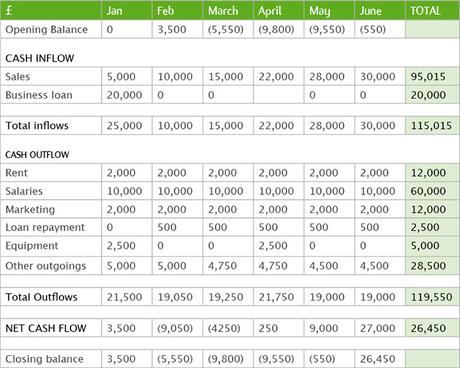

Example of a cash flow forecast source: Cashsolv

Step one: Find out your starting cash balance

Step one in making a cash forecast is to find out how much cash on hand you have today.

The easiest way to do this is by looking at your current Cash Flow Statement and getting your closing balance.

Most cloud accounting software have an option for you to get these types of reports, if not you will have to make one or get your accountant to make one for you.

Step two: Calculate projected income (Inflows)

Your projected inflow is the cash you plan to receive during the specific period, be it month or week. Cash inflows come from the following 3 categories:

- Operating Activities (Sales)

- Investing Activities (Interest received)

- Financing Activities (Loans)

Don't worry, we'll cover these more in detail in the next section.

Step three: Calculate projected expenses (Outflows)

Your outflow are all the payments and expenses you plan to make in the given period.

These are things like salaries, National Insurance, bills that come due, Corporation Tax payments, rent and others.

What to include in a cash flow forecast

Broadly, a cash flow forecast should cover anything involving a movement of cash, but what exactly needs to be included in a forecast? Here is a small list of the most common items to include in a cash flow forecast.

Cash inflows to include

Expected sales

To get your expected sales you'll want to create a sales forecast or review your previous year's sales figures as a starting point in your estimate.

To make your sales forecast more accurate look at your CRM to find out how many deals you have in your sales pipeline as well as your close rate. In addition, consider last year's growth, planned marketing initiatives and economic factors.

If you make sales on credit or don't get paid right away, only include what you plan to collect in that period as well as payments from accounts receivable.

Bank Loans or sale of company shares

If you plan to borrow money from a bank, a private lender or a friend that means your business will receive an inflow of cash. The same holds true if you sell company shares to investors as part of your financing activities.

Interest

If your company has made investments or has savings that generate interest they would be considered an inflow.

Other sources of income

In some cases your company may have other sources of income which should be included such as: royalties, licensing agreements or dividends from a subsidiary.

Cash outflows to include

Projected Expenses

Expenses are the fixed and variable costs incurred by the business regardless of sales. This may be easier to estimate by looking at last year's profit and loss statement.

Examples of expenses include office rent, salaries, marketing and cost of sales. Cost of sales refers specifically to the costs incurred to produce goods or services such as raw materials.

In some cases, if you are not paying upfront for your expenses, you will need to factor payments for your accounts payable as well.

Investments and purchases

If you plan to make business investments such as renovating your offices, expanding your wharehouse or purchasing equipment these should be included as part of your cash outflows.

Debt repayment

Any loan repayment you make on a monthly basis is considered an outflow.

Taxes and other outings

Taxes more often than not are going to be an outflow resulting from covering your tax liabilities. In somes cases, if the company lost money it could be an inflow, so keep in mind taxes can be both.

As far as other outings go, you should go over your income statement once more as well as other accounting reports to identify if you tend to have other unexpected cash outflows you may be able to predict. Think company van breaking down or attending a new conference.

Get help with your cash flow forecast

Creating a cash flow forecast is much simpler with the use of online accounting software.

Dedicated cash flow management platforms like Float or Futrli allow you to create accurate and up-to date cash flow forecasts and cash flow statements effortlessly by connecting directly to your financial data.

Besides, you can get extra insights and AI powered advice to improve your financial position. So you'll be saving time and getting better at managing your cash flow.

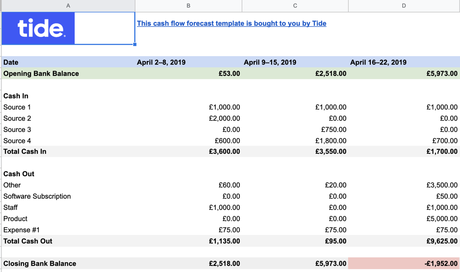

Alternatively, if you rather do it all yourself you can use a free template like the one below by downloading it here

Rather not create your own cash flow forecasts?

BrooksCity Chartered Accountants can provide you with the right expertise and knowledge to help you better manage your business cash flow.

We can create an initial cash forecast for your company, provide recommendations and help you make sense of the numbers.

We've helped hundreds of business owners just like you stay in control of their finances, grow profits and build a safety cushion. Talk to one of our London accountants today by requesting a quote here and let's grow your business together.