For years, craft breweries have played off the myth and ethos of being small, whether a single person creating one-barrel batches at a time or a national powerhouse like Sam Adams. This has become more evident in recent weeks with the creation of the Brewers Association "independent" seal, meant to convey the ideals of the trade group in a literal way.

Non-AB InBev of Molson Coors breweries are now "small and independent," two words tied together, not necessarily "craft." But what some of these businesses are finding is that "small" in theme doesn't mean the same in practice.

The future of beer is small and local or big and aggressive. This is no time for half measures.

- Jason Notte (@Notteham) August 17, 2017

On Aug. 10, New Belgium bought California's Magnolia Brewing along with minority investments from Belgium's Oud Beersel and former Elysian co-owner Dick Cantwell. The move saved the business from closure after a series of financial issues.

This was replicated in a similar fashion just a week later when San Diego's Green Flash, which already owns Alpine Beer Co. in addition to a production facility in Virginia Beach, announced it was opening another space - in Lincoln, Nebraska.

The kicker here is how they're doing it. Like New Belgium, Green Flash is entering the market through another distressed business in Ploughshare Brewing.

Founder Matt Stinchfield, who also as the Brewers Association's safety ambassador, announced in July that Ploughshare wouldn't continue after three years in business. In to the describing Lincoln Journal-Star the challenges he faced, he noted the brewery's construction was over budget, pushing debt deeper than anticipated from the get-go. When sales didn't line up with expectations, it became clear the business wouldn't be sustainable.

With Green Flash's latest example, along with other announced entries into new markets over the past year or so, it seems that the "small" craft breweries are starting to realize the financial impact of branching out. Even as they stay within a thematic ethos of who they're supposed to be as a small/independent/craft producer, the growing reality for the business sector of the beer industry is it makes sense to be anything but.

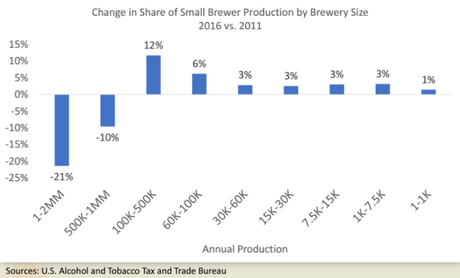

For years, the trend in size and production has been skewing small on a literal basis. By virtue of the number of startup breweries, there has to be a majority who are producing smaller quantities for (in theory) smaller and/or more niche groups of customers. It's the whole "local" aspect of food and drink. According to figures tracked by the TTB, almost three-quarters of U.S. brewers produced under 1,000 barrels in 2016. If every single one of those businesses maxed out to a level of 1,000 barrels, they'd still only combine to make roughly the same amount of beer as Yuengling.

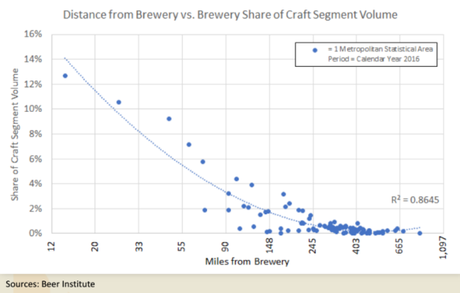

Both culturally and financially, it simply makes good sense to focus on ways to engage segmented markets, even if you're creating one out of nothing. There is a quantifiable affinity for your city/town/neighborhood brewery.

There is, of course, much more to it than that.

As noted by the West Coaster , Green Flash will begin its brewing in Nebraska as the largest production company in the state, starting out with a capacity for 10,000 barrels. Up until this point, Zipline Brewing was the largest brewer in Lincoln, making about 8,000 barrels a year. In addition to a competitive size of production, Green Flash is also taking over a 2,000-square foot restaurant, providing a reason for people to come for more than beer.

This works in a "two birds, one stone" kind of way. In a 2016 joint survey between the Brewers Association and Nielsen, 60% of craft drinkers said they "purchased a lot/little more" of a brewer's products after visiting a brewery. So not only is Green Flash establishing a physical presence, but it's high level of production also provides an ability to enter the off-premise market strong, ensuring that customers will be able to find Green Flash beers wherever they might shop. This falls perfectly in line with another recent move by the company, which is entering 1,000 convenience stores across California, Texas and Virginia as a way to find new locations for its products and specifically the brewery's GFB golden ale, an ideal brand and style to attract new drinkers.

This kind of tactic has been picking up steam quickly, although perhaps most notably by Craft Brew Alliance, which has long relied on geographical segmentation of its partner breweries for years. While the company uses a strategy that places Kona Brewing's beer as its "national" brand, it has shifted focus of Widmer Brothers and Redhook to their home states of Oregon and Washington, respectively, as well as found ways to quickly grow Cisco Brewers (Massachusetts) and Appalachian Mountain Brewery (North Carolina). "We really are picking our battles," CEO Andy Thomas told Brewbound .

In Chicago alone, Jolly Pumpkin is opening an outpost . Ballast Point, . Lagunitas has been there for four years.

If there is fear of a bubble or "shakeout," ( there shouldn't be ) instances like New Belgium, Green Flash and others like Oskar Blues/Fireman Capital show that there is some kind of safety net for those that might be impacted ... and it's the larger small/independent/craft companies that are happy to help, especially as they become more susceptible to a slowdown in sales .

The idea of growing big enough to hold a region - let alone space nationally - truly feels like a decades-old proposition. Small in scope and business is where today's success lies, which is why we're seeing these bigger businesses feeling more comfortable altering their course to follow the newer direction in which the industry is heading.

For all the shifting business models that must now be considered, what does "small" mean moving forward?

Bryan Roth

"Don't drink to get drunk. Drink to enjoy life." - Jack Kerouac