So, you’ve just started work and were handed a pile full of paperwork by your HR department. They tell you that they need everything back by Wednesday. Going through the stack you find forms to provide your address and other personal information, health insurance sign-up forms, and a form for enrolling in a Health Reimbursement Account (a subject for a later article). Then you find the form for a strange thing called a “401k account.” Along with it is a thick book listing various investing choices, disclosures, and other information. You just got out of college a couple of months ago where all you needed to do was call Mom and Dad and let them know that your tuition was due. Suddenly they expect you to become, an investor?!

The bad news is, what you do within the first five years or so with your 401k will have a huge impact on how much money you have when you get ready to retire in 40 years. The good news is: 1) it’s really not that hard to do well, 2) you don’t need to do everything perfectly, 3) if you do mess things up, you just need to work a little harder for a while and make extra contributions to catch up. The other good news is that you’ll be able to find everything you need in this article to get you started. After that, start reading The Small Investor regularly and pick up a few books like The Bogleheads’ Guide to Investing

Sound like a plan? Let’s get started!

In this series of articles under the category of “The Basics of Money Management,” we’ll go through some of the basic things you need to know to be a fully functioning, financially fit adult in the modern world.

(Note, if you click on a link in this post and buy something from Amazon (even if you buy something different from where the link takes you), The Small Investor will receive a small commission from your purchase. This costs you nothing extra and is the way that we at The Small Investor are repaid for our hard work, bringing you this great content. It is a win-win for both of us since it keeps great advice coming to you (for free) and helps put food on the table for us. If you don’t want to buy something from Amazon or buy a book, how about at least telling your friends and family about our website as a great place to learn about investing and personal finance. Thanks!)

What is a 401k plan anyway?

A <a href="http://<a target="_blank" href="401(k)s">401(k)s" rel="nofollow">https://www.amazon.com/gp/product/0764554689/ref=as_li_tl?ie=UTF8&camp=1789&creative=9325&creativeASIN=0764554689&linkCode=as2&tag=smallivy20-20&linkId=3cb7fc0913ce95362cb69f5dc1a01e43">401(k)s For Dummies</a>

Just to make things a little more complicated, 401k plans now come in two types, Standard (or Traditional) and Roth. These both act the same and have the same investments. The only difference is how they are treated for taxes: With a traditional 401k, you don’t pay taxes when you put the money in, but are taxed on the money when you take it out. With a Roth 401k, you pay your regular income taxes on the money you put in, but when you take it out, all of the money is tax-free.

For about 85% of people, you’ll end up with more money in the end if you use a Roth. If you make “too much money” when you’re working, however, you won’t be allowed to use a Roth and will only have a Traditional 401k as a choice. Your company may not offer a Roth 401k as well, in which case you’ll be stuck with the Traditional. You can also have both types of accounts where you put some of your money in a Traditional 401k and some in a Roth 401k. You can even convert from a Traditional to a Roth later (but you’ll pay taxes on the money when you do.)

Want all the details on using Investing to grow financially Independent? Try The SmallIvy Book of Investing.

Free money! The company match

A big advantage of 401k plans is that most companies add money to your account in addition to your salary. A pretty standard plan will match the first 1 or 2% of your pay that you contribute, then maybe match half of the next 3 to 5% that you contribute. For example, if you make $50,000 per year and contribute 5% of your pay ($2500), your company may throw in another 3% (matching the first 1% contributed, then half of the next 4%, making a total of 3%). This means that you’re getting an extra $1500 per year for doing something that helps you anyway! If you don’t contribute, you don’t get the money, so you’re leaving money on the table if you don’t sign up. (Why, why, why would you do that?!)

Company matches vary. Some companies put money in whether you contribute or not. Others put some amount in, then add extra if you contribute. Some companies may put in company stock instead of cash (which you should sell as soon as you can since you don’t want to lose your job and see your 401k decimated at the same time should your company get into trouble). Some companies may not provide a match. During bad economic times when companies are just trying to survive, they might stop contributing (there is no requirement that they do, they only do so to keep good employees).

A little more about Roth and Traditional 401ks

With a Traditional 401k, you put money away before taxes. This means you’ll get a little more in your paycheck than you would if you didn’t contribute. Because it is reducing your effective income, you’ll be saving at your maximum tax rate. For example, if you’re in a 20% tax bracket and you contribute $5000, you’ll be saving $1000 in taxes. This means that it’s like Uncle Sam is helping you save for retirement.

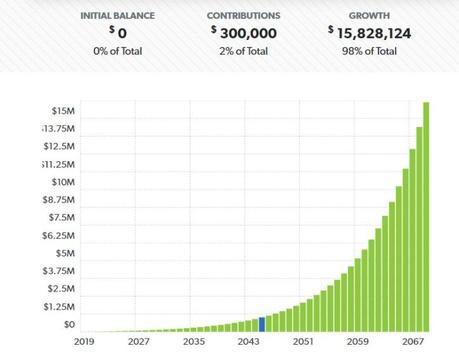

The bad news is that when you pull the money out, you’ll pay taxes then. If you do it right, you should have millions in your account at retirement. This means you’ll probably be pulling hundreds of thousands out at a time (you are required to start withdrawing a certain percentage each year once you reach 70 1/2 years old). This further means that you’ll probably be in a high tax bracket when you’re taking the money out (take a look at the chart above).

The other bad news (which is actually good news) is that you’ll pay a 10% penalty in addition to taxes on the money if you try to take it out before retirement age. This is a bad thing because it means your money is locked up. It is a good thing, however, in that you really, really don’t want to take your money out early. You see, every thousand dollars you contribute and when you’re 20 will be worth about $250,000 when you reach retirement age. Every $1000 invested when you’re 40 will only be worth $30,000. In fact, if you contribute from 20 to 35 and then stop, it really won’t affect your retirement savings that much. Wait until you’re 35 and then start contributing, however, and it will have a huge effect. Every time you cash out your account, beyond paying a penalty, you’re losing hundreds of thousands of dollars. Don’t do it!

Want to learn more about the power of compounding and how investing can make your financial life a whole lot better? Check out The Parable of the Pipeline:

With a Roth, you’re taxed when you put the money in. This means that you’d need to contribute $4000 instead of $5000 in our example above or find $1000 somewhere else so that you could still contribute the full amount. When you take it out, however, there are no taxes on either the money you put in or the earnings. Pull out $200,000, and you’ll get to keep $200,000. Pull out $200,000 from a Traditional 401k and you might lose $100,000 to taxes.

Roths have other advantages as well. A big one is that you are never forced to take money out. Instead, you can go ahead and leave it in the account, growing tax-free, if you don’t need the money when you’re retired. With a Traditional 401k you could reinvest the money in a taxable account once you took it out and paid the taxes on it if you did not need it right then, but you’d still need to pay taxes on your earnings from then on. With a Roth, you’re done with taxes. (Note, this is if they don’t change tax laws, which is a big if. Over that time they may decide to tax Roth withdrawals anyway, add an inheritance tax to them, or create a consumption tax where you would be paying taxes on the money when you spent it.)

Roths also allow you to withdraw your contributions at any time (but not the interest) without a penalty. You can also use Roth money to do things like buy a first home. Warning: This is a really bad idea for the reasons stated above. If you’re under desperate circumstances like you’ll be out on the street, tapping into your 401k might be necessary. Doing so will cost you hundreds of thousands of dollars, however, so don’t look at your 401k as a piggy bank, even if you can do so without a penalty.

Which is better, Traditional or Roth?

Mathematically, if you are in the same tax bracket when you put the money in as you are when you take it out, it doesn’t matter if you’re taxed when you put it in (like a Roth) or when you take it out (like a Traditional). If you’re in a higher bracket when you put it in, you’ll do better with a Traditional and vice-versa. Note that this assumes that you put less in the Roth because of taxes (for example, you put $5000 in a Traditional but only $4000 in a Roth because of the taxes). If you pay the taxes using other money and still put the same amount in a Roth as you would in a traditional, you’ll end up with more money from the Roth.

Most people will be in a higher tax bracket when they retire because they’ll have so much money built up in their 401k. (This is especially true if they follow The Small Investor and become experts on investing and money management. Hint, hint.) You also don’t know what tax rates will do over time, but they tend to go up. For this reason, a Roth is usually the better way to go. Again, though, tax rates can change and someone might decide in the future to start taxing Roth withdrawals, so you never know for sure.

How do I decide on a contribution amount?

One of the things you’ll need to decide on that 401k form, once you’ve chosen Roth or Traditional, is how much of your paycheck you want to contribute to your 401k. If you can afford it, put 15% of your paycheck away. Do this, and invest your money in a diversified set of investments (more on this later), and you won’t need to worry about having enough when you get to retirement.

If you can’t contribute 15%, see if you can contribute 10%. With an average company match, this will get you back up into the 15% range and you’ll still be golden. The reason not to just invest 10% and take advantage of the company match right off the bat is that sometimes companies stop matching. If this happens, you want to make sure you’re still putting away enough for retirement.

If you can’t contribute even 10%, try to contribute at least as much for which you get a company match. For example, if they provide matching funds up to 5% of your paycheck, try to contribute 5%. Otherwise, you’re leaving money on the table. See if you can eat lunch at your desk a few more days per week or bring coffee from home instead of stopping on the way in so that you can find some more money for retirement.

If you’re not putting away 15%, try this: Start by putting away what you can afford. After that, each time you get a raise, increase your 401k contributions by 1% or more. (If you get a big raise, you can jump up a lot more quickly.) Because this is not money that you’re using yet, it should be a lot less painful than trying to find money once you already have all of your money spent on things each month. If you can start contributing 15% right when you start a new job, however, it will be easiest since you haven’t put all of your paycheck into buying other things yet.

How do I select investments?

Most of the time you’ll be putting your money into mutual funds from a list provided by your company. Once you’ve signed up for the plan, you’ll need to direct where your funds should be invested. Normally you assign this by percentages. For example, you might direct that 20% go to Fund A, 40% go to Fund B, and 40% go to Fund C. With each paycheck, a corresponding amount would be invested in each of the funds. (You can also go in later and shift money around among the funds, or even add or remove funds, but we won’t get into that now.)

All plans are different, so it is difficult to write an article covering everyone. Still, there are some general guidelines that you can use when choosing investments. You can also check out these articles on The Master Portfolio and Adjusting the Master Portfolio for the Millenial Investor to see some basic portfolios. Let’s go through these guidelines:

- Do not put all (or even a substantial amount) of your money into the money market fund. This is like a bank account where you receive interest payments. It might seem like a safe place for your money, but the interest you receive will always be a little less than inflation. This means you are actually losing 1-2% each year even if the account balance is increasing. Over 40 years, you’ll actually lose about half of the money you put in at the start. You should really not have any money in this type of investment for any length of time unless you’re retiring within a year or two.

- Spread your money out among different types of investments. Buying different types of investments means that you’ll always be invested in whatever is doing well at the moment. Over time, this will make your returns a lot better than they would be if you plop it all down into one place. Stocks are divided into categories like Large and Small, or Value and Growth. You’ll want to divide money up among these different categories. (Note that you can buy Large and Small, or Value and Growth, but there is no reason to buy all four since they’ll overlap.) You may also want to put a smallish percentage (like 15%) into REITs, which invest in real estate, and also about 20-25% of your money should go into an international stock fund, which invests outside of the US. Check out the article, The Master Portfolio and the 401k investing section of FIREd by Fifty: How to Create the Cash Flow You Need to Retire Earlyfor ideas.

3. Buy index funds, which are low in cost. All funds charge a fee each year which is based on the amount you have invested. Managed funds, where there is a fund manager making investment decisions, typically charge 1.5% or more, meaning you’ll pay $1500 each year for each $10,000 you have invested. Index funds, where the fund buys a fixed set of stocks, typically have fees of 0.25% or less. This means they cost less than $250 per year per $10,000 invested. Studies have shown that index funds do better than managed funds after fees are included. You should, therefore, use index funds whenever they are available. One of the only reason to use a managed fund is if it is your only choice for a category. The other place where a managed fund may be worth it is an international fund, since there, manager selections may be better than just buying the broad market.

4. Bonds make things smoother, but at a cost. Buying bonds and income funds will smooth things out. When the stock market takes a dive, bonds funds may not go down as far or even go up. Another way to think of it is that stocks makes your portfolio grow, but bonds help you keep the money you’ve earned. The only issue with bonds is that they don’t perform as well as stocks over long periods of time, so you’ll do better being in all stocks when invested for 30 years, say, than 50% stocks and 50% bonds.

When you are young and have a long time until retirement, you really don’t need to have any bonds if, and this is a big if, you are willing to accept big moves down in your portfolio from time to time. Expect to see your portfolio go down by 40% or more about every ten to fifteen years. If you can get yourself realize that your portfolio doubled or quadrupled before that happened, so that you’re really only temporarily giving back some gains, or that it will recover (typically within a year or two) to where it was and continue upwards, so that you don’t get freaked out, you might want to be in all stocks until you are within 15 years of retirement or so. If you can’t take the oscillations, however, put between 10 and 25% of your portfolio into a bond fund. You’ll hate it when the markets are rising, but love it when they fall.

5. Consider a target-date portfolio. A target-date portfolio takes care of your investment selections for you. They also automatically adjust the ratio of stocks and bonds that you have to be appropriate depending on how long you have until retirement. This means that they will oscillate a lot like an all-stock portfolio when you’re in your 20’s, 30’s, and part of your 40’s, but start to calm down after that. Think of it like having an automatic car, where you give up a little bit of performance to not need to worry about shifting things around. Having fine control is great when you know what you’re doing, but you might shift at the wrong time and break the transmission if you don’t.

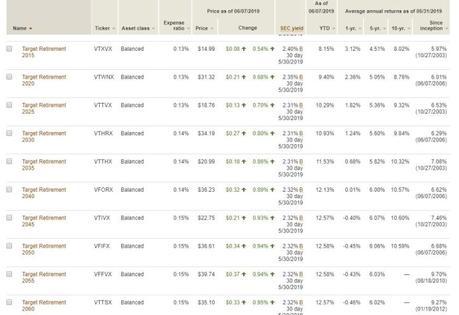

When buying a target-date fund, all you do is select a fund with a year in its name near your retirement date. A list of target-date funds from Vanguard is shown below. For example, if you are retiring in 2057, you might pick a 2055 or a 2060 fund. The further out the year, the more the fund will move around but the better your returns will be. (During the first couple of decades, the 2055 and 2060 fund performance will actually be about the same.) Notice in the list below that the year-to-date (YTD) return is better for the funds with farther out target dates, but from the 1-year returns that they’ve also lost more money than the funds that are closer in during the current market downturn.

If you decide to buy a target-date fund, invest only in that fund. Do not try to add other funds to your portfolio in addition since then you’re not letting the target-date fund do its job. This is kind of like having an automatic transmission but then also trying to shift gears some of the time. It doesn’t work very well.

6. Set it and forget it. One of the worst things you can do is to try to move money around in your 401k to try to time the market. No one is able to time the market, and trying to do so is why most investors don’t get as good a return as the markets. Just leave things alone and don’t worry about what your coworker says at the water cooler or about what you hear on TV. It is too late to sell once the markets drop and it is too late to buy once the markets have gone way up. Just relax and keep money going from your paycheck into your funds.

At most, shift money around about once per year to get back to the percentages you chose for each fund. This is called “rebalancing” and most 401k plans have tools to let you do this easily. Many plans will also not let you go back into a fund within 6 months once you sell it, however, so don’t try to do this very often. Choose a date you can remember, like your birthday, then just let things take care of themselves otherwise.

Have a burning investing question you’d like answered? Please send to[email protected] or leave in a comment.

Follow on Twitter to get news about new articles. @SmallIvy_SI

Disclaimer: This blog is not meant to give financial planning or tax advice. It gives general information on investment strategy, picking stocks, and generally managing money to build wealth. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. Tax advice should be sought from a CPA. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.