Just hitting those long term market price fibonacci resistance areas does not guarantee the fibonacci areas will resonate as resistance. However, market sentiment is also frothy as we enter those fibonacci resistance areas. Market sentiment reflects that the bears are capitulating, which is corroborative that the resistance areas are working. Fibonacci and swing extensions should act as pain points for the wrong way traders, in this case the bears. If the bears capitulate, they were the hold outs and there would be no more buyers higher. If there are no more buyers higher, the stock market has no reason to go up. The stock market will instead move downwards to force longs to sell and free up buyers.

These are long term stock market resistance areas and cycle points. The cycle window runs from approximately November 22-December 6 as indicated in the prior post which also contains the anticipated scenario described in the DOW index. Price wise, we have entered the turn window. Watch for a market reaction down out of these time and price areas. The forecast and outlook anticipates a move down into January for an initial wave down.

There always coexist a bear and a bull path. Nobody can know with 100 percent certainty which path the future will choose.

Peace, Om.

SoulJester

Just hitting those long term market price fibonacci resistance areas does not guarantee the fibonacci areas will resonate as resistance. However, market sentiment is also frothy as we enter those fibonacci resistance areas. Market sentiment reflects that the bears are capitulating, which is corroborative that the resistance areas are working. Fibonacci and swing extensions should act as pain points for the wrong way traders, in this case the bears. If the bears capitulate, they were the hold outs and there would be no more buyers higher. If there are no more buyers higher, the stock market has no reason to go up. The stock market will instead move downwards to force longs to sell and free up buyers.

These are long term stock market resistance areas and cycle points. The cycle window runs from approximately November 22-December 6 as indicated in the prior post which also contains the anticipated scenario described in the DOW index. Price wise, we have entered the turn window. Watch for a market reaction down out of these time and price areas. The forecast and outlook anticipates a move down into January for an initial wave down.

There always coexist a bear and a bull path. Nobody can know with 100 percent certainty which path the future will choose.

Peace, Om.

SoulJester

Business Magazine

Weekly Stock Market Update, Outlook and Forecast for Week of November 25, 2013

Posted on the 25 November 2013 by Souljester @souljester618

Happy Thanksgiving Week! This is the weekly stock market update, outlook and forecast for the week of November 25, 2013. This will be my only post this week.

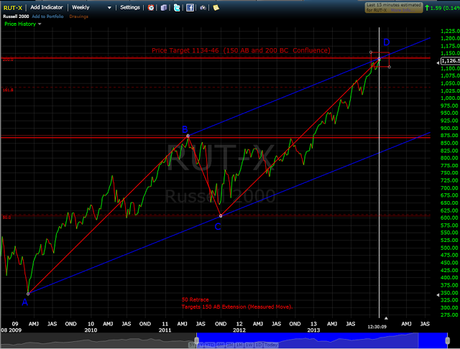

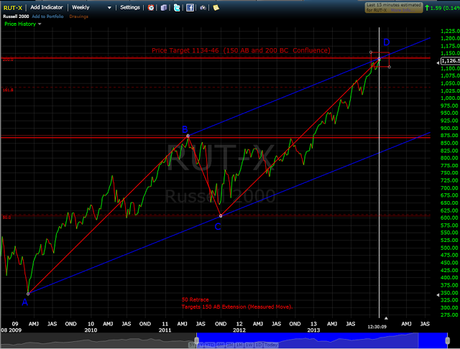

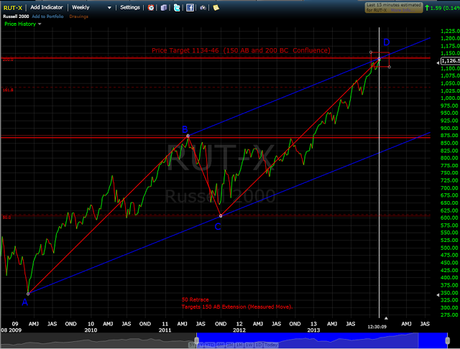

As indicated, last week we entered the Time Window for a Move Down. I have been tracking the long term fib areas for reversal and we have hit the areas in the broad indexes SPX and NYSE. The one stock market index that had been short of the area was the small caps Russell 2000 Index. Updating that index, with today's move, it has entered the price resistance area this week. This price resistance calculation is the perfect measured move swing area off the 2009 low. These swings do not hit exact as there is always some compensation from prior waves. This is especially true when the swing is multi-year calculation as we have presently. However, the broad area is what is important and we have arrived at that area.

Here is the stock market chart, which is based on closes:

Just hitting those long term market price fibonacci resistance areas does not guarantee the fibonacci areas will resonate as resistance. However, market sentiment is also frothy as we enter those fibonacci resistance areas. Market sentiment reflects that the bears are capitulating, which is corroborative that the resistance areas are working. Fibonacci and swing extensions should act as pain points for the wrong way traders, in this case the bears. If the bears capitulate, they were the hold outs and there would be no more buyers higher. If there are no more buyers higher, the stock market has no reason to go up. The stock market will instead move downwards to force longs to sell and free up buyers.

These are long term stock market resistance areas and cycle points. The cycle window runs from approximately November 22-December 6 as indicated in the prior post which also contains the anticipated scenario described in the DOW index. Price wise, we have entered the turn window. Watch for a market reaction down out of these time and price areas. The forecast and outlook anticipates a move down into January for an initial wave down.

There always coexist a bear and a bull path. Nobody can know with 100 percent certainty which path the future will choose.

Peace, Om.

SoulJester

Just hitting those long term market price fibonacci resistance areas does not guarantee the fibonacci areas will resonate as resistance. However, market sentiment is also frothy as we enter those fibonacci resistance areas. Market sentiment reflects that the bears are capitulating, which is corroborative that the resistance areas are working. Fibonacci and swing extensions should act as pain points for the wrong way traders, in this case the bears. If the bears capitulate, they were the hold outs and there would be no more buyers higher. If there are no more buyers higher, the stock market has no reason to go up. The stock market will instead move downwards to force longs to sell and free up buyers.

These are long term stock market resistance areas and cycle points. The cycle window runs from approximately November 22-December 6 as indicated in the prior post which also contains the anticipated scenario described in the DOW index. Price wise, we have entered the turn window. Watch for a market reaction down out of these time and price areas. The forecast and outlook anticipates a move down into January for an initial wave down.

There always coexist a bear and a bull path. Nobody can know with 100 percent certainty which path the future will choose.

Peace, Om.

SoulJester

Just hitting those long term market price fibonacci resistance areas does not guarantee the fibonacci areas will resonate as resistance. However, market sentiment is also frothy as we enter those fibonacci resistance areas. Market sentiment reflects that the bears are capitulating, which is corroborative that the resistance areas are working. Fibonacci and swing extensions should act as pain points for the wrong way traders, in this case the bears. If the bears capitulate, they were the hold outs and there would be no more buyers higher. If there are no more buyers higher, the stock market has no reason to go up. The stock market will instead move downwards to force longs to sell and free up buyers.

These are long term stock market resistance areas and cycle points. The cycle window runs from approximately November 22-December 6 as indicated in the prior post which also contains the anticipated scenario described in the DOW index. Price wise, we have entered the turn window. Watch for a market reaction down out of these time and price areas. The forecast and outlook anticipates a move down into January for an initial wave down.

There always coexist a bear and a bull path. Nobody can know with 100 percent certainty which path the future will choose.

Peace, Om.

SoulJester

Just hitting those long term market price fibonacci resistance areas does not guarantee the fibonacci areas will resonate as resistance. However, market sentiment is also frothy as we enter those fibonacci resistance areas. Market sentiment reflects that the bears are capitulating, which is corroborative that the resistance areas are working. Fibonacci and swing extensions should act as pain points for the wrong way traders, in this case the bears. If the bears capitulate, they were the hold outs and there would be no more buyers higher. If there are no more buyers higher, the stock market has no reason to go up. The stock market will instead move downwards to force longs to sell and free up buyers.

These are long term stock market resistance areas and cycle points. The cycle window runs from approximately November 22-December 6 as indicated in the prior post which also contains the anticipated scenario described in the DOW index. Price wise, we have entered the turn window. Watch for a market reaction down out of these time and price areas. The forecast and outlook anticipates a move down into January for an initial wave down.

There always coexist a bear and a bull path. Nobody can know with 100 percent certainty which path the future will choose.

Peace, Om.

SoulJester