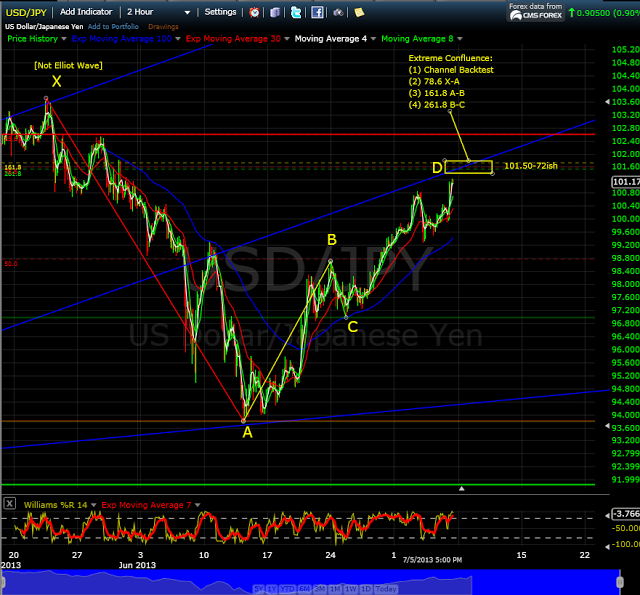

The chart above is not labelled in Elliott Wave, so do not think it is or that will confuse. Likewise, for the wavers, I fully understand that move off the low may be a 5 wave impulse. There is also some bearish hidden divergence on the daily chart that suggests this wave up off the mid-June low may be a counter trend move with a lower low coming in July. That would be consistent with our bearish market scenarios that live below the 50 DMA on SPX.

Now, if this Fibonacci area in the dollar yen pair does provide a bearish reaction, US equities have been correlated to USDJPY. Accordingly, if the correlation continues, one would expect a bearish reaction in equities as well (Holiday Friday was a head fake scenario). If bearish reaction follows in equities, that would mean the gut feel for Friday was right that the Holiday market move above the 50 DMA was a head fake. Stock Market Update, Forecast and Outlook for Next Week-2 and Stock Market Update, Forecast and Outlook for Next Week-1.

This is what I would call "Fibonacci speculation" because the daily USDJPY chart is not PRESENTLY bearish, meaning that we have a breakout as of the close last week and not a breakdown. If that daily breakout persists it could smash right through this resistance. So mind your stops, do your own do diligence, and all of that. However, I will be speculating short off this area using small charts. I will also, as was planned and discussed, be patient this week with equities to see if that move on Friday was for real or not while also respecting the middle of the chart, the price action and the levels. The dollar yen is giving some data points that this holiday move above the 50 DMA might not have been for real or at least might be subject to a retrace that will take the long stops sitting below the 50 DMA and 13 EMA.

CONCLUSION

On the right side of the blog is additional information of value, including free chart links, links to friend sites, and other sites of interest. I have also included two polls that I created and find the results interesting so far. Please vote if you have not yet voted. Also, this is a free site that I keep largely for my own purposes, but if you like what you see here click on an advertiser to buy a round of beer. Thanks and see you at the end of July.

The chart above is not labelled in Elliott Wave, so do not think it is or that will confuse. Likewise, for the wavers, I fully understand that move off the low may be a 5 wave impulse. There is also some bearish hidden divergence on the daily chart that suggests this wave up off the mid-June low may be a counter trend move with a lower low coming in July. That would be consistent with our bearish market scenarios that live below the 50 DMA on SPX.

Now, if this Fibonacci area in the dollar yen pair does provide a bearish reaction, US equities have been correlated to USDJPY. Accordingly, if the correlation continues, one would expect a bearish reaction in equities as well (Holiday Friday was a head fake scenario). If bearish reaction follows in equities, that would mean the gut feel for Friday was right that the Holiday market move above the 50 DMA was a head fake. Stock Market Update, Forecast and Outlook for Next Week-2 and Stock Market Update, Forecast and Outlook for Next Week-1.

This is what I would call "Fibonacci speculation" because the daily USDJPY chart is not PRESENTLY bearish, meaning that we have a breakout as of the close last week and not a breakdown. If that daily breakout persists it could smash right through this resistance. So mind your stops, do your own do diligence, and all of that. However, I will be speculating short off this area using small charts. I will also, as was planned and discussed, be patient this week with equities to see if that move on Friday was for real or not while also respecting the middle of the chart, the price action and the levels. The dollar yen is giving some data points that this holiday move above the 50 DMA might not have been for real or at least might be subject to a retrace that will take the long stops sitting below the 50 DMA and 13 EMA.

CONCLUSION

On the right side of the blog is additional information of value, including free chart links, links to friend sites, and other sites of interest. I have also included two polls that I created and find the results interesting so far. Please vote if you have not yet voted. Also, this is a free site that I keep largely for my own purposes, but if you like what you see here click on an advertiser to buy a round of beer. Thanks and see you at the end of July.

Peace, Om, SoulJester