The gentleman in this picture is Joseph E. Stiglitz. Stiglitz is a professor of economics at Columbia University, a Nobel Prize winner, a former vice-president and chief economist of the World Bank, and a former Chairman of the government's Council of Economic Advisors. In short, Stiglitz is an expert on economics and the effect that economic policy has on the economy.

The gentleman in this picture is Joseph E. Stiglitz. Stiglitz is a professor of economics at Columbia University, a Nobel Prize winner, a former vice-president and chief economist of the World Bank, and a former Chairman of the government's Council of Economic Advisors. In short, Stiglitz is an expert on economics and the effect that economic policy has on the economy.And in an interview with Bill Moyers, Stiglitz said he doesn't believe the wealthiest Americans are paying their fair share of taxes. Stiglitz said:

"We have a tax system that reflects not the interest of the middle. We have a tax system that reflects the interest of the 1 percent."

"Median American income today is lower than it was almost a quarter a century ago. Our economy has grown over the quarter century, . . . but all of that growth has gone to the top."

"We can have a tax system that can help create a fairer society. Only ask the people at the top to pay their fair share. It's not asking a lot. It's just saying those in the top 1 percent shouldn't be paying a lower tax rate than somebody much further down the scale."

Is Stiglitz right? The Republicans in Congress don't think so. They still cling to their failed "trickle-down" economic policy. They believe that the solution to all of this nation's economic problems is to give the rich (and the corporations) even more tax cuts -- in spite of the fact that they already enjoy one of the lowest tax rates since before the Great Depression.

I agree with Stiglitz. I believe the economic policy imposed and defended by the GOP has been a disaster for the American economy. And after being devastated by the Great Recession (and still feeling the effects of that recession), the American people are also starting to realize that Stiglitz is right (and the GOP is wrong).

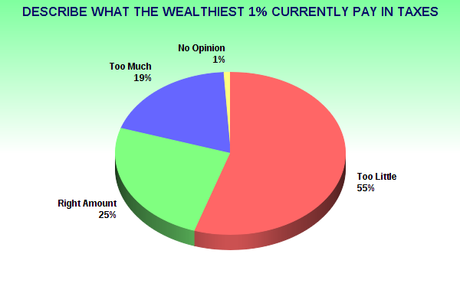

A new CNN / ORC Poll (done between May 29th and June 1st of a random national sample of 1.003 adults, with a 3.5 point margin of error) shows that a significant majority of Americans think the wealthiest 1% of Americans pay too little in taxes.

About 55% of Americans say the wealthy don't pay their fair share in income taxes. Only 25% say they pay the right amount, and amazingly, about 19% say they pay too much. That's an 11 point difference between those who say the wealthiest 1% don't pay enough, and those who disagree.

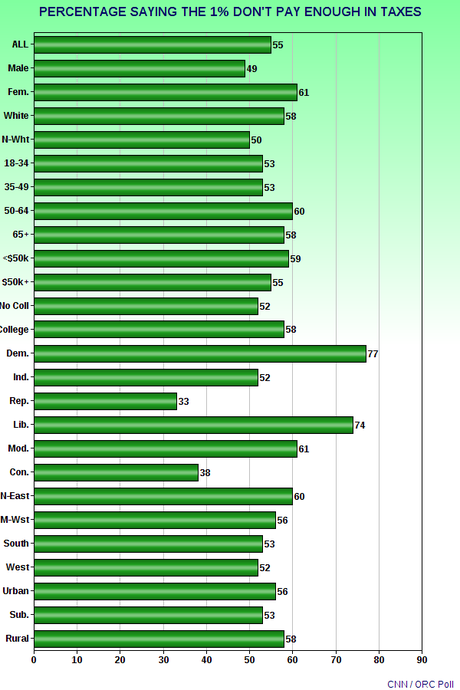

About 55% of Americans say the wealthy don't pay their fair share in income taxes. Only 25% say they pay the right amount, and amazingly, about 19% say they pay too much. That's an 11 point difference between those who say the wealthiest 1% don't pay enough, and those who disagree.And as the chart below shows, this belief that the wealthy don't pay enough in taxes cuts across all demographic lines -- age, gender, education, race, region, income level, or residential location. Only two groups show a majority believing the rich pay either the right amount or too much -- Republicans and conservatives. Most people in the other groups believe taxes should be raised on the rich (at least a small amount) -- to lower the deficit, help hurting Americans, and fund a program to create new jobs.

(Note -- the image above of Joseph E. Stiglitz is from a photograph taken by Peerapat Wimolrungkarat for the government of Thailand.)