It's this sort of thing that makes me respect Senator Elizabeth Warren (D-Massachusetts) more every day. While the Republicans in Congress (and some blue dogs among the Democrats) worry only about the rich and the corporations -- wanting to cut their taxes and pay for it by cutting services for hurting Americans -- Senator Warren wants to help the people who need help.

It's this sort of thing that makes me respect Senator Elizabeth Warren (D-Massachusetts) more every day. While the Republicans in Congress (and some blue dogs among the Democrats) worry only about the rich and the corporations -- wanting to cut their taxes and pay for it by cutting services for hurting Americans -- Senator Warren wants to help the people who need help.She has championed the establishment of a consumer protection agency to protect ordinary American from the giant financial institutions, and she has spoken against going to a "chained CPI" method of figuring inflation -- which would not keep up with the real inflation rate, and amounts to little more than a benefit cut for those on Social Security and those receiving Veterans' benefits.

None she is speaking up for students who cannot afford the rising and exorbitant college costs, and must borrow money from the government to get their education.

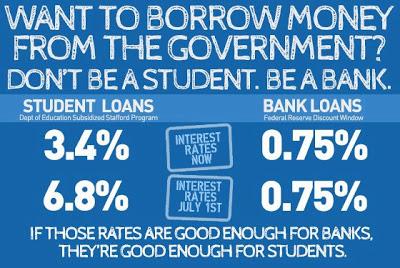

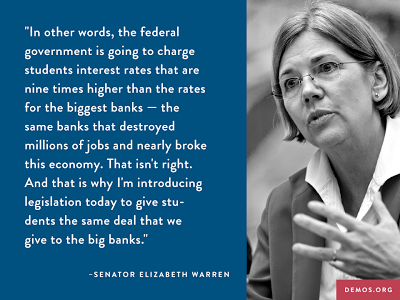

She has pointed out that we are still letting the giant Wall Street banks borrow money at a ridiculously low interest rate -- 0.75% (and yes, that's taxpayer money they are borrowing at that tiny rate). But when it comes to loaning money to students, who need it far more than the giant banks (who are using it as profit and giving huge bonuses to their executives), we are currently charging 3.4% interest -- and this summer that will go up to 6.8%. That's about seven times the interest rate charged to the banks.

Some of you are probably thinking that since these students are borrowing money from the government (us taxpayers), they should pay some interest. But should it be seven times the interest paid by Wall Street? Isn't raising the interest rate to nearly 7% just making it harder for those students to pay the money back? I have no problem with charging a small interest rate, but it is in our best interest to keep that rate as low as possible to insure it can be easily repaid.

The truth is that these loans are "cost-effective" for the government anyway. Even if these were grants (which didn't have to be repaid) instead of loans, the federal government would come out ahead by offering them. That's because these students, after getting their education, will pay far more in taxes than if they didn't get that education -- and those future taxes will easily eclipse the money they have borrowed.

Warren is introducing the Bank On Students Loan Fairness Act, which would make money available for the student Stafford loans at the same interest the banks are paying. The bill would only do it for one year, but you can be sure the Republicans will kill it anyway (since it does not put money in the pockets of the rich. But in spite of the fact it could never pass the GOP-controlled House, the bill actually makes a lot of sense. Imagine helping people who actually need that help!