Growing wealthy is actually quite simple. While a high income can certainly help one become wealthy faster, most people with high incomes are still a paycheck away from missing their house payment. When a job is lost, suddenly people are digging into their 401k’s and IRAs – their only real savings – losing millions of dollars in retirement by raiding their tax deferred savings to meet expenses. The difference between a person who will become wealthy and the average person (the broke person) lies not in the income but in the cash flow – what each person does with his money.

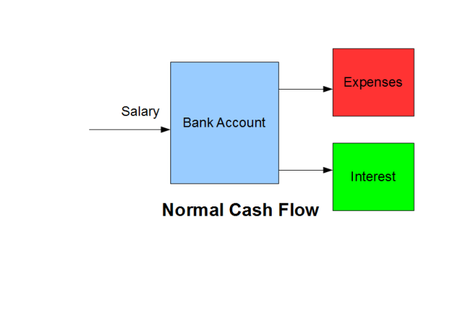

Below is the cash flow diagram for the “normal” person – one who will never become rich. Income comes into the bank account in the form of a salary. This could be a very large salary or an average to small salary – it really doesn’t matter. The entire salary only pauses in the bank account, soon being doled out to various recurring expenses such as house payments, car payments, cable bills, cell phone bills, credit card payments, student loans, etc…. Often the money is spoken for before the month even starts. Individuals like this see millions of dollars pass through their hands during their working lifetime, yet retire with only a few thousand in savings.

In addition to the recurring expenses, interest is also being paid, meaning that more is being paid for things than face value. Often individuals will use credit cards to spend more than they make, run up the balance on those credit cards (at 15% interest or more), and then refinance that balance into their home loan, only to start the cycle again. That Big Mac is now paid for over 30 years.

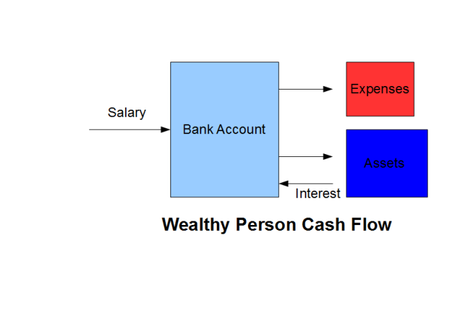

Below is the cash flow diagram of someone who will become wealthy. Note two things. First of all, the expenses are less than the person’s income. He does not add payments to his life until every dollar is spoken for before the month begins. Second of all, the individual directs some of his money into the purchase of assets. Things such as stocks, real estate, or bonds. These things actually generate additional income for the person. Instead of paying interest, the person is receiving interest. This enables him/her to actually pay less for things, or at least work less for things. This is done by foregoing some of the stuff until later – living below one’s means.

As time goes on and the amount of assets grows, the income received from these assets will be larger than one’s salary. At that point the person is said to be “financially independent,” meaning that he could quit his job without affecting his lifestyle. One can then enjoy the higher income to buy nice cars, houses, and take nice vacations, and give more to churches, charities, and individuals since one’s income will be higher than that of one’s peers.

Most individual who become wealthy, however, will allow some of their additional income to go back into the purchase of more assets. This process is called “compounding.” The power of compounding is truly amazing, because while the increases seem small at first, it is astounding how large the sums can get if left alone to double every five to seven years.

In summary, if you wish to become wealthy: 1) Live below your means and delay purchases until you can buy them with cash, 2) Direct some of your income into assets – things which generate an income for you, and 3) Allow some of the income to compound. At that point you can live in security. You will also have the means to help others, rather than being one misfortune away from needing help yourself.

Your investing questions are wanted. Please send to [email protected] or leave in a comment.

Follow on Twitter to get news about new articles. @SmallIvy_SI

Disclaimer: This blog is not meant to give financial planning or tax advice. It gives general information on investment strategy, picking stocks, and generally managing money to build wealth. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. Tax advice should be sought from a CPA. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.

About these ads