The UTI Infrastructure Fund is an open-ended equity mutual fund that predominantly invests in stocks of companies that are directly or indirectly engaged in the infrastructure sector of the economy. The fund employs a bottom-top approach while investing and concentrates on individual companies rather than the sector as a whole. The infrastructure sector of the country is poised to see rapid growth in the near future and this fund seeks to profit from the early market cycles this sector will go through.

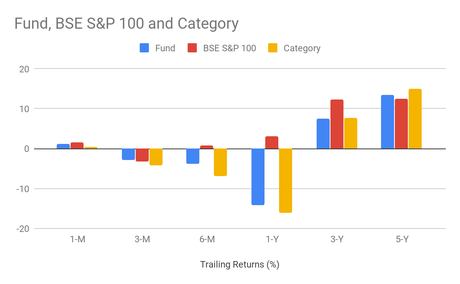

PerformanceSince February 2018 the UTI Infrastructure Fund has been closely trailing its benchmark index, the BSE S&P 100. The fund has regularly outperformed its benchmark and category and in 2017 it outperformed its benchmark and closely trailed its category. As this fund has a sector bias it is exposed to concentration risks. The fund saw its best performance between September 2013 and September 2014. The performance of this fund against its category and benchmark index has been provided below.

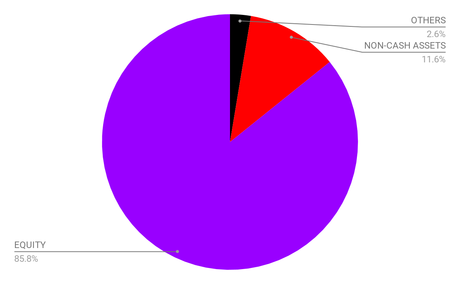

The UTI Infrastructure Fund primarily invests the corpus in equity and equity related instruments, but also invests nominally in debt and other money market instruments to provide the fund a level of stability. The fund changes the composition of debt to equity dynamically, but under normal circumstances, will maintain an equity-bias. The asset allocation of the fund according to its mandate has been provided in the table below.

· The fund may invest up to 100% in securitized debt under special circumstances.

The Present asset allocation of the fund has been provided in the pie chart below.

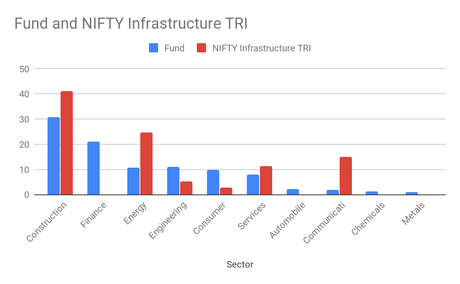

The UTI Infrastructure Fund, being a sectoral fund, primarily invests in companies that are either directly or indirectly involved in the infrastructure sector of the country. The fund presently invests large portions of the corpus in the Construction, Finance, Engineering and Energy sectors of the economy. The present sectoral allocation of assets against the NIFTY Infrastructure TRI has been provided in the chart below.

The UTI Infrastructure Fund being an equity-based mutual fund is prone to equity market risks. The fund is exposed to market fluctuations which can cause a loss of returns during volatile market cycles including a loss of the capital invested. The fund is a sectoral fund is also exposed to concentration risks, which are usually sector-specific. High trading volumes, transfer procedures and settlement periods can affect the liquidity of the fund.

Debt RiskThe UTI Infrastructure Fund nominally invests in debt and other money market instruments to enhance the stability of the fund during trading cycles. Even though debt instruments are considered relatively stable when compared to equity, they carry risks of their own. Through exposure to debt the fund is exposed to credit risk. Credit risk arises when an issuer of a debt instrument cannot fulfil the obligation towards repayment of the debt instrument. The fund is also exposed to interest rate risks. Small changes in interest rates can have a drastic effect on long-term debt. An adverse effect on long-term debt can have an adverse effect on the Net Asset Value (NAV) of the fund.

Risk Mitigation Measures

Equity Risk MitigationThe fund employs a bottom-top analysis while picking stocks of companies, but it also employs a top-bottom analysis while choosing the sector within which it intends to function to mitigate sector-specific risks. The fund strives to maintain an asset-liability balance to ensure that payments are done in a timely manner when units are redeemed by the investor.

Debt Risk MitigationThe fund takes great care when choosing debt instruments to invest in, and only chooses instruments that have a good credit rating by a SEBI registered credit rating agency. The fund also endeavours to time the maturity of its investments in accordance with expected interest rate changes to mitigate interest rate risk.

Mr. Sanjay Ramdas DongreMr. Dongre is a Senior Fund Manager with UTI Asset Management Company (P) Ltd. Mr. Dongre started his career in Reliance Petrochemicals Ltd., as an Office-in-charge of the Instrumentation Department. In 1994 he joined UTI as a Debt Analyst and support service for fund management activities. Mr. Dongre currently serves as Vice President and Fund Manager of UTI Mutual Fund - Growth Sector Funds - Software Funds. Mr. Dongre holds a PGDM from Indian Institute of Management (IIM) - Calcutta and a B.E. in Instrumentation from College of Engineering.