%%bloglink%%

Every year around this time, you will hear estimates on how much shoppers will likely spend during the upcoming holiday season and how this is so important for investors to consider because consumer spending is such a big part of the economy.

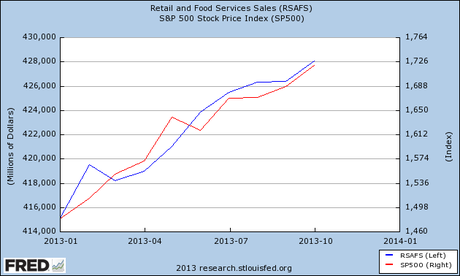

Below I have listed headline forecasts for each of the 2009 to 2013 shopping seasons along with how the S&P 500 Index and Retail Sales performed during the following year.

You be the judge how well they have lined up.

Forecast: “Challenging Holiday Season Ahead” National Retail Foundation. Sept 23, 2008

Actual Results: Retail Sales increased by 3% and the S&P 500 Index increased by 28%

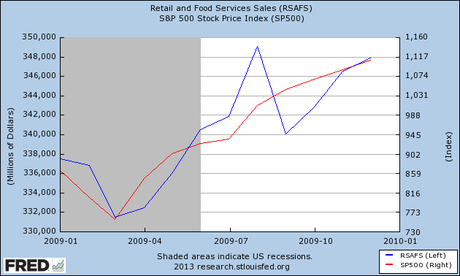

Forecast: “Holiday sales expected to fall 1% from 2008, trade group says” Los Angeles Times. October 6, 2009

Actual results: Retail Sales increased by 7% and the S&P 500 Index increased by 10%

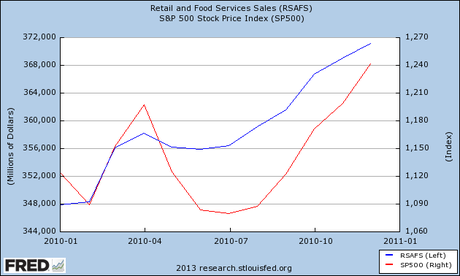

Forecasts: “Holiday sales expected to increase modestly” Los Angeles Times. October 7, 2010

Actual results: Retail Sales increased by 6% and the S&P 500 Index fell by 3%

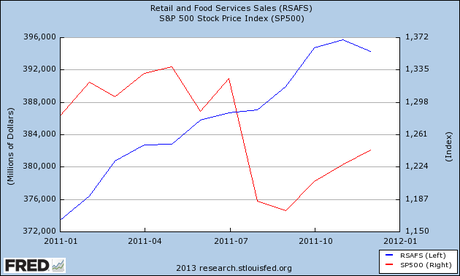

Forecasts: “Retailers expect modest rise in holiday sales” Los Angeles Times. October 5, 2011

Actual results: Retail Sales increased by 4% and the S&P 500 Index increased by 9%

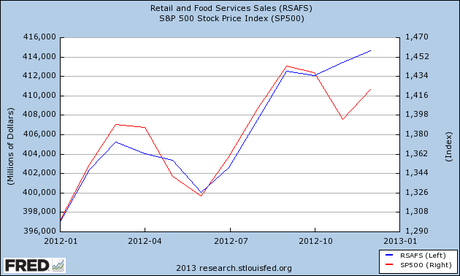

Forecasts: “Holiday sales expected to rise 4.1% in 2012” Los Angeles Times. October 2, 2012

Actual results: As of October 2013, Retail Sales had increased by 3% and the S&P 500 Index had increased by 16%

And here is the latest forecast: “Holiday retail sales forecast is bleak” Los Angeles Times. November 1, 2013.