Donald Trump loves to brag about the economy. In June of 2018, he said we have the greatest economy in the history of our nation -- and he has repeated that claim many times since then.

Donald Trump loves to brag about the economy. In June of 2018, he said we have the greatest economy in the history of our nation -- and he has repeated that claim many times since then.I understand why he continues to make that claim. It's because the economy is the only thing he has not been able to destroy -- yet. He has failed miserably at everything else. But is he telling the truth this one time? Is this the greatest economy in United States history?

No! The economy is doing great for the rich and the super-rich. They are making more money (and keeping more of it) than at any time in our history. Maybe that's what Trump is talking about, because we know he only cares about rich (white) men.

Unfortunately, there are a lot of people in this country that are not rich -- and the economy is not doing so great for them.

There are a lot of problems with this economy for ordinary Americans, but let me highlight just a few. The following charts and statements are from Politifact. They examined this question and found the following:

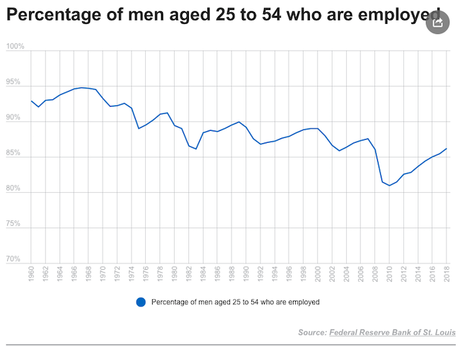

The percentage of men between the ages of 25 and 54 and who are employed has dropped consistently since the early 1960s.

In fact, while today’s rate — 86 percent employment among men — has recovered from its deep slide during the Great Recession, it remains lower than it was at any point between 1960 and 2007, despite the overall strong economy.

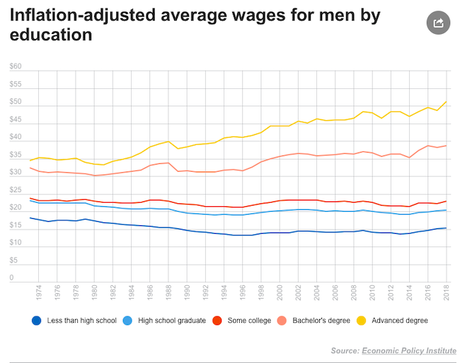

Broadly speaking, people with higher education have done well in recent years, and people without college degrees have suffered. Once again, this is especially true for men.

Broadly speaking, people with higher education have done well in recent years, and people without college degrees have suffered. Once again, this is especially true for men.The top two lines show that men with bachelor’s degrees and advanced degrees have seen clear gains since 1974, even taking inflation into account.

By contrast, high-school dropouts, high-school graduates, and those who began but didn’t finish college have seen inflation-adjusted wages decline, on balance, since the early 1970s.

To many men with less education, there’s little reason to celebrate the state of the economy.

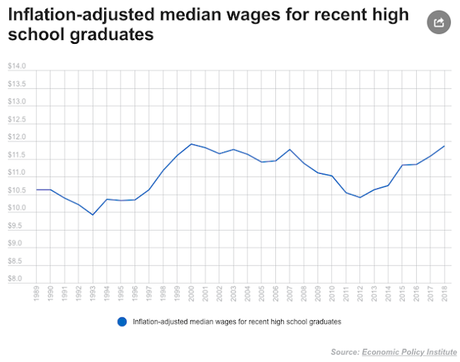

The typical wages for recent high-school graduates entering the labor market have climbed in the past six years — but only to a point.

The typical wages for recent high-school graduates entering the labor market have climbed in the past six years — but only to a point. After taking inflation into account, recent high-school graduates are not earning any more than their peers did in 2000, which was about the time today’s recent high school grads were being born.

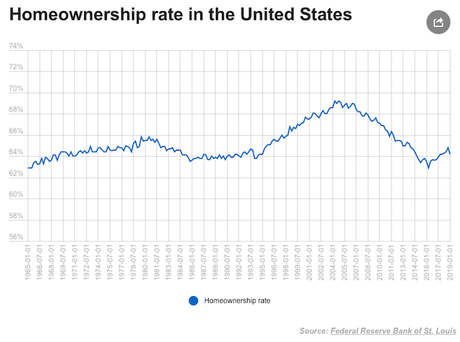

The percentage of Americans owning a home remains lower than it was before the Great Recession.

The percentage of Americans owning a home remains lower than it was before the Great Recession.Today, home ownership rates are roughly the same as they were between the 1960s and the early 1990s. There has been none of the steady growth in home ownership seen for a decade beginning in the mid 1990s.

Why are relatively low levels of home ownership important? Because home ownership affects wealth holdings, especially for the broad middle class.

"Many middle- and lower- income families have wealth levels below comparable families in the 2005-2007 period," Gary Burtless (Brookings Institute) said. "Why? Because homeownership rates, especially of young adults, remain lower than they were back then."