The US Dollar Index hit a two-month low on Tuesday. Stimulus talk optimism puts pressure on the US Dollar Index, which is on a selling bias.

The forex market now hinges on the US fiscal stimulus talks. Tuesday is the last day for an agreement to be voted, before the elections on Nov 3.

Michael Barnier will resume talks with the European Commissioner. "We need a clear assurance from the EU that there is a fundamental change in approach in talks. It is a genuine negotiation", says Barnier. "Talks are within reach", states Barnier, and his statements give the Sterling a further boost.

Euro and Swiss Franc continue to show strength in Europe. The CAD is strengthening against the weaker dollar.

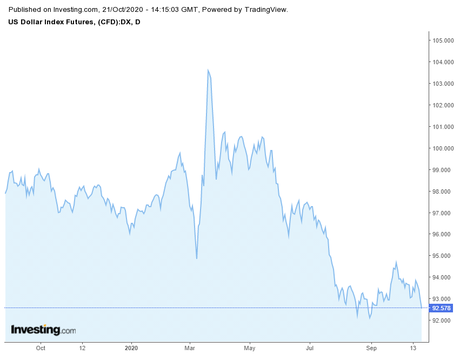

US Dollar Index

US Dollar Index Firmly Below 93 LevelsThe political scenario in the US keeps investors eager about another fiscal stimulus package. "We are willing to bring a package that is more than a $2.2 trillion package as proposed by the Democrats", says President Trump. The "lower for longer" approach by the Federal Reserve keeps hopes alive of a strong recovery in the economy.

The US Dollar Index is currently below the 93.00 levels, at October lows. The US dollar has weakened against the euro and other major currencies. A decline below 93 levels will gather momentum downside, where support lies at 92.80 and 92.50, predicted experts on Monday 19 Oct and it has happened.

Though Housing Starts have improved by 1.9%and Building Permits saw a rebound by 5.2% on a month-on-month basis in September, investors are showing more interest in the fiscal package in the US. If the stimulus package is announced, data from other sectors of the society may also see a rebound.

The greenback is losing strength against the JPY, AUD, and the NZD.

USD/CAD

USD to Canadian Dollar Within a Tight RangeUSD/CAD currency pair hovers just below the 1.31 levels. The USD against the Canadian Dollar currency pair has tested this level several times earlier. The US dollar is weakening against a basket of other currencies. If the USD to CAD currency pair moves past 1.3135 levels, there is a possibility of a rebound towards the 1.3200 levels. However, the US Dollar to Canadian Dollar continues to move within a tight band around 1.31 levels for the past several days.

GBP/USD

British Pound Crosses 1.30 Levels EasilyThe British Pound could not maintain its intraday gains and fell lower on Tuesday but rebounded on Wednesday 21, Oct at 12.55 pm GMT.

The GBP/USD currency pair saw a brief rally on Tuesday towards the 1.30 level. It is a psychological level that is a very significant resistance level. However, with selling pressure, the British Pound slid downwards. The 1.28 levels is an important support level.

If the Brexit talks materialize positively, it may serve as a driver for the GBP/USD exchange pair for an upmove. The GBP/USD is moving ahead, past the 1.30 level on Wednesday, as investors expect an optimistic outcome over the Brexit front.

The selling bias on the US Dollar is a stimulant to the Sterling gaining strength.

Some sticking points over the UK and EU negotiation deal continue to delay talks. Fishing access and other competition issues continue to rattle talks between the leaders. UK spokesperson reiterates that talks will resume only if the EU changes its approach over these issues. EU Chief Negotiator Michael Barnier and UK leader David Frost are negotiating talks.

The inflation rate has increased by 0.5% y-on-y, in line with expert opinion in the United Kingdom. Core Inflation Rate has risen by 0.6%, while analysts expected a 1.3% increase.

GBP/USD is on an upside momentum and is heading past 1.30, its resistance level. The currency pair has moved past 1.300 and the October highs at 1.3075. It is currently trading at 1.3090 on Wednesday, 19 Oct at 12.55 pm GMT.

EUR/USD

Euro Strengthens Against the DollarThe EUR/USD index strengthened to move past 1.1830 to 1.865. It is at the highest level this month. The weakening US dollar is driving the Euro higher.

If the Euro breaks the 1.20 level on the upside, it may continue to see a higher move. On the downside, the 1.17 level was strong support, and the Euro to the US Dollar shows a steep climb.

Though the coronavirus infection cases are on the increase in Europe, the Euro and the Swiss Franc continue to dominate the currency market.

The current account surplus in the Eurozone has widened to Euro 19.9 B in August, while it was forecast at 17.2B. The Swiss trade surplus has come down in September to 3.2B Swiss francs, below the expected level at 4.32B Swiss francs. The German PPI on a month-on-month basis is at 0.4%, better than the anticipated 0.1%.

In China, the GDP continues to gain momentum with good economic growth. It has expanded 4.9% from last year for the quarter July to September, according to data released by China on Monday. It is the only major country that is showing good growth in the pandemic year 2020. Stringent lockdowns, COVID-19 curbs, and restrictions on international travel continue in China.