The US Dollar is on an uptrend. In the race for the White House, the greenback has always appreciated whichever party comes to power.

The Forex market and the major Indices in the US remain volatile ahead of the US election on 3 Nov.

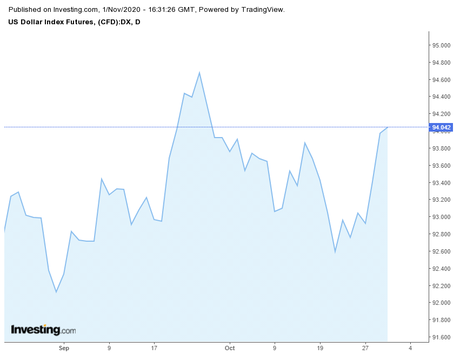

US Dollar Index

US Dollar Index Fluctuates with Market Volatility

The US dollar continues its upward momentum rising to 94.00 levels, an increase of 0.60%. It is moving towards its 100 DMA at 94.28. The greenback is at its four-week highs on Friday. The US elections and the surge in coronavirus are taking its toll on the greenback.

The US Dollar Index is on a steady increase after touching a low of 92.50 levels on 21 Oct.

The euro and the sterling have weakened against the strengthening US Dollar index. For the week, the US dollar has increased by 1.4%, the best performance in more than a month.

In the US, the GDP for the third quarter shows a 33.1% increase quarter-on-quarter. Unemployment Claims has come down to 751,000 for the week ended 24 Oct, while it was 791,000 claims the previous week.

Covid cases are on the increase in the US and Europe. Out of 50 states, 41 states have reported an increasing number of Covid cases.

Stimulus Packages and Elections

In 2008, the government unveiled a $787 billion stimulus package after the global recession that brought a financial meltdown in countries across the world. An amount of $212 billion was spent on tax rebates, while $296 billion was spent on Medicaid and unemployment benefits. Another $279 billion was spent on economic growth. It was during this period that the US Dollar fell from 90 levels to 74 levels. Quantitative easing led to the fall of the dollar by 2011.

In 2014, quantitative easing ended, and by 2015, the dollar index strengthened back to 100 levels.

In 2020, the stimulus provided in the US to address the Covid pandemic has been enormous, much higher than that provided by other countries. The dollar fell from its highest level in March at 103 levels. The dollar index slid 9.5% to 93 levels in October.

The next package is still under negotiation between the Republicans and Democrats. If the stimulus package comes up, the dollar may weaken further, going by history.

Chairman Jerome Powell warns that another pandemic related fiscal stimulus is needed to accelerate growth. Governor Lael Brainard also states that the failure of another fiscal support will create more downside risk than the virus itself.

Election Results: Trump or Biden?

The US Elections are on Tuesday, 3 Nov. The first exit polls are expected on Tuesday night. Joe Biden from the Democratic Party has been leading in national polls, although the gap narrowed notably in recent days. Key swing states are Arizona, Florida, Michigan, and Pennsylvania.

Over the past three decades, the dollar index has appreciated irrespective of which party wins. Both Trump and Biden have promised huge stimulus packages. Irrespective of who wins, the country will receive a stimulus package.

Election time is often a time of uncertainty. The judicial system, legislative decisions, and leaders change. As uncertainty looms, investors in the stock market and the forex market are wary of the changes that may take place.

All markets are open on Election Day. Trading continues, even as voters continue to vote for a leader of their choice. The greenback may see a move higher against its counterparts until the election results.

While some investors are waiting on the sidelines for election volatility to settle down, other investors are riding the wave of volatility and continue to remain invested in the Forex market.

EUR/USD

Euro Jittery Ahead of Further Lockdown in the Eurozone

The euro slid 3% after the European Central Bank expressed its view on further monetary easing by the end of the year.

The ECB has kept interest rates steady on Thursday. The ECB president has promised to bring in measures to rescue the economy from the second wave of Covid-19 by the December meeting.

Both Germany and France have restarted lockdown measures in the economies. In Italy, strict restrictive measures have been introduced. With the winter just ahead, the situation may worsen, and the coronavirus infection may increase, say, medical experts.

The Eurozone is showing a steady weakness, and experts feel that monetary easing is not enough in the Eurozone.

Yuan Shows Strength

The Chinese Yuan is showing strength with the economy going strong. The Chinese economy has been powering ahead of other countries after the coronavirus pandemic. The Yuan continues to show strength against the dollar. The Yuan is almost 4% higher from what it was at the beginning of the year. The Chinese Yuan has gained 4% against the US Dollar. Economic growth has been good in China. GDP in China has grown by 4.9% year-on-year for the third quarter.

Russian Rouble fell 0.5% towards 80 per dollar. It is a drop of 4% this week. The Canadian dollar saw its worst week.