As one of the three major US credit agencies, TransUnion is familiar with credit Score. In an increasingly overcrowded credit monitoring market, this needs to be taken into account.

TransUnion offers a superior product for credit monitoring and identity theft, a true identity. The company was generous enough to sponsor the contents of Money Under 30 so we can talk about it, but rest assured that the following analysis is mine.

Summary: We conduct a detailed review of TransUnion and discuss its features, characteristics, pricing, policies, and all the important things you need to know before making the final decision. Read the section about the TransUnion Review in the following section.Transunion Review 2019: Is It Worth the Cost?🤑

Detailed About TransUnion Review

TransUnion is a world-class credit monitoring service. You have unrestricted access to your TransUnion credit.

You'll also receive notifications of important changes to your credit information, such as: For example, a change of address or a new account opened on your behalf. You can be sure that if someone tries to steal your identity, you can take quick action to prevent it from intensifying.

TransUnion benefits

TransUnion primary credit monitoring service is similar to what Experian and Equifax offer. It comes with the basic features that you need to monitor your credit score.

To stand out from the competition, TransUnion has introduced two security features. These additions provide additional identity theft protection, giving you unprecedented security.

What is the true identity? (Check Out Full TransUnion Review)

TransUnion also offers an identity theft prevention product called TrueIdentity.

This product provides customers with insurance against identity theft and constant monitoring of suspicious activity based on their personal information. The base product is free and includes $ 25,000 in identity theft insurance.

The premium product includes all the usual functions of credit control as well as debt analysis, tracking of court records, control of the identity of black marketers and the control of sex offenders.

However, it does not offer the Credit Lock Plus feature, but the default Credit Lock feature.

TransUnion is a monthly subscription service that starts with a first 7-day trial that you can cancel at any time.

After these seven days, users will be billed monthly and they will receive the service until terminated. To use TransUnion services, you must first prove your identity to prevent identity theft and fraud.

Why should I use the TransUnion Credit Lock?

TransUnion and other credit monitoring services provide credit to several companies when they review their creditworthiness.

If you want to control who can see your credit report, you can use the credit lock to restrict access to your TransUnion account statement. With the smartphone application, you can prevent others from accessing your TransUnion credit report without your permission.

If you need to publish your credit report for legitimate reasons, such as: For example, for a bank credit check, unlock and replace it.

The key benefit of the loan revocation feature is that it protects against identity theft and guarantees your privacy. All credit monitoring agencies have had data breaches, providing an additional layer of protection for your data.

The main disadvantage of this service is that it only applies to your TransUnion credit report. When companies conduct a credit check, they receive reports from Experian, TransUnion, and Equifax. If you use the credit lock, only your TransUnion report will be assigned, while the others will remain easily accessible.

TransUnion offers Credit Lock Plus, which allows you to block your TransUnion and Equifax credit reports. However, you can not view your Equifax report yet, but it prevents unauthorized access.

Immediate TransUnion notifications

Instant Alerts is another service offered by TransUnion as part of its credit monitoring program. This service will send you an e-mail each time you ask for your credit report.

This is a great feature if you are concerned about identity theft and can quickly determine if someone is trying to borrow from your data and stop it early. You can then take all necessary steps to avoid the loan, for example by restricting access to your credit record.

The main disadvantage of this product is that, like the credit lock, it only applies to TransUnion credit reports. Fortunately, most financial institutions receive credit reports from various credit bureaus. There is a good chance that an immediate alert will help protect against fraud and identity theft.

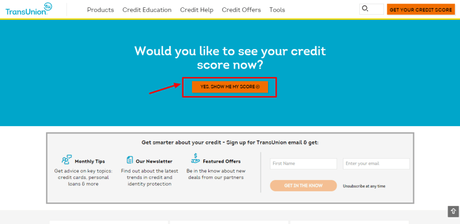

How do I check my credit rating with TransUnion?

Although the TransUnion website is not always concise, the office seems to offer only one way to display your VantageScore: through its credit monitoring subscription service.

For about $ 20 a month, he will become a TransUnion member with unrestricted access to the TransUnion Score & Report, which includes his VantageScore 3.0, a sector score co-developed by the three principal officers.

Like similar office software, you have access to expert advice and resources to help you analyze your debts, challenge the elements of your report, or get more information on the path to financial freedom.

The importance of credit monitoring

If you are new to credit monitoring products, let me underline the importance of periodically reviewing your credit rating and reports.

You and your credit score

Good or bad, your credit report is an integral part of your identity.

Even if you do not want to lend money, homeowners, insurance companies, and in some cases even employers, are judging by the information in your mortgage file. credit

By tracking your credit, especially your credit history, you can better understand the impact of using your loan on your creditworthiness.

After a few months of credit monitoring, you will find that your credit rating increases when you pay by credit card or decreases when you lose a payment.

The risk of identity theft.

On the financial side, you can be meticulous, never stretch too much and pay any bill on time, but you still have to worry about identity theft.

I know, you never think it will happen to you. I thought about last winter when I regularly checked my credit online and noticed an account that I did not recognize.

It turned out that someone opened a credit card account in my name at a shopping center 3,000 km away and started shopping right away.

I do not know for sure how the thief got my personal information, but I suspect that this is one of the most important data security breaches in recent years that has endangered the confidential financial information of millions of Americans.

So keep in mind: Nobody looks in your credit report for errors or signs of fraud. You have to do it yourself!

Enter TransUnion credit monitoring

With TransUnion superior credit monitoring products, you can stay in control of your credit data, reassure and understand why your credit score changes over time.

Peace of mind

TransUnion credit monitoring gives you unlimited credit and credit reports. This is an important difference to free credit monitoring sites, where you can only view updated data every 30 days.

TransUnion sends you email updates of important changes to the credit information of your three credit reports, such as: For example, new or closed accounts, late payments, or material changes to your personal information.

If someone asks for a credit on your behalf, TransUnion can send you a notification immediately, so that you can act immediately.

For example, you can immediately freeze your TransUnion credit report with the one-touch credit lock feature. This prevents thieves from opening additional accounts.

In the worst case, TransUnion also advises on identity theft and identity theft insurance up to $ 1 million.

Credit monitoring and education

In addition to regular monitoring and unlimited updates, TransUnion provides learning features that help you understand the factors that affect your balance. For example, you can use your point simulator to investigate simulation scenarios. With the Score Simulator, you can see what can happen to your credit score if you:

Make individual payments on all your accounts for 12 months.

- Refund of an existing credit card

- Request a new credit balance

- Close an existing credit account

- Pay an invoice 30 days late

In addition, TransUnion's Score Trends feature provides an interactive graph of your score history over time. I find it fascinating because your score may not increase or decrease over time. My score usually varies by a few points, depending on how high my credit cards are at the end of the month.

(Even if I pay them in full every month, the final balances in one month of higher spending are higher than my combined credit limit, which can lead to a drop in my score from 10 to 20 points). Over time, however, I can see the benefits of an ever-longer loan term with 100% on-time payments.

TransUnion also provides calculators that help you assess your overall financial situation and access personalized credit and debt analysis to identify savings opportunities.

What would you like to have?

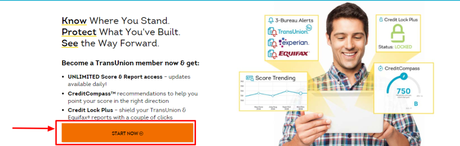

Monitoring TransUnion Premium Loans costs $ 9.95 per month. This will give you:

You can cancel at any time by contacting TransUnion. When you register, your credit monitoring starts immediately and you also have access to your agency's reports and credits worth $ 29.95.

Why TransUnion? (Read Full TransUnion Instruction)| Full Review Here

- Unlimited soft drinks for your TransUnion score and report

- Immediate notification of critical changes or if someone requests credit on your behalf

- One-touch credit lock to freeze your TransUnion report

- Learning tools, including score trends and score simulator

- Unlimited, free access for identity theft and identity theft insurance specialists of up to $ 1 million.

If you buy credit monitoring, you have an option, but if you really want to understand and protect your credit, TransUnion is a wise choice. With TransUnion Credit Monitoring, you can view your data directly from the source.

Unlimited updates allow you to check your current credit score 24 hours a day, 7 days a week. This is especially helpful if you are looking for a credit score goal before applying for a car loan or mortgage.

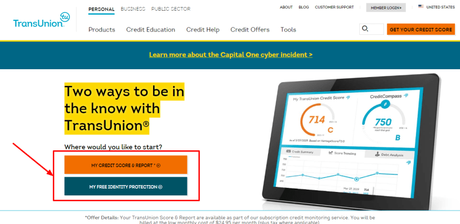

How do I sign up?

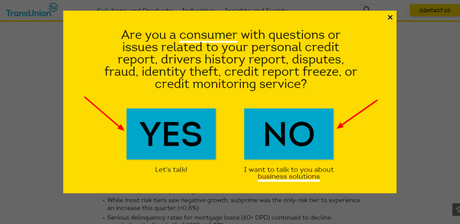

To subscribe to TransUnion's credit monitoring service, visit the company's website and click on My Credit Score and report your credit rating.

To create a TransUnion account to log in later and access your subscription benefits, you must:

What other services does TransUnion offer?

Your membership includes:

- Enter your personal information, including your full name, date of birth, current address and social security number.

- Create a username and password.

- Enter your credit card details for payment.

- Check your identity with a series of security questions that only you should know the answer to.

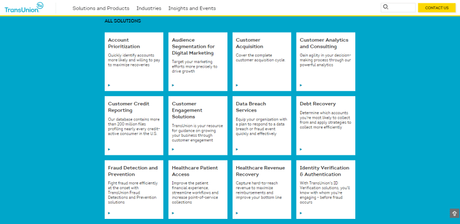

On the enterprise side, TransUnion uses its extensive consumer information database to help companies and industries focus more on specific customers and employees, and to evaluate consumer data and trends.

- Credit Lock Plus Use this tool to freeze your TransUnion and Equifax reports and prevent creditors from taking a look without your permission.

- Instant Notifications Know each time someone tries to apply for a credit on your behalf.

- Insurance against identity theft. Make sure you're insured for up to $ 1 million if you're a victim of identity theft or fraud.

The company also designs products for the government to assess risks, ensure security and prevent cyber fraud.

How does the price of TransUnion work?

TransUnion offers two paid services: Credit Monitoring and TrueIdentity Premium. Both services are monthly subscription services that can be terminated at any time and cost $ 19.95 / month. If you want a single credit report in 3 offices, you can pay a one-time fee of $ 29.95.

If you want a simple credit control package, a direct fraud line, free access to TransUnion credit reports, credit lock and instant alert services, the best option is the free TrueIdentity software package

However, if you want a more complete version and want to provide identity protection, the TrueIdentity Premium package must meet your needs. It includes all the features of the credit monitoring service, with the exception of Credit Lock Plus, more additional benefits and the same cost, making it the smartest option.

TransUnion customer reviews

If you just look at the TransUnion service offerings, you expect a high level of customer satisfaction. They offer suitable products at attractive prices. Your free TrueIdentity product is a good gesture for those who want to stay informed about their credit rating.

However, TransUnion has a terrible reputation among its customers for several reasons.

On the external consumer web site, they are rated with 3 stars based on 770 customer reviews. Better Business Bureau has filed more than 2,300 complaints in the past three years and completed only 605 investigations last year. Most of these complaints are billing or product issues.

An important disadvantage of TransUnion is the design of the site, which is confusing and difficult to navigate. Users report being continually redirected to a subscription page. Many were forced to sign a product they did not want. It is also difficult to find accurate information about TransUnion services on the site, and it may be almost impossible to obtain contact information.

The customer service by phone is a little better. Many customers said that the agents "read a script" and did not receive clear answers to their questions.

Finally, TransUnion's credit monitoring services offer credit reports only on the basis of their unique credit rating system. The problem is that it does not accurately reflect the FICO score, which causes confusion.

If you want to access a credit report from one of the other two credit bureaus, you must pay an additional fee for each report you access. This service can be added quickly.

Customer service

TransUnion customer service would be frustrating. This appears to be the result of the availability of specific telephone numbers for each service, making it difficult to contact the representative who can provide a better service.

The easiest way to start is by signing in to your TransUnion account. Your dashboard includes options for managing your subscription, troubleshooting an item in your report, blocking access to your credit history, and much more.

Or call TransUnion to speak to an agent:

Questions about the subscription. Call from 8:00 am to 8:00 pm Monday through Thursday at 1-855-681-3196. at midnight EST and from Friday to Sunday from 8 in the morning. at 8 pm.

Reports and credit disputes. Call 1-800-916-8800 during the week from 8 in the morning. at 11 pm.

Pros and Cons | TransUnion Review

Conclusion: Why should you choose TransUnion? | Review 2019

ProsTransUnion credit monitoring service offers several useful features and should be integrated with other credit monitoring agencies' offerings. Credit blocking and instant notifications are great features for people who care about privacy and identity theft. However, these exceptional features are not enough to sell the credit monitoring program.

- The credit lock prevents access to your credit file

- Immediate notifications inform you immediately when a credit check is performed

- Dashlane password protection is included

- The free application is included in the subscription.

If you are looking for a reasonable entry-level credit control program, the TrueIdentity Base Package is a good option. However, if you are looking for something more sophisticated, you may not find it in TransUnion.

ConsThe lack of sophisticated features and the most negative comments make it difficult to recommend payment credit monitoring services, especially as TransUnion's competitors offer better market options.

- Information is difficult to find online.

- The company has a bad reputation for customer service.

- For credit information from all three offices, additional fees will apply

- With the free subscription, you will only receive USD 25,000 in identity theft insurance.

- There are no services or features available for families or children.

Also Share your opinion on TransUnion Rreview in the comment section. Share this review in linkedIn, Facebook,etc.

READ ALSO